Why is ETH still stuck at $3,200 despite billions of dollars in fund flows?

Jakarta, Pintu News – Ethereum continues to be in the center of investors’ attention with increased buying activity, yet the price of Ethereum (ETH) still hovers around $3,200. This phenomenon raises a big question among market participants about when a significant price movement will occur.

Liquidity Flow to Ethereum (ETH)

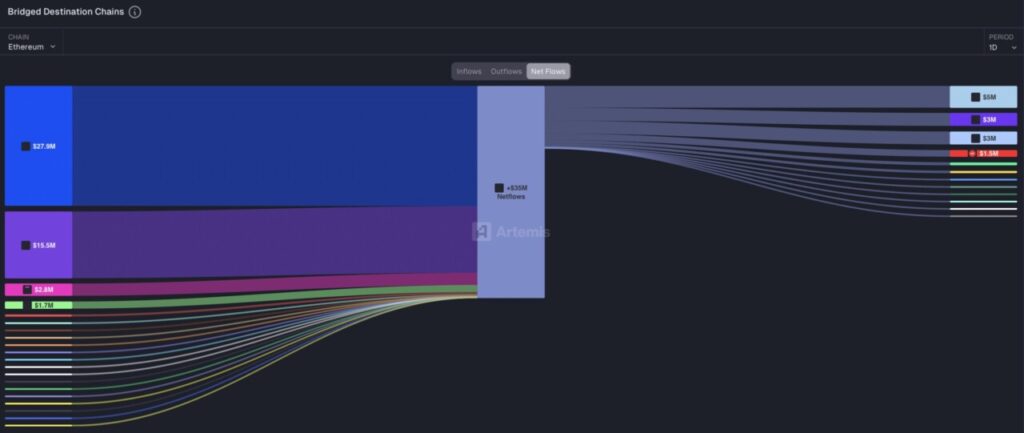

Investments continue to flow into the Ethereum (ETH) ecosystem as positive sentiment from investors grows. Based on data from Artemis, the inflow of funds into Ethereum (ETH) via Bridged Liquidity Netflows reached $35 million in the last 24 hours, making it the second largest flow among the tracked networks. These funds mostly came from Layer-2 blockchains such as Base and Polygon.

The increased liquidity flow indicates a rotation of capital between ecosystems. This indicates that ERC-20 tokens are likely to benefit from this shift. Along with the concentration of liquidity in the Ethereum (ETH) network, assets in the ecosystem are likely to experience increased activity and demand.

Also Read: 5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s What Needs to Happen!

Capital Raising Supports Ethereum (ETH)

In addition to the potential capital flow into ERC-20 tokens, Ethereum (ETH) has also recorded an increase in direct market participation, as seen by its ever-increasing Total Value Locked (TVL). From January 1 to 7, Ethereum’s (ETH) TVL has increased by approximately $6.52 billion, with fund inflows reaching $178 million in just the last 24 hours.

An increase in TVL indicates growing investor confidence in Ethereum’s (ETH) medium to long-term prospects. This indicates that more participants are locking up the asset in the hope of future gains, often with the expectation of higher prices.

The Origin of Capital Flowing into Ethereum (ETH)

Demand for Ethereum (ETH) is increasing on various exchanges, supported by spot traders and institutional participants. Spot Exchange Netflow data shows a clear trend of accumulation, signaling that traders have a strong belief in Ethereum’s (ETH) price upside potential.

For example, between January 3 and 6, investors spent just $20.76 million on Ethereum (ETH). However, by this time, purchases had surpassed five times that amount, with investors moving $108.66 million worth of Ethereum (ETH) off exchanges, a move usually associated with bullish sentiment and long-term holding strategies.

Conclusion

Despite the massive flow of funds into the Ethereum (ETH) ecosystem, the price is still hovering around $3,200. This situation suggests that there may be other factors influencing the price dynamics or perhaps investors are waiting for the right moment to activate the capital they have parked in the form of stablecoins and other assets.

Also Read: The Pattern Repeats? Ripple (XRP) is Ready to Surge Like 2017!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects

this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum sees billions in inflows, so why is ETH still stuck near $3200?. Accessed on January 9, 2026