Ripple (XRP) Mixed Signal: Reserve Decline in Korea and First ETF Outflow

Jakarta, Pintu News – At the start of 2026, Ripple is showing mixed signals. On the one hand, Ripple (XRP) reserves on South Korean exchanges such as Upbit and Bithumb experienced a sharp decline, a pattern that previously preceded a 560% increase in the Ripple (XRP) price by the end of 2024.

On the other hand, large transactions on the Ripple Ledger reached a three-month peak with 2,802 transactions. However, on January 7, the spot Ripple (XRP) ETF in the US recorded the first net outflow since its launch in November 2025, with $40.8 million exiting in a single day.

Reserve Decline in Korean Exchanges Illustrates Previous Rally Patterns

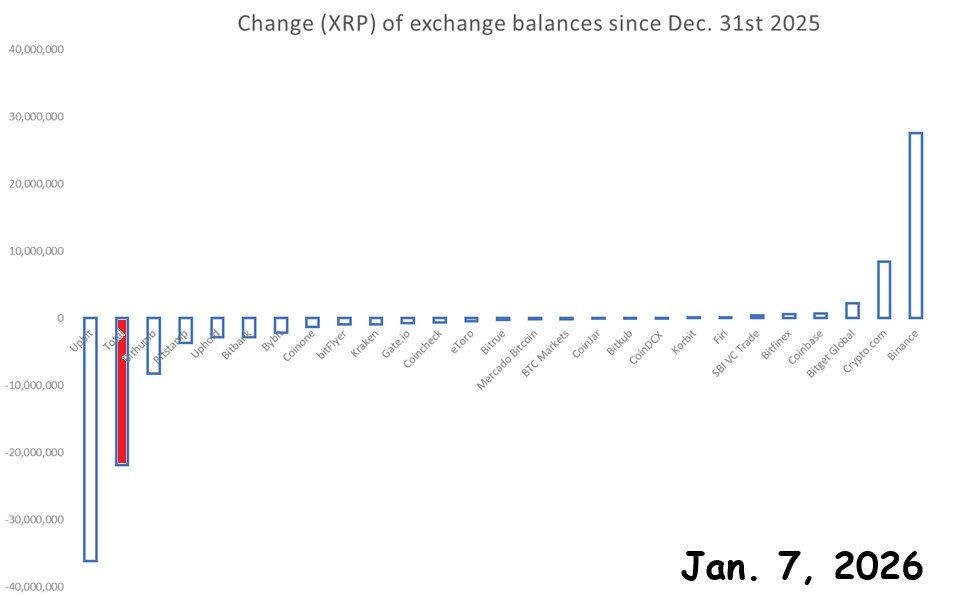

During the first week of 2026, Ripple (XRP) balances on major South Korean exchanges experienced a significant decline. A manual analysis of wallets holding more than 1 million Ripple (XRP) showed that reserves were reduced by about 22 million tokens-0.14% of the total supply-since December 31, 2025.

