Is XRP Gearing Up for a Surge? Domino Effect Could Drive Price to $3.30

Jakarta, Pintu News – The price of XRP rose by about 1% on January 27, but this increase in itself is not very meaningful. What’s more important is what’s going on behind the movement.

Short-term traders are starting to exit, while medium-term holders are coming in. Fund flows into XRP ETFs have also quietly returned to positive. These changes together create a potential domino effect, where one small technical trigger could set off a much larger move-perhaps back to the levels XRP reached last year.

Confidence Replaces Speculation as XRP Holders Shift

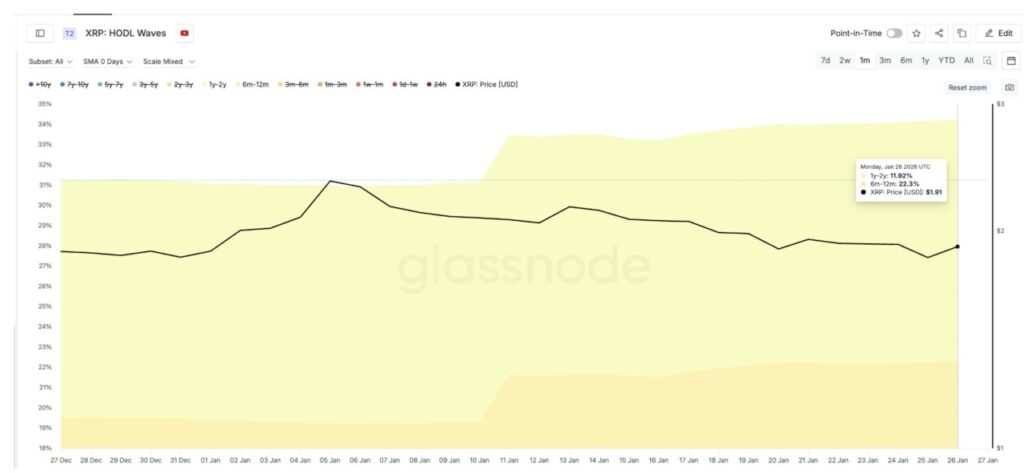

One of the most noticeable changes is seen in XRP’s HODL Waves metric. This metric shows how long the coins are held for, helping to differentiate between short-term traders and long-term holders with high conviction.

Read also: Grayscale Moves Closer to Sui ETF Approval with Official Filing Update to U.S. SEC

In the past month, speculative supply fell sharply. The number of holders in the 1 day to 1 week bracket fell from around 1.5% of total supply to 0.76% between January 9 and January 26.

Meanwhile, the 1-week to 1-month holder group also fell, from 5.71% to around 2.07% on a monthly basis since December 27. On the other hand, long-term holders showed the opposite trend.

The 6-month to 12-month holder group rose from 19.5% to 22.3%. In addition, the 1-year to 2-year group also rose slightly from 11.73% to 11.92%.

This is important because speculative money usually exits when the price hits a local low, while high conviction owners tend to build positions quietly.

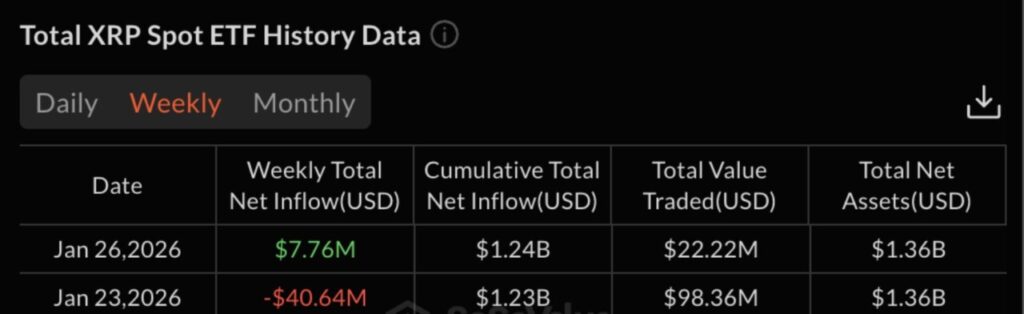

Fund flows into the XRP ETF-one of the biggest confidence indicators-also support this view. After last week ended with net outflows, this week started positively with an influx of new funds.

In simple terms, fast money is going out, and patient money is coming in.

Price Charts Reveal Domino Setups, Not Instant Breakouts

On the price chart, XRP formed a large inverse head-and-shoulders pattern that started in early November. At first glance, this pattern looks unrealistic as theneckline is well above the current price.

To reach the neckline alone, XRP needs to gain about 31%. If it manages to break the neckline, its measured upside potential is about 33%.

As far-fetched as it may sound, the domino effect does not start from the neckline. The trigger is momentum. XRP lost ground above its 20-day EMA (exponential moving average) on January 17. The EMA gives greater weight to recent prices and helps gauge the strength of short-term trends.

To reclaim the 20-day EMA, XRP only needs to rise about 3-4% in a day. The last time XRP managed to do this-on January 2-the price jumped almost 26%. A similar push could accelerate the move towards the neckline.

Momentum support is also starting to show from the RSI (Relative Strength Index) indicator, which measures the strength or weakness of price momentum.

Between late November and January 25, the XRP price printed a lower low, but the RSI printed a higher low. Bullish divergences like this are often a signal that selling pressure is starting to weaken, even before prices actually rise.

This is how the domino effect starts:

RSI stabilized → 20-day EMA recaptured → momentum strengthened → price approached the neckline → neckline broken → active breakout.

Read also: HIP-3 Fuels Hyperliquid Surge — Can HYPE Price Hit $50 in February 2026?

Whale Accumulation Supports Domino Effect of XRP Price Towards $3.30

Large holders(whales) seem to be positioning themselves to deal with this movement scenario. For example, wallets holding between 10 million to 100 million XRP increased their combined balance from around 11.16 billion to 11.19 billion tokens after January 25.

This buying started shortly after the bullish divergence appeared, indicating that the whales were also responding to the change in momentum seen on the charts. This accumulation was cautious, rather than aggressive, but in line with the broader long-term conviction trend.

From this point on, the price level becomes very important.

XRP price needs to first reclaim the 20-day EMA. Above it, there are resistance levels in the range of $2.05 and $2.20. If it is able to break and hold above $2.52, theneckline will come back into focus.

If the neckline is successfully broken, the domino effect will be completed, paving the way towards the price of $3.30 ($3.34 to be exact), which is a projected 33% increase from the head to the neckline. In addition, this is also the price level that XRP had reached in October last year.

This technical structure starts to weaken if the price drops below $1.80, and becomes invalid if it falls below $1.76.

For now, XRP has not experienced a breakout, but the chain of events leading up to the breakout is forming slowly and quietly.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Price Analysis: Chain Reaction. Accessed on January 28, 2026