7 Core Market Insights Predicted When Bitcoin (BTC) Trades Below US$87,000

Jakarta, Pintu News – The prediction market for Bitcoin is now showing signals of caution after the price of the largest cryptocurrency traded below the US$87,000 level, triggering mixed dynamics in the expectations of market participants. This phenomenon provides a snapshot of how sentiment and market data interact in determining short-term price direction and risk expectations on major cryptocurrencies.

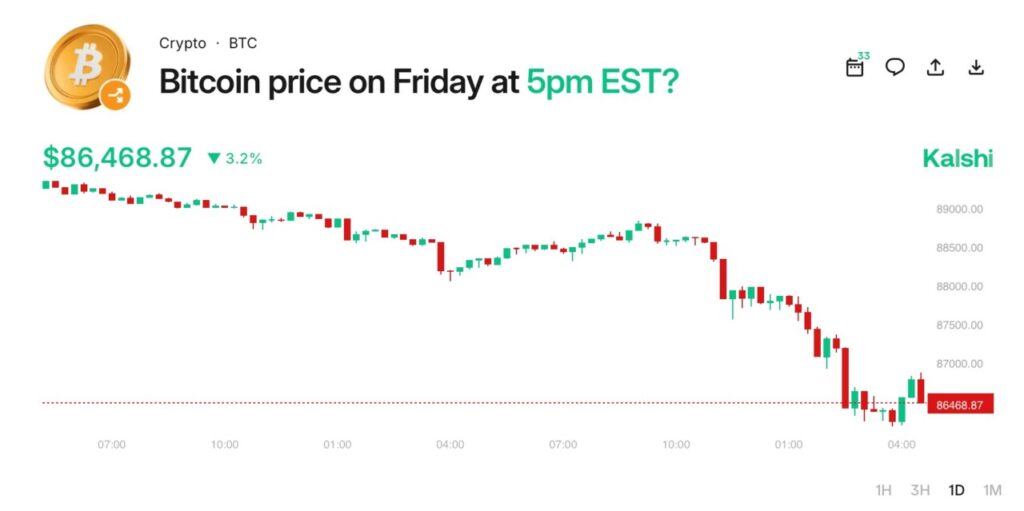

1. Bitcoin (BTC) Drops Below US$87,000

Bitcoin (BTC) price traded below US$87,000 recently, an important technical level after consolidating near that mark. This decline reflects selling pressure and investor caution amid the broader market. These price movements affect the prediction market which measures future price expectations.

Although not far from this level, the weakening price triggered a change in positioning and expectations from short-term traders. A drop below a psychological level is often interpreted as a risk signal, especially in a market that is still vulnerable to sentiment variability. Other technical data shows Bitcoin fluctuating in a sideways pattern while waiting for a stronger catalyst.

Also Read: Silver Price Prediction 2026-2030, How will it fare in the next 5 years?

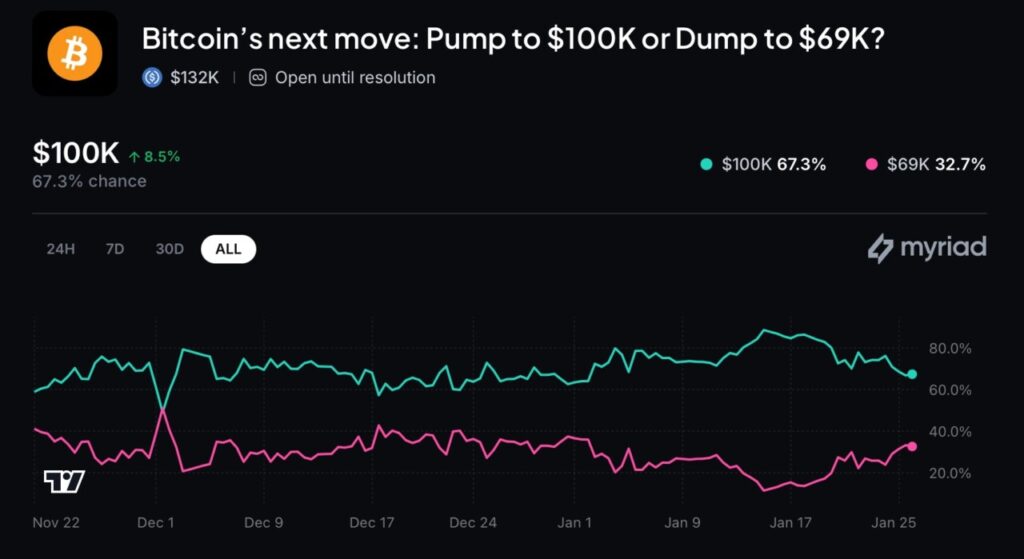

2. Prediction Markets Reflect a Mix of Expectations

Prediction markets, which are platforms where market participants place bets on future prices, are now showing more cautious signals. As BTC prices fall, investors’ expectations of a possible rebound or continuation of the downtrend are becoming less firm. This indicator is often used as a proxy for medium-term investor sentiment.

This mix of signals suggests that some market participants still see potential price support, while others are bracing for a possible further correction. This implies that liquidity and volatility remain high in major crypto markets.

3. The Role of Macro Sentiment in Price Movements

BTC’s movement below US$87,000 is often attributed to broader macro risk sentiment, including global economic conditions and market liquidity. Investors often associate cryptocurrencies with other risky assets when market uncertainty increases. Previous academic analysis suggests that Bitcoin’s high volatility makes it particularly sensitive to macroeconomic shocks.

This sentiment was also reflected in futures trading volumes and adjusted leverage positions, where most traders reduced their exposure to avoid large liquidations on sharp price movements.

4. Liquidity and Open Interest Decline

Derivatives market data showed a decline in open interest in Bitcoin futures contracts, signaling reduced interest in speculative long-term and short-term positions. This decline illustrates that some traders are opting out of the market or reducing the size of their positions.

This decrease in liquidity contributes to increased price volatility, as markets with lower liquidity tend to experience sharper price fluctuations on any new news or large orders.

5. Observed Critical Technical Levels

Technically, the US$87,000 level serves as a key support area, while the nearest resistance is around US$90,000-US$92,000. A breakout above these resistances could trigger stronger bullish sentiment, while a close below the support area could extend the sideways trend or correction.

Technical traders often view this pattern as a symmetrical triangle, which indicates a period of consolidation before a potential big move. The uncertainty in this pattern reflects the caution of the current prediction market.

6. Impact of Volatility on Investment Decisions

Increased volatility impacts both short-term and long-term investment strategies. Investors holding BTC and other altcoins such as Ethereum are likely to wait for confirmation of price direction before adding large positions.

In this context, the prediction market helps gauge the market’s collective expectation of a price level, although this indicator alone cannot be used as an exact predictor of Bitcoin’s price direction.

7. Prediction Market Integration in Risk Analysis

Prediction markets are now part of a wider analytical toolkit for crypto traders and investors. With more cautious signals, the market is showing that medium-term risk expectations are rising. This could have implications for risk management strategies and portfolio allocation across the cryptocurrency ecosystem.

Investors are advised not to rely on just one metric or indicator, but to combine predictive market data with more holistic technical and fundamental analysis.

Also Read: 3 Cryptocurrencies that are Ready to Rise Again in 2026

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Prediction Markets Turn Guarded as Bitcoin Trades Below $87K. Accessed January 28, 2026.