5 Key Insights: Ethereum (ETH) Lost Almost 5 Months in a Row, What’s Up?

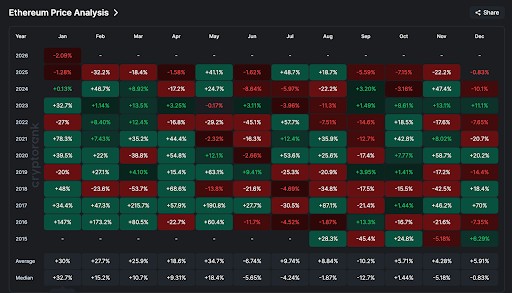

Jakarta, Pintu News – Recent news shows that Ethereum , the second-largest crypto asset after Bitcoin , is facing a prolonged downward price trend. If January 2026 ends with a price drop, ETH will close five consecutive months in the red, a phenomenon that has only happened before in major downtrend cycles in the crypto market. This trend provides an important insight into the ongoing selling pressure in the cryptocurrency market.

1. Prolonged Downward Trend in Prices

On-chain data and price movement analysis show that Ethereum has closed the last four months with a negative performance, and there is no sign of significant recovery in January 2026. The current ETH price is still moving in the range below USD 3,000, reflecting the relatively strong bearish pressure in recent months. This trend technically underscores the lack of bullish momentum required to reverse the market direction from the long-term downtrend.

Consecutive months closing in the red suggests that market demand may not yet be strong enough to generate a sustained price rebound. Investors need to understand that long periods in a downtrend like this often require a strong catalyst for the trend to change direction.

Also Read: 5 Key Facts on Silver vs Gold Supply Gap and Its Impact on Crypto & Commodity Assets

2. Historical Impact If 5 Red Moons Occur

ETH’s movement history shows that the last time a trend like this occurred was in 2018, when Ethereum fell sharply over an extended period before eventually recovering. At that time, Ethereum experienced several months of consecutive sharp declines before finally rebounding in the next phase of the market cycle.

If history repeats itself, a fifth month closing in the red could trigger a deeper consolidation phase or even a bearish extension before the next potential bullish momentum emerges. However, historical patterns are no guarantee of the future, so additional analysis of current market conditions remains important.

3. Technical & On-Chain Factors to Consider

Additional technical analysis shows that despite the drop in ETH price, structural market indicators such as long-term support are being tested regularly. Hashrate trends, market liquidity, and other on-chain activities are also factors that influence price dynamics. For example, active ADDRESS, trading volume, and MVRV ratio show that ETH is currently in an undervalued zone according to several on-chain analysis metrics.

This means that despite the price drop, there are indications that some investors see long-term value in ETH, which could create accumulation opportunities at lower prices if sentiment changes.

4. Comparison with the Broader Crypto Market

Ethereum’s decline is not an isolated phenomenon; most cryptocurrency markets have experienced high volatility and a prolonged downward phase since 2025. In addition, market capital is often switched between asset classes such as gold and silver that are experiencing a surge in social interest, even though crypto volatility remains high.

Investors need to understand that ETH price conditions are also influenced by external factors such as global monetary policy, institutional capital flows, as well as broader investor risk sentiment. Changes in macroeconomic trends can accelerate or slow down price momentum in the digital asset market.

5. Implications for Young & Beginner Crypto Investors

For young or novice investors, Ethereum’s negative price trend confirms that the crypto market is highly volatile and high-risk. Several months of closing in the red is not a definitive indication that the asset is “failing”; rather, it is part of a complex market cycle. Understanding technical support, risk management, and the cyclical structure of the market is crucial before making an investment decision.

Investors are advised to combine technical analysis with monitoring of fundamentals and market sentiment factors to assess potential medium- and long-term movements in assets like ETH. A well-thought-out and disciplined investment strategy remains key in the face of downward price trends.

Read More: Altcoin Price Spikes: A Seasonal Phenomenon Not to be Missed!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Scott Matherson/NewsBTC. 5 Months In Red: What Happens If Ethereum Price Closes January With A Loss? Accessed January 28, 2026.