Shiba Inu’s Rare Signal Returns: Is Another 2021-Style Rally on the Horizon?

Jakarta, Pintu News – Like a number of other meme coins, Shiba Inu started the year performing quite well. However, in the last seven days, the situation started to change as the SHIB price took a dip and lost some of its previous gains.

However, judging from the on-chain data, a number of whales seem reluctant to sell their assets. Historically, this has often been followed by a spike in SHIB prices.

However, considering the different market conditions today, the question arises: is it possible for these memecoins to make another surge like before?

Rare Shiba Inu Signal Reappears

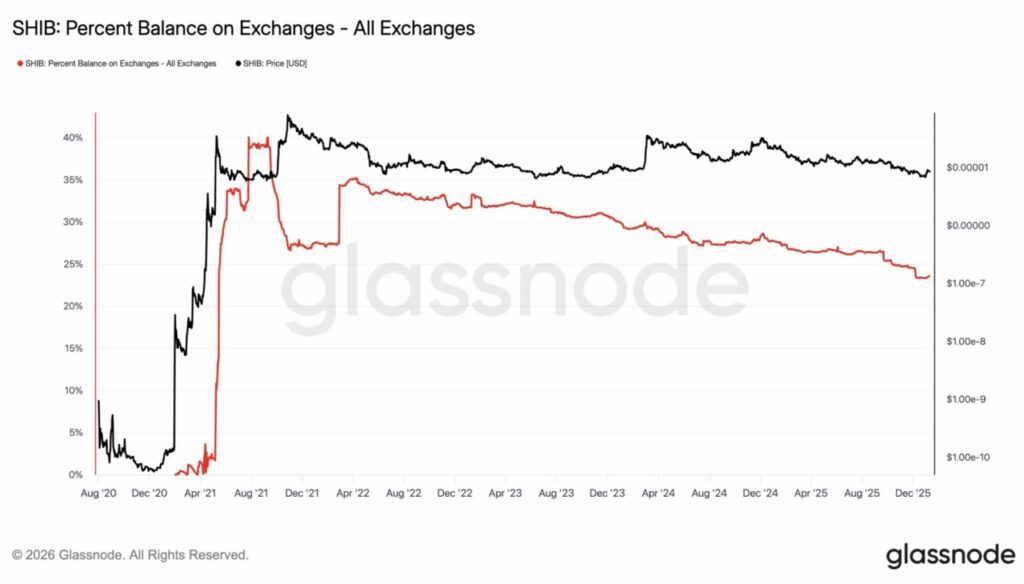

One of the key on-chain metrics to keep an eye on right now is the SHIB Balance on Exchanges. According to data from Glassnode, only about 23.55% of the total circulating SHIB supply is currently held on exchanges.

Read also: Shiba Inu Price Prediction: 30% Rally Welcomed by Whale Sell-off, Uptrend or Just Hype?

The last time the supply percentage on the exchange was this low was in May 2021, when the SHIB price was still at its cyclical low point. A few months later, SHIB experienced a huge rally and peaked at around $0.000075.

The current situation looks quite similar. Only about 290.4 trillion SHIBs are held on the exchange, down from about 370.3 trillion, out of a total outstanding supply of about 589.24 trillion SHIBs.

Since December 5, net exchange outflows totaled about 80 trillion SHIB, and fresh wallets have withdrawn about 82 trillion SHIB from centralized exchanges in the past 60 days. This is important because SHIB balances on exchanges reflect the most liquid part of the supply-in other words, coins that are on exchanges are the easiest to sell quickly.

So, when the number of SHIBs on the exchange shrinks, the immediate selling pressure is usually reduced. This means that SHIB prices can rise more easily as they require smaller buying volumes, as long as the supply on the exchange remains low.

However, this signal is not an automatic guarantee. Outflows from exchanges are a positive indication, but will only have an impact if demand for SHIBs remains strong. If prices spike but many investors rush to send SHIBs back to the exchange to sell, then conditions can quickly change and selling pressure reappears.

For now, the continued outflow of SHIBs from the exchanges suggests a tighter accumulation and supply pattern, which could potentially help SHIBs form a stronger price base and open up opportunities for further upside.

Not yet in Full Risk-On Mode

Although SHIB still has the potential to go higher this year, data from the MVRV Long/Short Difference metric shows that current conditions are not yet favorable for a big spike like in 2021 that pushed prices to around $0.000075.

During the breakout in 2021, this metric jumped up to 232.50%. Such a high number usually reflects a market that has gone intofull risk-on mode, where long-term holders enjoy huge unrealized gains, and short-term buyers rush to buy on momentum.

However, the current situation is much different. The MVRV Long/Short Difference stands at -23.47%, which means the level of unrealized gains is still low, and the market sentiment is not as hot as it used to be.

Negative numbers like these generally signal cautious market conditions, suboptimal price performance, or the early phase of an upward movement-not peak cycle conditions.

Therefore, SHIB prices may still be able to rise gradually, but the data suggests that a return to the previous peak is unlikely unless there are major changes in terms of profitability levels, investor demand, and overall market liquidity.

Read also: Polygon Price Jumps 50% on the Back of On-Chain Demand: Will it Last?

SHIB Price Analysis: Ready to Rocket?

From a technical perspective, the daily chart shows that SHIB prices are experiencing a temporary decline (pullback). However, the overall price structure still shows a bullish trend. The price movement pattern forms a bull flag, which is usually a continuation pattern after a previous increase.

Momentum indicators also support this view. The MACD (Moving Average Convergence Divergence) indicator has given a bullish crossover signal, indicating that the upward momentum is starting to regain strength.

If this signal holds, the SHIB price is expected to be able to hold above the $0.0000079 support level, and avoid a deeper drop.

In this scenario, the next upside target is around $0.0000096, which is in line with the 0.618 Fibonacci level. If the bullish momentum continues to strengthen, SHIB could rise further towards $0.000011. However, this outlook is highly dependent on consistent buying activity. If selling pressure increases and the bull flag pattern fails to hold, then this technical setup will be broken.

Under these conditions, SHIB prices could drop further and retest support around $0.0000068.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Last Time This Happened, Shiba Inu (SHIB) Price Rocketed to $0.000075: How About Now? Accessed on January 13, 2026