Shiba Inu Price Prediction: Is the 30% Rally the Start of an Uptrend or Just Another Hype?

Jakarta, Pintu News – The price of Shiba Inu briefly traded at around $0.00000862 after experiencing a sharp surge of 30 percent in the first week of 2026. This spike sparked debate among analysts as to whether the meme coin was entering a recovery phase or just a pause in its long-term downward trend.

The price increase came after testing support levels around $0.00000700 in late December. However, concerns over the sustainability of this uptrend are starting to rise as trading volumes remain thin and fund flows to the exchange are showing negative numbers.

Whale activity increases, but direction remains unclear

Large transfers of SHIBs worth more than $100,000 surged 111 percent in early January, following 406 whale transactions in December that moved 1.06 trillion SHIBs onto exchanges. This surge marked a sharp reversal from the quiet accumulation pattern seen throughout late 2025.

Read also: Polygon Soars 50% as On-Chain Activity Heats Up — But Can the Rally Hold?

Spot flow data shows a net outflow of $332,790 on January 10, indicating that some holders took advantage of the price rally to exit their positions. When large holders send tokens to exchanges as the price rallies, this usually signals distribution (selling) rather than accumulation.

About 62.65 percent of SHIB’s supply is in the largest wallets, with one address alone holding about 41 percent or approximately $3.3 billion worth. This concentration means that even a small number of transactions can trigger significant price movements, increasing both the potential for price spikes and the risk of sharp drops as positions change.

This concentration of wallets creates a binary situation. If the whales sustain the breakout, SHIB could continue to rise. But if they continue to send tokens to exchanges, this rally will only be a liquidity moment to exit, not the start of a new trend.

Breakout from Channel Faces Obstacles from a Set of EMAs

Shiba Inu prices today are trading above the 20 and 50-day EMAs after successfully breaking out of a descending channel pattern that has been suppressing prices for the past seven months. This breakout briefly pushed the price up to $0.00001020, but since then the price has fallen back to test the support level.

Key technical levels are now showing:

- 20-day EMA: $0.00000822

- 50-day EMA: $0.00000832

- 100-day EMA: $0.00000912

- 200-day EMA: $0.00001056

- Supertrend: $0.00000754

SHIB is currently between the 50-day EMA and 100-day EMA, forming a neutral zone. To confirm a trend reversal, buyers need to push the price back above $0.00000912 in order to challenge the 200-day EMA at $0.00001056. Conversely, if the price drops below $0.00000832, the breakout is considered a failure and the price could potentially drop to the Supertrend support level at $0.00000754.

The daily chart structure does show improvement, but the lack of upside continuation after the initial spike signals that the bulls are not fully in control of the market yet. The price needs to be able to hold above the 50-day EMA before it can challenge higher resistance.

Read also: Dogecoin Price Edges Higher Today — Could Selling Pressure Still Be Weighing on DOGE?

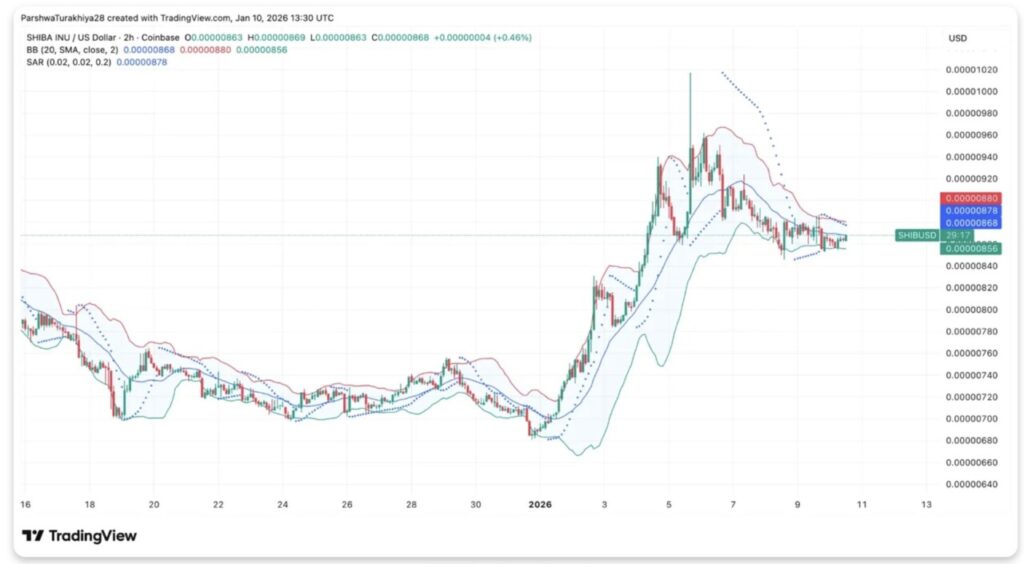

Short Term Consolidation Test Middle Bollinger Band

On the 2-hour timeframe (10/1/26), SHIB is seen consolidating near the middle Bollinger Band at $0.00000868, after its previous sharp rally peaked at $0.00001020. Currently, the price is testing this level as support, with the lower band at $0.00000856 as the next floor of support.

The Parabolic SAR is currently at $0.00000878, slightly above the current price. A price close above this level would indicate a bullish signal and show that buyers are still defending the breakout structure.

Conversely, if the price drops below $0.00000856, there will likely be pressure towards the lower Bollinger Band and retest the 50-day EMA.

Burn Rate Surge Fails to Drive Momentum

On January 1, SHIB’s burn rate jumped dramatically to 10,728.80 percent in just 24 hours, with approximately $172 million worth of SHIB sent to wallets that could not be recovered. However, in the following few days, the burn activity reversed drastically, even dropping 17 percent, despite the price moving up.

The community-led burn mechanism remains an important part of SHIB’s deflation strategy. However, even extreme burn spikes like this one only result in a small reduction to SHIB’s total circulating supply of 589 trillion tokens.

The absence of burn sustainability after the initial January spike suggests that coordinated efforts have not been consistent.

Low Volume and Fear Index Show Cautiousness

Despite SHIB’s 30 percent price increase, the 24-hour trading volume only reached $106.5 million-well below the level that usually supports a sustained trend change. The Fear & Greed Index stood at 28, reflecting the dominance of fear among traders, rather than the greed that usually accompanies meme coin rallies.

The combination of low volume and negative sentiment indicates that retail investors have not yet taken part in this price movement. In SHIB’s previous rallies in 2024, trading volume briefly surpassed $500 million as activity on social media increased. The current breakout is yet to show the same signs of confirmation.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Shiba Inu Price Prediction: 30% Rally Meets Whale Selling as Sustainability Debate Intensifies. Accessed on January 12, 2026