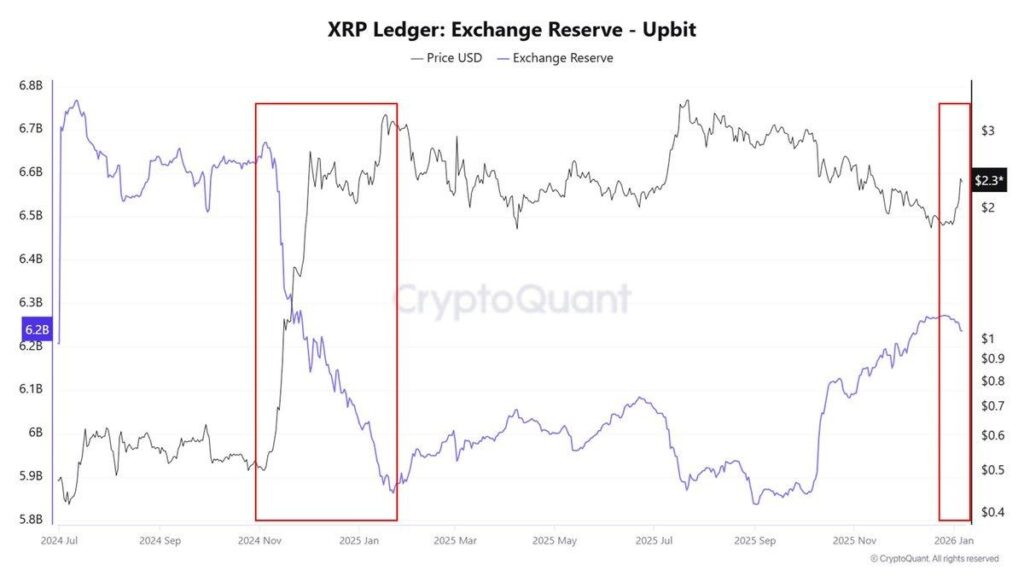

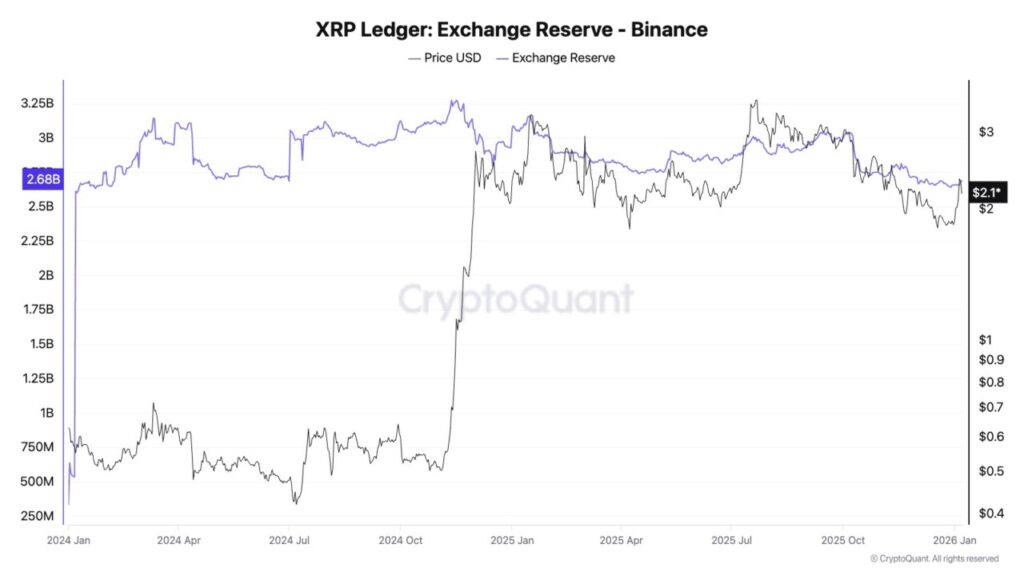

Upbit lost around 40 million Ripple (XRP), Bithumb around 20 million, while Binance gained an additional 25 to 30 million in the same period. This pattern attracts attention because of its history.

When Ripple (XRP) started leaving Upbit in November 2024, the price rose from $0.50 to $3 in the following months. Exchanges in South Korea remain one of the largest Ripple (XRP) trading centers, so changes in reserves there could affect global price discovery.

Also Read: 5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s What Needs to Happen!

Ripple (XRP) ETF Records First Outflows Since Launch

The spot Ripple (XRP) ETF in the US ended its trend of fund inflows on January 7, recording a net outflow of $40.8 million-the first since the product was launched in mid-November 2025. The 21Shares Ripple (XRP) ETF (TOXR) led withdrawals with $47.25 million, while Grayscale’s GXRP was the only fund to record inflows of $1.69 million.

This outflow came after several weeks of consistent institutional buying. Cumulative net inflows still stand at $1.2 billion, with total assets under management at $1.53 billion. However, this reversal raises the question of whether institutional interest is starting to decline just as retail investors in Korea seem to be moving their assets off the exchanges.

Not All Outflows Lead to a Rally

Data from CryptoQuant for Binance shows reserves hit a similar low in mid-2024, yet prices remained in the $0.50 range for several months. The rally that began in November 2024 only occurred after reserves had climbed back above previous levels-not when supply was tightest.

Some analysts have also noted that frequently cited exchange data may underestimate the total supply available. Broader tracking across 30 platforms shows around 14 billion Ripple (XRP) on exchanges, well above figures from sources that monitor fewer platforms.

Conclusion

Ripple (XRP) was trading near $2.30 in early January 2026, a far cry from its July 2025 peak of $3.65. The token surged from $0.50 to over $3 between November 2024 and January 2025, then spent most of 2025 in consolidation. The current configuration displays conflicting signals.

Korean exchange outflows and increased whale activity reflect the pattern seen before the 2024 Ripple (XRP) year-end rally. However, the first ETF outflows and historical precedents suggest that these indicators alone do not guarantee a rally. Whether retail activity in Korea can offset the decline in institutional flows becomes a key question ahead of the rest of January.

Also Read: The Pattern Repeats? Ripple (XRP) is Ready to Surge Like 2017!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects

this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. XRP Korean Reserves Drop, ETF First Outflow. Accessed on January 9, 2026