Why did Antam Gold Drop Today (30/1/26)?

Jakarta, Pintu News – Antam gold prices today, Friday (30/1/2026), recorded a decline after previously moving at the highest level in recent days. This price correction occurred in line with weakening global gold prices and investor profit taking after a sharp rally throughout January. In addition to external factors, exchange rate movements and market sentiment ahead of global monetary policy also influence the adjustment of gold prices in the country.

Antam Gold Price Drops Rp48,000 Today

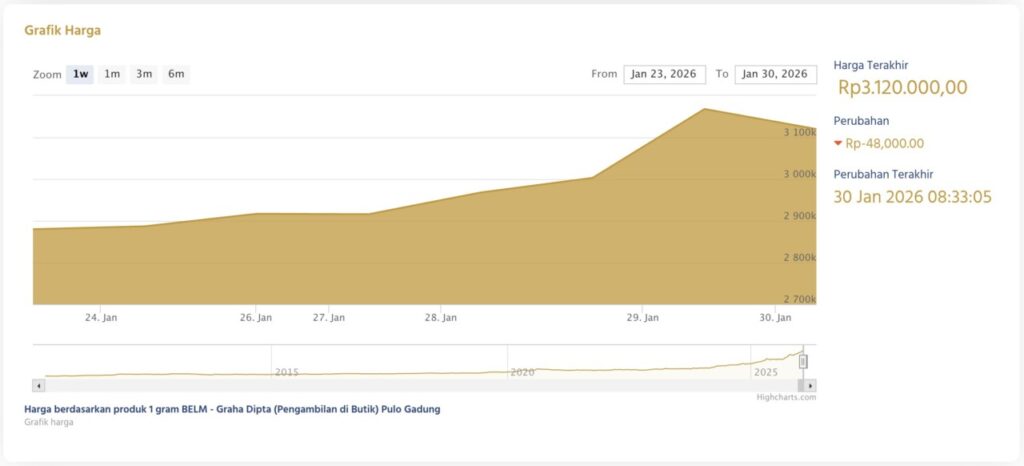

The chart shows the movement of gold prices per gram in the period January 23-30, 2026 with a gradual upward trend throughout the week. The price moved steadily at the beginning of the period, then began to rise more significantly since January 27 to reach a peak near IDR 3.17 million on January 29, 2026. This increase reflects the strengthening of market interest in gold in the short term.

Entering January 30, 2026, the price experienced a mild correction and was recorded at the level of IDR 3,120,000 per gram, with a daily decline of IDR 48,000. Despite the adjustment, the final price position is still higher than at the beginning of the week, so on a weekly basis the trend remains positive. This pattern indicates that the correction was technical after a quick rally, not a trend reversal.

Read also: Antam Gold Buyback Price Today, Friday, January 30, 2026

Why did Antam’s Gold Price Drop Today?

Antam Gold prices experienced a downward correction on January 30, 2026 after several days of record high prices. This decline is in line with the weakening of global gold prices, where the price of the precious metal fell from its peak position in the last few trading sessions due to profit taking by investors after a sharp rally to reach its highest level.

A similar phenomenon was seen in global markets, where gold prices fell about 1.3% from fresh highs as investors realized profits after prices surged significantly this January.

In addition, fundamental factors such as a strengthening US dollar or expectations of changes in central bank interest rate policies also often influence the direction of gold prices. These conditions can make interest-based instruments more attractive than non-yielding gold, leading to a temporary drop in demand for gold and a decline in domestic prices.

This correction is part of the normal dynamics of the commodity market where after reaching a peak, investors tend to take profits and then adjust their exposure. The decline in Antam Gold prices today reflects a response to profit-taking selling pressure in global markets as well as market technical factors after the previous strong rally.

Digital Gold: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Precious Metals

- Featured Image: Harian Jogja