Top 5 Meme Coins That Soared This Week Amid Growing Investor Interest

Jakarta, Pintu News – Social volume data from Santiment reveals that the crypto community’s attention has shifted towards meme coins as early as 2026. The data tracking platform reported increased interest in tokens such as Pepe , Popcat (POPCAT), and Mog Coin (MOG) after experiencing significant price spikes in the sector.

The market capitalization of meme coins is increasing rapidly and attracting traders after the challenging year of 2025.

Many Coin Memes are Starting to Rise

According to CoinEdition, the community-driven hype cycle is once again driving the market, despite the bearish sentiment that dominated the previous year. Familiar meme coins such as Dogecoin , PEPE, and SHIB began to climb back up as retail traders returned to speculative positions.

Read also: Dogecoin Price Prediction: DOGE Survives as Market Enters Critical Consolidation Phase

This social volume measurement method assesses how often an asset is discussed on various crypto platforms, providing insight into which assets traders are focusing on.

Price Performance Confirms Social Volume Trend

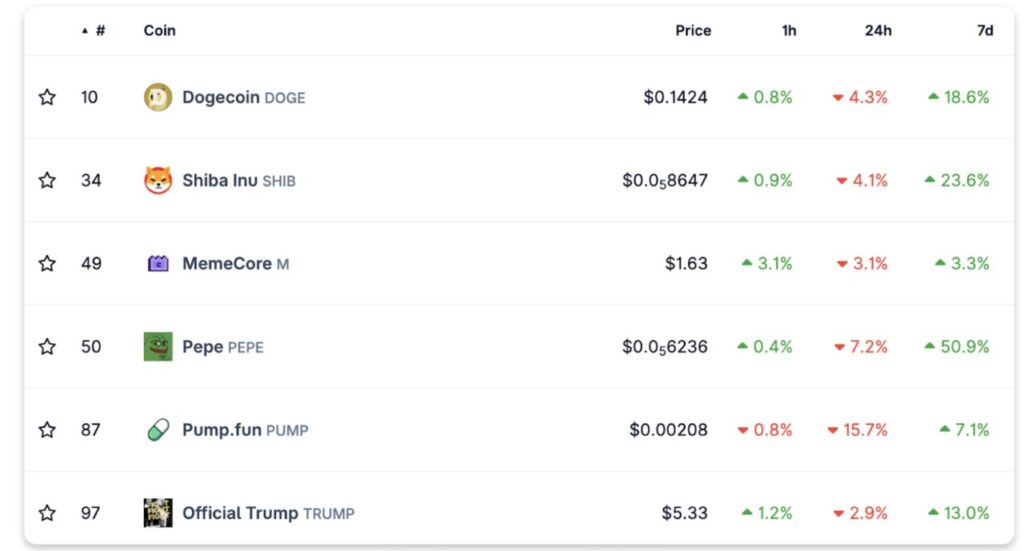

Price performance data confirms the pattern identified in Santiment’s social metrics. The PEPE token rose by 45.9% in the last seven days, despite a 7% decline in the last 24 hours. Currently, PEPE is trading at $0.000006277 and is ranked 50th by market capitalization.

Bonk , a Solana based meme token, recorded a 38% gain in a week, although it fell 7% in the past day. BONK is currently trading at $0.00001064 and is ranked 105th.

Pudgy Penguins (PENGU) recorded a 31% gain over seven days, despite a 4% decline compared to the previous day, and is currently priced at $0.01156.

Shiba Inu saw a 20% gain in the weekly period, with the current price at $0.000008696. Although SHIB fell 4% on January 8, 2026, the token recorded a 0.9% gain in the last hour. SHIB is ranked 34th out of all cryptocurrencies by market capitalization.

Dogecoin rose 15% in seven days to reach a price of $0.1392. As the first meme token, DOGE is currently ranked 10th, despite a daily decline of 4%.

Meanwhile, Official Trump Token recorded a 13.0% gain in a week, at $5.34, and was ranked 97th.

Read also: Shiba Inu Still Under Pressure Due to Surge in Liquidations: Can SHIB Price Rise?

Meme Coin Sector Shows Mixed Movement in the Short Term

MemeCore (M) recorded a moderate weekly gain of 3.3%, with a current price of $1.63 and ranked 49th. The token gained 3.1% in the last hour, but declined 3.0% in 24 hours (8/1).

Pump.fun (PUMP) recorded a 7.1% gain on the week, despite dropping a staggering 14.8% in 24 hours (8/1) and 0.8% in the last hour. The token is currently trading at $0.002102.

Crypto sentiment data from CryptoRank identified MELANIA, BELIEVE, and KDA as anti-leaders during this period. These tokens performed poorly compared to the meme coin sector as a whole, with some even facing operational closures or technical issues.

The correlation between the surge in social volume and the price rally suggests that retail trader sentiment is currently the main driver of momentum in the meme coin sector.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Edition. Top 5 Meme Coins That Surged Over the Past Week, Raising Interest. Accessed on January 9, 2026