Bitcoin to $150K in 2026: Institutional Supercycle Era Begins?

Jakarta, Pintu News – The uncertain year of 2025 has not only shaken up risk assets, but has also had a significant impact on crypto stocks. With the Digital Asset Token (DAT) ecosystem growing, market volatility has forced investors to offload their shares, which in turn increases pressure on risk assets.

However, with large capital flows into key sectors such as Real World Assets (RWA), stablecoins, and Decentralized Finance , 2026 is predicted to be a turning point with Bitcoin potentially reaching the $150,000 target.

Market Analysis After the Year of the Bear 2025

The year 2025 was a tough one for many assets, including Strategy (MSTR) shares which plummeted 45%, recording the worst year since the 2022 bear market. This fall had a direct impact on Bitcoin (BTC), which crashed in October and triggered $20 billion worth of liquidations.

Despite this, key sectors such as RWAs, stablecoins, and DeFi continue to attract large capital flows, showing a clear separation between speculation and strong fundamentals.

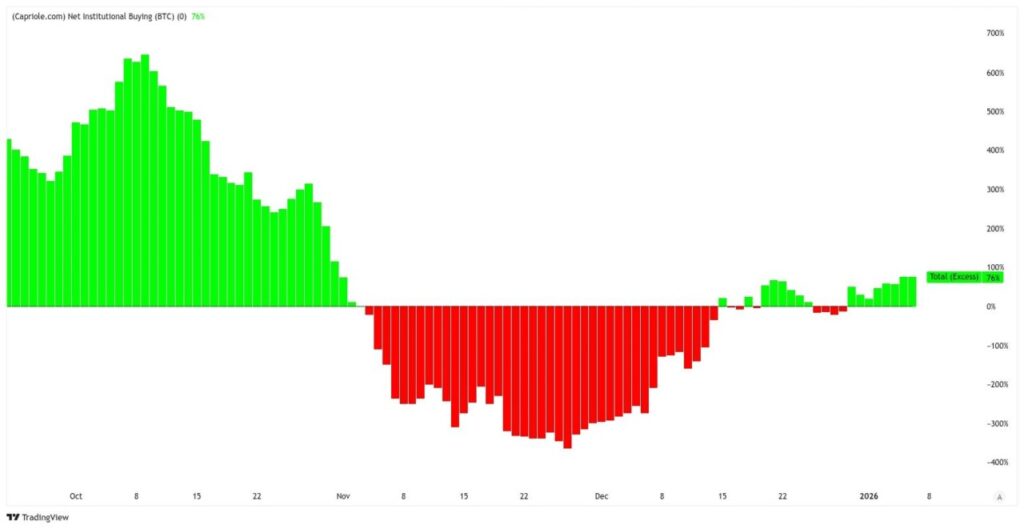

Given this momentum, some analysts predict that 2026 will be the start of the so-called “institutional cycle”. This is supported by increased demand from institutions as seen from on-chain data, where institutions are buying 76% more Bitcoin (BTC) than miners are producing, creating a significant supply deficit.

Also Read: 5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s What Needs to Happen!

Fundamentals Driving the Bitcoin Cycle in 2026

The RWA tokenization market shows very strong growth in 2025, with the value reaching $18 billion, up 210% from the previous year. This signals strong momentum in tokenized assets. On the other hand, the supply of stablecoins also increased by more than 50%, showing the market’s growing confidence in the stability and security offered by stablecoins.

The combination of these two fundamental factors paint an optimistic picture for Bitcoin (BTC) in 2026. The rise in institutional demand and the supply deficit created are strong indicators that 2026 could be the year Bitcoin (BTC) reaches a value of $150,000.

Prospects and Expectations for 2026

While the market experienced a lot of stress in 2025, this served as a necessary pause to allow capital flow into long-term sectors. This helps separate speculation from strong fundamentals, which will ultimately support sustainable growth.

With strong indications from on-chain data and market analysis, 2026 is seen as a potential year for a major breakout for Bitcoin (BTC). The 4% rally experienced by MSTR already indicates this shift, while growing institutional demand is expected to push the crypto’s value towards its year-end target of $150,000.

Conclusion

With favorable fundamentals and momentum building from key sectors, 2026 has the potential to be a pivotal year for Bitcoin (BTC). The institutional cycle that is expected to start could be the catalyst that will bring Bitcoin (BTC) to reach and even surpass its $150,000 price target.

Also Read: The Pattern Repeats? Ripple (XRP) is Ready to Surge Like 2017!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects

this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin eyes $150k: Is 2026 the start of an institutional supercycle?. Accessed on January 9, 2026