3 Altcoins Facing Potential Liquidation Soon — Here’s What Investors Should Watch Closely

Jakarta, Pintu News – The altcoin market entered the second week of January with still unclear signals. Some tokens have reached all-time record high prices, while others have started to recover amid market indecision.

Most altcoins are still struggling to bounce back after the massive sell-off that occurred in October last year. In this situation, three altcoins face the risk of major liquidation as traders are likely to misjudge the actual market demand.

Solana (SOL)

The wave of meme coins in early 2026 was not very strong, but it showed that traders are starting to be more open to risk. The Solana ecosystem itself set a number of new records. DEX volumes on Pump.fun reached an all-time high, and the number of meme tokens launched daily also increased sharply.

Read also: Solana Overtakes Ethereum in Perpetual Futures Volume – Is SOL Ready for $190?

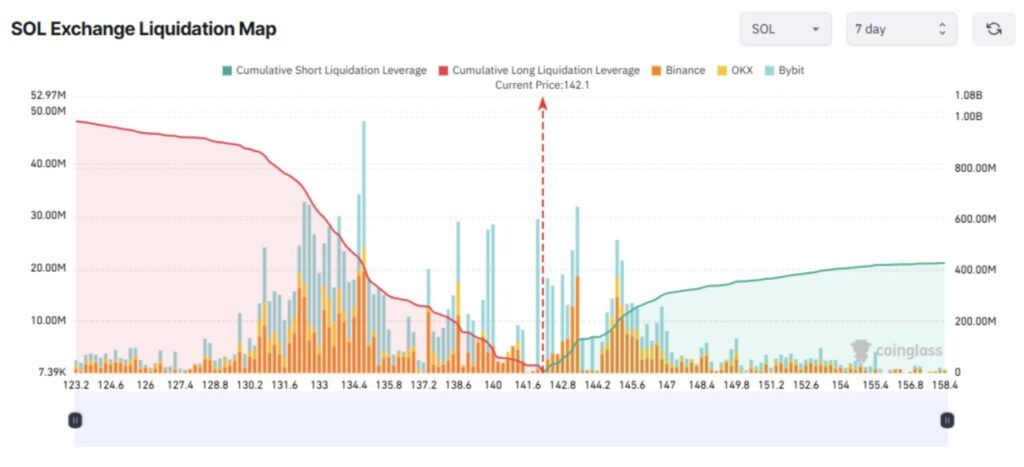

As such, many traders are still optimistic that SOL prices will continue to rise throughout the rest of January. This optimism is reflected in the liquidation data, where the cumulative liquidation potential for long positions is much higher than that of short positions.

However, it is possible that traders are overestimating this market demand. Data from Santiment shows that the number of new wallets created each week reached 30.2 million in November 2024, but has now dropped dramatically to 7.3 million.

The chart shows that the SOL rally is closely related to the weekly growth of new wallets. The sharp decline in this metric undermines the fundamental basis of the price increase earlier this year.

“Solana has surged to $144 and is trying to break resistance at $145. However, this largely depends on whether SOL network growth can pick up again,” according to a report from Santiment.

A recent report from the BeInCrypto page also mentioned that SOL has experienced a recovery, with institutional funds flowing into its ecosystem. However, retail investors are still nowhere to be seen. In fact, this group was previously the main driver of the SOL price surge.

If long traders continue to pursue positions without a strict stop-loss strategy, they risk liquidation of almost $1 billion. This risk could occur if SOL prices fall back to the $132 range this week.

Monero (XMR)

The conversation about Monero (XMR) in the crypto community is now more positive than ever. Today, XMR set an all-time record high price. On the other hand, its competitor, Zcash , experienced a sharp decline due to weakening market confidence.

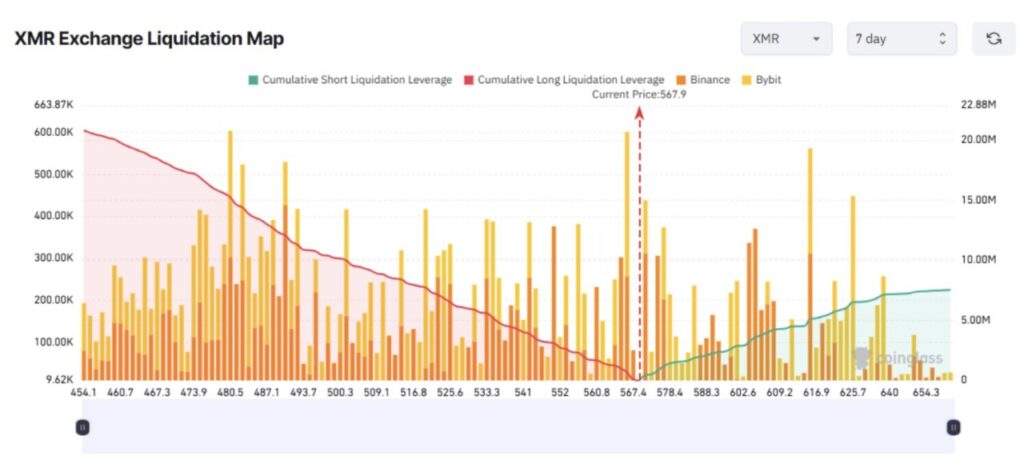

The liquidation heatmap for the past seven days shows that the cumulative liquidation potential of long positions is much greater than short positions. As such, long XMR traders need to be cautious this week, for at least two main reasons.

First, XMR has reached a new high price while touching a strong resistance trend line that has been forming since 2018. This triggered huge selling pressure from existing holders looking to realize their profits.

