7 Facts about the $89 Million Bitcoin (BTC) Whale Action and its Impact on Price Movement

Jakarta, Pintu News – Bitcoin showed a market response after a large accumulation action by whales, in which one large entity bought 1,000 BTC worth about $89.2 million to capitalize on recent price pressure and a potential short-term trend reversal.

This buying comes as demand from spot platforms such as Binance and OKX are starting to show signs of recovery, while selling pressure from other exchanges is still being felt. This report provides an overview of the dynamics of large buyers and its implications on BTC price around important support levels.

1. Whale Buys 1,000 Bitcoins Worth $89.2 Million

The big whale bought 1,000 BTC from OKX in two batches of 500 BTC each, totaling about $89.2 million. These purchases indicate significant buying interest from large investors at a time of relatively low prices. This action is often seen as a signal that the whale sees attractive long-term value in BTC.

Read More: 5 Key Gold Price Predictions for 2026-2030 in the Context of Global Asset Markets

2. Bitcoin Maintains Support Level

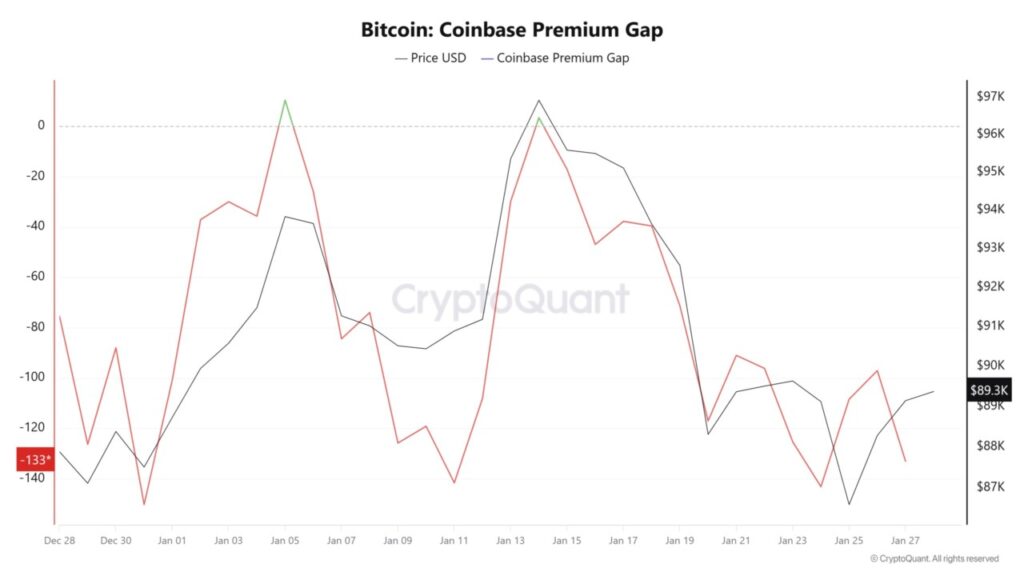

After rallying from around $86,000, Bitcoin managed to hold the $88,000 support level before stabilizing back around $89,000. This suggests that whale buying may have helped absorb broader selling pressure. This support is an important reference point in short-term technical analysis.

3. Selling Pressure from U.S. Curbs Momentum

Despite demand increasing activity on exchanges like Binance and OKX, selling pressure from investors on Coinbase remains high. The negative Coinbase premium index indicates that selling on US exchanges is still pressuring BTC prices. Negative expectations from the US domestic market could delay a strong rebound if it is not covered by large accumulations.

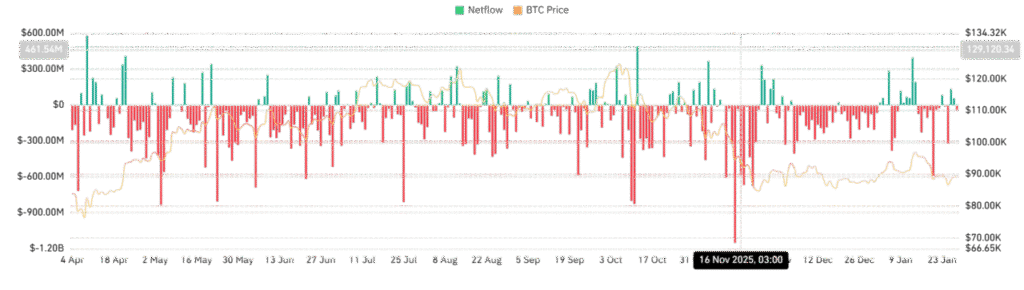

4. Spot Netflow Indicates Buyer Dominance

Bitcoin showed a negative netflow on exchanges in the most recent period, meaning more BTC went out of exchanges than came in. This outflow is often attributed to accumulation by long-term investors or whales moving assets to private wallets.

Negative netflow can also reduce available liquidity for selling pressure.

5. BTC Market Momentum Indicator

The Relative Strength Index (RSI) indicator rose from around 35 to 46, but is still within the bearish zone. This suggests that despite the buying, the bullish momentum is not yet strong enough to trigger a significant uptrend. The RSI remaining in negative territory indicates the risk that the price could remain range-bound if the selling pressure continues.

6. Broader Market Context

The recent Bitcoin price has not shown a major breakout after a period of high volatility and negative ETF netflow fluctuations. Outflows from spot BTC ETF products, such as about $147.3 million, show that not all investor capital is in the accumulation phase. Global factors such as macro sentiment and traditional market movements also affect BTC demand.

7. Implications for Crypto Investors

This whale action is important as a potential signal of stronger demand from large investors, especially when Bitcoin price is propping up at technical support. Young and novice investors need to understand that large purchases can absorb some of the selling pressure but do not guarantee a sustained bullish trend without a strong fundamental catalyst. A combination of on-chain and technical analysis can help assess the likelihood of the price moving above key resistance or remaining in consolidation territory.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– AMBCrypto. Bitcoin: Can $89 mln in whale buys help BTC clear its recent losses? Accessed January 29, 2026.