Gold Adds Bitcoin’s Market Cap in a Single Day as Crypto Markets Lag Behind

Jakarta, Pintu News – Global markets were shocked by gold’s aggressive rally when the precious metal added almost as much value as Bitcoin’s market capitalization in just one day. This rise came at a time when the crypto and cryptocurrency markets were performing relatively weakly.

This divergence in direction has reignited the debate on Bitcoin’s role as a hedge asset. In the context of global economic uncertainty, gold has reasserted its dominance as the ultimate safe haven.

Gold Rally Sets New Records and Explodes Market Capitalization

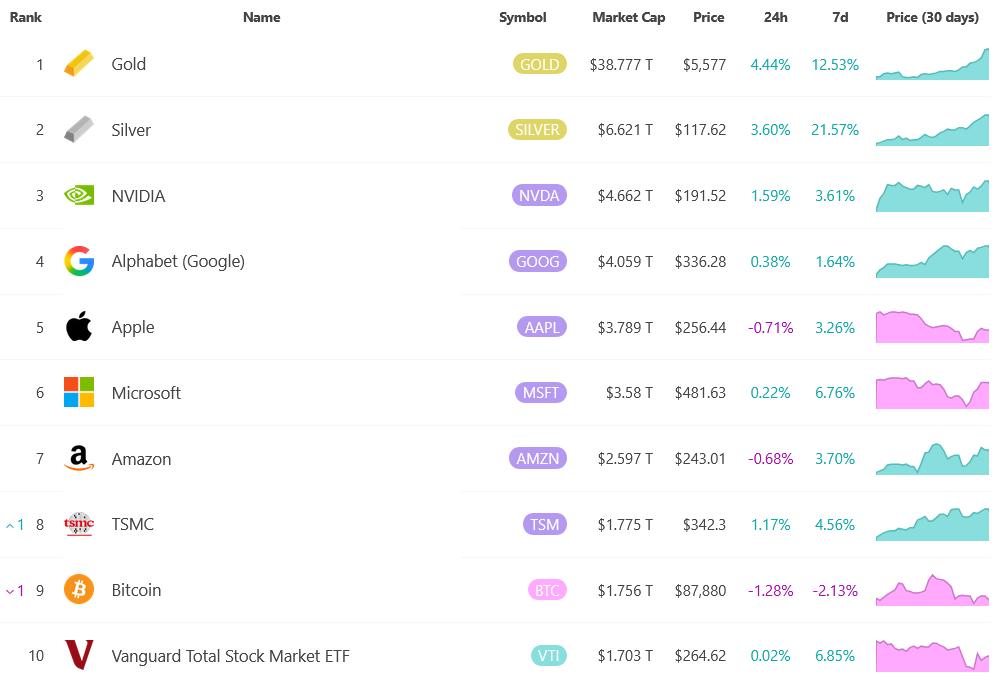

Gold prices jumped about 4.4 percent in 24 hours and broke through the level of 5,500 US dollars per troy ounce or the equivalent of around Rp92.38 million. This price surge pushed gold’s market capitalization up by about 1.5 trillion US dollars in one day. If converted, the increase is equivalent to around Rp25,195 trillion. In total, the market value of gold is now close to 34 trillion US dollars or around Rp571,098 trillion.

The daily increase almost matches Bitcoin’s total market capitalization, which stands at around US$1.75 trillion or around Rp29,395 trillion. This comparison highlights the scale of gold’s dominance in the global market. In a single trading day, gold was able to add value almost equivalent to the entire value of Bitcoin. This phenomenon reinforces the perception that gold is still a key asset in the face of inflationary pressures and geopolitical risks.

Also read: World Copper Prices Today, Friday January 30, 2026: Stable at $6.28 – $6.32 per Pon

Bitcoin on hold, safe haven narrative questioned

In the midst of gold’s rally, Bitcoin is under pressure and trading lower. Since early October, Bitcoin’s price movement has been relatively stagnant after the crypto market was rocked by a major crash. The fall triggered the liquidation of positions worth more than $19 billion or around Rp319.14 trillion. Since then, BTC’s upward momentum has not fully recovered.

Before the October correction, many investors believed Bitcoin and gold would both benefit from the so-called debasement trade. This narrative stemmed from concerns over monetary expansion and global fiscal indiscipline.

However, the last five years of data show that gold actually outperformed Bitcoin. In that period, gold rose by about 185.3 percent, while Bitcoin recorded an increase of about 164 percent.

Read also: Rupiah Exchange Rate Today, Friday, January 30, 2026: Weakened

Institutional Optimism and Contrasting Market Sentiment

Although Bitcoin’s short-term performance is lagging, institutional investors continue to show optimism. The Coinbase survey revealed that 71 percent of institutions think Bitcoin is still undervalued in the price range of 85,000 to 95,000 US dollars. About 80 percent of respondents even stated that they would hold or add to their positions if the crypto market fell another 10 percent. This attitude reflects a long-term belief in cryptocurrencies as an asset class.

The divergent views of investors are also reflected in market sentiment indicators. The Crypto Fear & Greed Index currently stands at 26 out of 100, signaling the fear zone. In contrast, the Fear & Greed index for gold records a score of 99 out of 100, falling into the extreme greed category. This contrast illustrates how investor confidence is currently favoring precious metals over digital assets.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Gold nearly adds to Bitcoin’s entire market cap in a single day. Accessed January 30, 2026.

- Featured image: The Economic Times