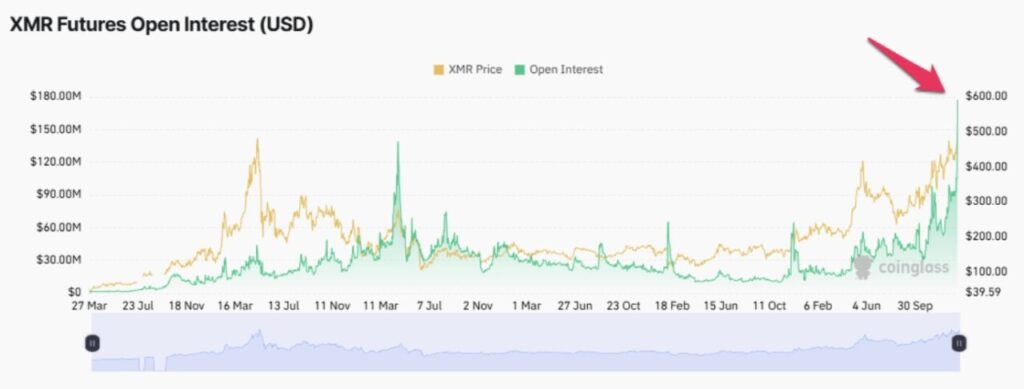

Secondly, data from Coinglass showed that XMR’s open interest jumped by almost $180 million-the highest figure in history.

Read also: Analyst Peter Brandt Reveals the Potential for Monero (XMR) to Print a Silver-like “God Candle”

This means that traders start adding capital and leverage right when XMR is in the key resistance zone. This behavior is extremely high-risk. If the price of XMR corrects back to the $454 level within this week, long traders could potentially face liquidation of more than $20 million.

Render (RENDER)

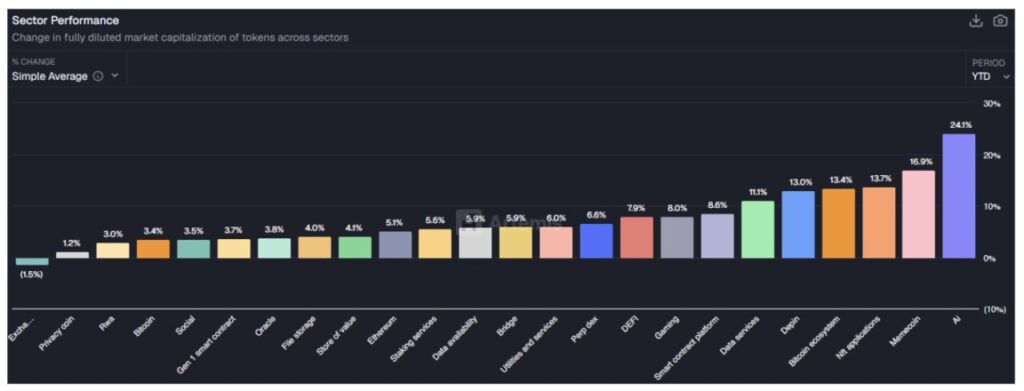

Since the beginning of this year, Render has surged by more than 90%. Data from Artemis shows that not only RENDER, but also other AI coins, recorded strong gains. This makes the AI sector the best performing segment of the crypto market so far in 2026.

Investors seem to prefer AI-based coins at the beginning of this year. This positive sentiment could push RENDER and other AI tokens to continue rising after reaching a short-term balance.

“This AI token is performing so well, it’s barely even seen on the timeline lately. FET and RENDER stand out. Buying on the spot market and waiting seems to make sense, as the move is not yet complete,” commented Altcoin Sherpa.

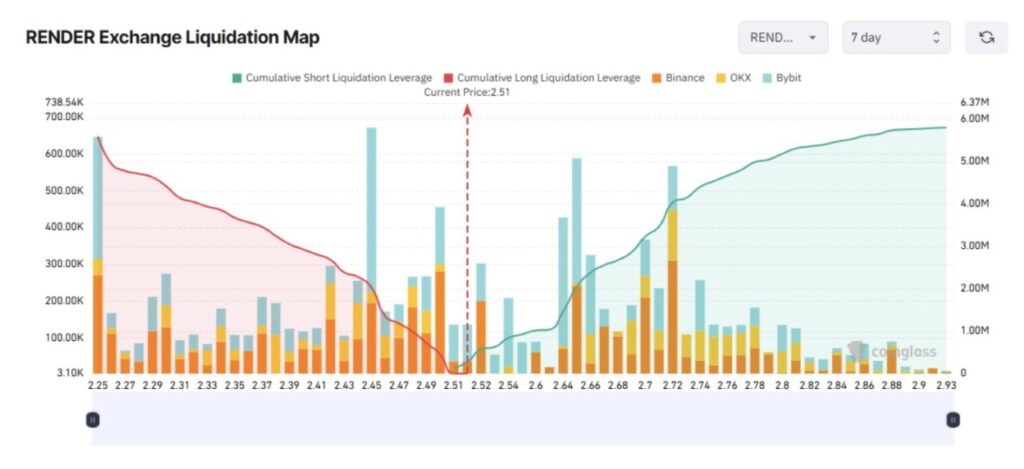

The seven-day liquidation map for RENDER shows relatively balanced expectations between long and short positions.

If interest in the AI coin continues to rise this week, RENDER short traders could face liquidation of up to $5.8 million. This risk arises if the RENDER price rises to the $2.93 level.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Face Liquidation Risk. Accessed on January 16, 2026