Dogecoin Dips 2% Today, But Strategic Japan Partnerships Could Spark a Turnaround

Jakarta, Pintu News – The Dogecoin price briefly hovered around $0.1394 following the announcement of a strategic partnership between House of Doge, abc Co., Ltd. and ReYuu Japan to expand the Dogecoin ecosystem in Japan.

These fundamental factors along with the bullish divergence signal on the daily chart – the fifth such signal since August – suggest that technical and narrative conditions may be converging to push prices higher.

So, how is the Dogecoin price moving today?

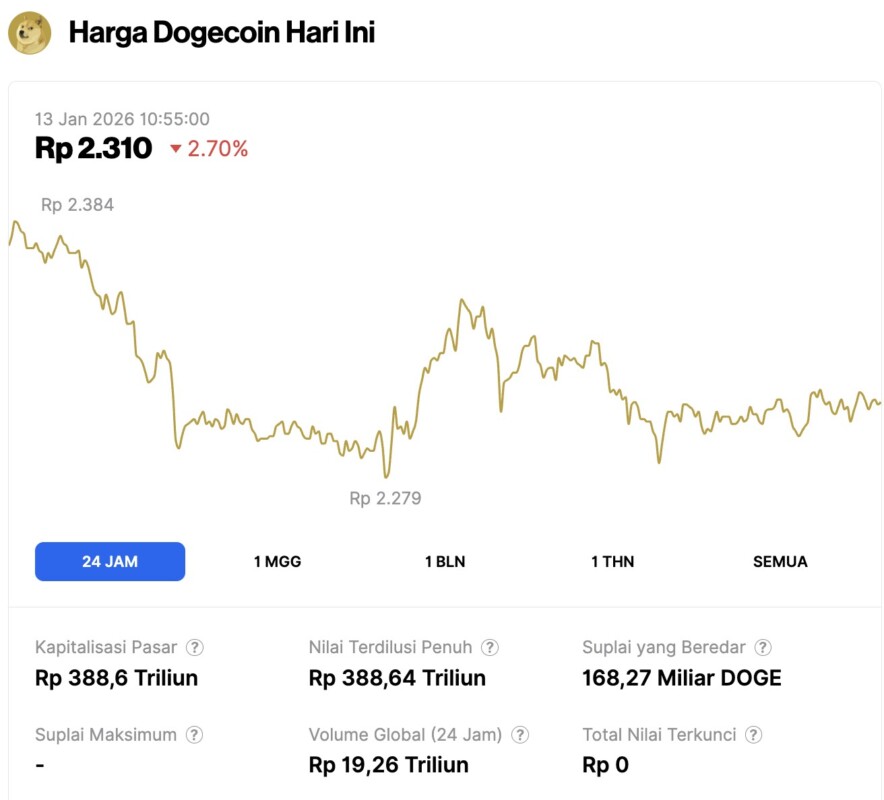

Dogecoin price drops 2.70% in 24 hours

On January 13, 2026, Dogecoin saw a 2.70% drop over the past 24 hours, trading at $0.1368, or approximately IDR 2,310. During that time, DOGE fluctuated between IDR 2,384 and IDR 2,279.

At the time of writing, Dogecoin’s market capitalization sits at around IDR 388.6 trillion, with a 24-hour trading volume of roughly IDR 19.26 trillion.

Read also: Ethereum Steadies Around $3,100 — With Strong Support From Long-Term Holders

Partnerships in Japan Focus on RWA and Stablecoin Adoption

The House of Doge, as the official corporate body of the Dogecoin Foundation, announced a tri-party framework aimed at expanding Dogecoin’s utility in the real world, particularly in Japan.

The cooperation covers several potential areas, including the development of gold asset-backed stablecoins, regulatory support for the listing of RWA (Real World Assets) tokens under Japan’s “green list” framework, as well as the establishment of a joint fund within the Dogecoin ecosystem.

CEO Marco Margiotta stated that Japan is a natural market for Dogecoin due to its high level of acceptance of digital innovation. The partnership combines ReYuu Japan’s business development expertise and abc’s capabilities in token economy design and smart contract development.

The announcement emphasizes real-world applications, not just speculation, with a focus on regulated stablecoin transfers and on-chain transaction settlement infrastructure. This move marks Dogecoin’s shift from being a meme coin to utility-based adoption in a market known for its regulatory clarity.

The timing of the announcement also coincides with DOGE testing important support levels after a prolonged decline from its October peak near $0.27. Fundamental catalysts in oversold conditions have historically often been the narrative trigger for technical bounces.

Fifth Bullish Divergence Signal Since August

On the daily chart (11/1), the RSI Divergence indicator showed a bullish signal with the RSI value at 51.66 – marking the fifth signal since August. The previous signals that appeared in early September, mid-October, late November, mid-December, and early January were all followed by price rallies of between 15 to 30 percent.

This indicator detects when the price forms a lower low, while the RSI prints a higher low. This pattern indicates that the selling momentum is starting to weaken although the downward pressure is still ongoing.

Divergences like this are often a sign of a reversal when sellers start to lose steam and buyers start to enter at the support area.

Current key technical levels:

- 20-day EMA: $0,1380

- 50-day EMA: $0,1432

- 100-day EMA: $0,1599

- 200-day EMA: $0,1797

Currently, DOGE is trading slightly above its 20-day EMA ($0.1380), but still below all moving averages for the longer term. The descending channel that has capped the price since October is still above the current price, with resistance levels around $0.145.

Read also: Shiba Inu Rare Signals Reappear: Will SHIB Prices Soar Like in 2021?

For this divergence signal to be truly valid and translate into real buying pressure, prices need to break the 50-day EMA at $0.1432. Until that happens, this signal is still considered an early unconfirmed indication.

Supertrend Support Stands at Critical Levels

On the 30-minute chart, Dogecoin is seen holding above the Supertrend support level at $0.1386, which has so far been the price floor during the latest consolidation phase. Currently, the price is testing the lower side of the descending channel resistance around $0.1400.

The Parabolic SAR indicator is at $0.1401, slightly above the current price. If the price manages to close above this level, the indicator will turn into a bullish signal for the short term, confirming that buyers are defending the price structure – not just providing a temporary boost.

It is also noticeable that a triangle pattern is forming within the larger descending channel, indicating a narrowing of volatility as the apex approaches. Compression zones like this are usually a precursor to significant price movements. The combination of bullish divergence signals, positive fundamental news, and technical support increases the probability of an upward breakout.

During this consolidation phase, trading volumes are still moderate – showing no signs of panic selling or massive accumulation. The next directional movement will most likely be accompanied by a surge in volume, which will be a confirmation of which side is in control of the market: bulls or bears.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Dogecoin Price Prediction: House Of Doge Japan Partnership Meets Bullish Divergence Signal At $0.139. Accessed on January 13, 2026