XRP Price Spike and Drop: XRP January 2026 Analysis and Outlook

Jakarta, Pintu News – Ripple is now trading above the $2.20 level after several days of price increases driven by positive sentiment. Despite the price increase giving investors pause, market confidence remains fragile.

Analysts are divided in their predictions, some indicating that the broader market structure still suggests a prolonged bearish phase, while others argue that Ripple (XRP) may be at the beginning of a recovery phase if key levels can be maintained.

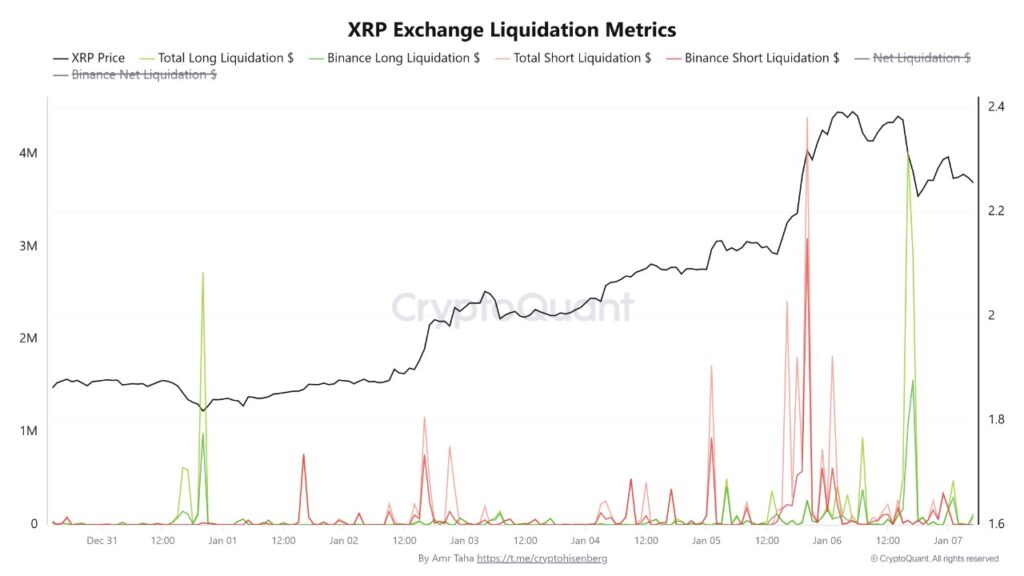

Binance Futures Data Reveals Ripple (XRP) Price Dynamics

Analysis from CryptoQuant shows that activity on Binance Futures has provided insight into the recent price fluctuations of Ripple (XRP). On January 5, there was a sharp increase in the liquidation of short positions that reached over $4.4 million, with Binance accounting for the largest portion of the figure. This pushed the price up and helped Ripple (XRP) reach the $2.40 area.

However, this rise did not last long. On January 6, prices started to reverse direction and the market started targeting long positions. A wave of long liquidation occurred totaling around $4 million, including around $1 million on Binance.

Shortly after, there was an additional liquidation spike of around $1.5 million in long positions, signaling that late buyers entering the market were starting to be eliminated. The liquidation heatmap shows that price action first wiped out liquidity on the short side before pivoting lower to squeeze out newly opened long positions.

Also Read: 5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s What Needs to Happen!

Ripple (XRP) Price Key Resistance After Recovery

Ripple’s (XRP) 3-day chart shows the market’s attempt to stabilize after a long corrective phase, but it still faces clear structural resistance. The price has bounced sharply from the 2025 year-end low in the $1.80-$1.90 range, which acts as a demand zone in line with the long-term red moving average.

This recovery suggests that the downward momentum has weakened, at least temporarily, as sellers struggle to push prices below that support. However, this recovery runs into resistance in the $2.25-$2.30 area. This zone coincides with the declining blue and green moving averages, which previously served as dynamic support during the uptrend and now serve as resistance.

The rejection near this level suggests that Ripple (XRP) is still in a broader corrective structure rather than a confirmed trend reversal. Although the rebound was quite strong, the volume has not increased significantly compared to the previous distribution phase.

Conclusion

Ripple (XRP) is showing strength in recovery, but confirmation is still missing. To significantly change the momentum, Ripple (XRP) will have to maintain a position above $2.20 and reclaim the $2.40-$2.60 range. Otherwise, the risk of further consolidation or retest of lower support will increase. The market is likely to remain volatile in the short term as market positions are recalibrated.

Also Read: The Pattern Repeats? Ripple (XRP) is Ready to Surge Like 2017!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects

this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. XRP Sees Back-to-Back Liquidation Waves, Binance Absorbs Majority of Liquidations. Accessed on January 9, 2026