XAU/USD Analysis and Prediction Today January 29, 2026

Jakarta, Pintu News – In today’s trading session, gold (XAU/USD) recorded a new high after breaking over USD 5,300 per ounce, with peaks reaching around USD 5,311/oz before a mild consolidation took place. This movement is a continuation of the strong rally that has lasted several days, indicating significant bullish momentum in the precious metals market.

Global governments and investors remain focused on allocating capital to gold as a safe-haven asset amid macroeconomic and geopolitical uncertainties that continue to loom over global markets.

Fundamental Pressure and Market Sentiment

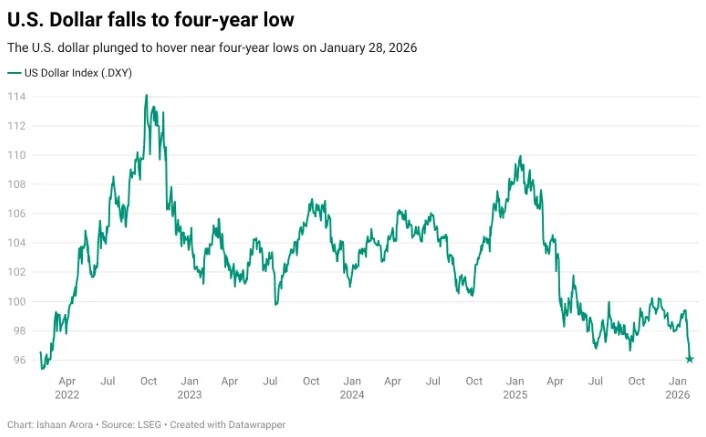

The main catalyst driving gold’s rally this time is a combination of global geopolitical turmoil, a drop in the value of the US Dollar (USD) to a multi-year low, as well as expectations of monetary policy changes from the Federal Reserve (Fed).

Demand for safe-haven assets like gold increases when market risk sentiment increases or when investors anticipate potential future interest rate cuts. A falling USD makes dollar-pegged commodities like XAU/USD more attractive to overseas buyers.

Read More: 5 Key Gold Price Predictions for 2026-2030 in the Context of Global Asset Markets

XAU/USD Technical Analysis

Technically, gold prices are currently in a strong bullish trend. The breakout of USD 5,300/oz indicates strong buying pressure, although indicators such as the Relative Strength Index (RSI) signal overbought conditions on some timeframes.

The key support is at levels around USD 5,200 which if held could be the basis for a healthy consolidation before resuming the rally. Conversely, a move down below this support could open up room for further correction. The next short-term resistance lies around USD 5,380-5,400 and above at USD 5,500 levels if the bullish momentum remains strong.

Short-term Price Outlook

In the short term, XAU/USD odds remain upside biased despite the market showing overbought conditions, which could trigger a consolidation phase or minor correction before the uptrend resumes. The daily trading range is likely to move between USD 5,250-5,400 depending on global financial market dynamics, including market reaction to the latest monetary policy comments from central bank officials.

A partial profit-taking plan at key resistance levels can be a strategy for short-term traders, while stop-losses placed below key support can help manage risk.

Risk Factors to Monitor

Some risks to watch out for today include market reaction to the latest US macroeconomic data, policy statements from the Fed, as well as USD movements that could affect gold prices. A strengthening dollar could pressure XAU/USD although the general trend is still bullish. Also, if the trading momentum weakens without any new fundamental catalysts, the sideways consolidation could last longer.

Medium Outlook

Looking at the broader picture, gold’s sustained rally is likely to continue in the coming weeks if geopolitical uncertainties and market pressures remain high. Some analysts even see potential medium-term targets above USD 5,500-5,800 if the strong safe-haven trend holds, but this is highly dependent on released macro data and global interest rate policies.

Strategy Recommendation

- Short-term traders: consider a buy entry when the price approaches the technical support around USD 5,200-5,250 with a resistance target of USD 5,380-5,400.

- Medium-term traders: pay attention to macro market developments and potential breakout higher above USD 5,400 for further targets.

- Risk management: use stop-losses below major support and monitor momentum indicators to avoid dumping when conditions are overbought.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Zain Vawda/MarketPulse. Gold (XAU/USD), Silver (XAG/USD) Technical Outlook: Navigating the Current Climate as Gold Taps $5300/oz, Silver Eyes Wedge Breakout. Accessed January 29, 2026.