Is Ethereum at Risk of Another Crash? Peter Brandt Sounds the Alarm as Vitalik Withdraws 16,384 ETH

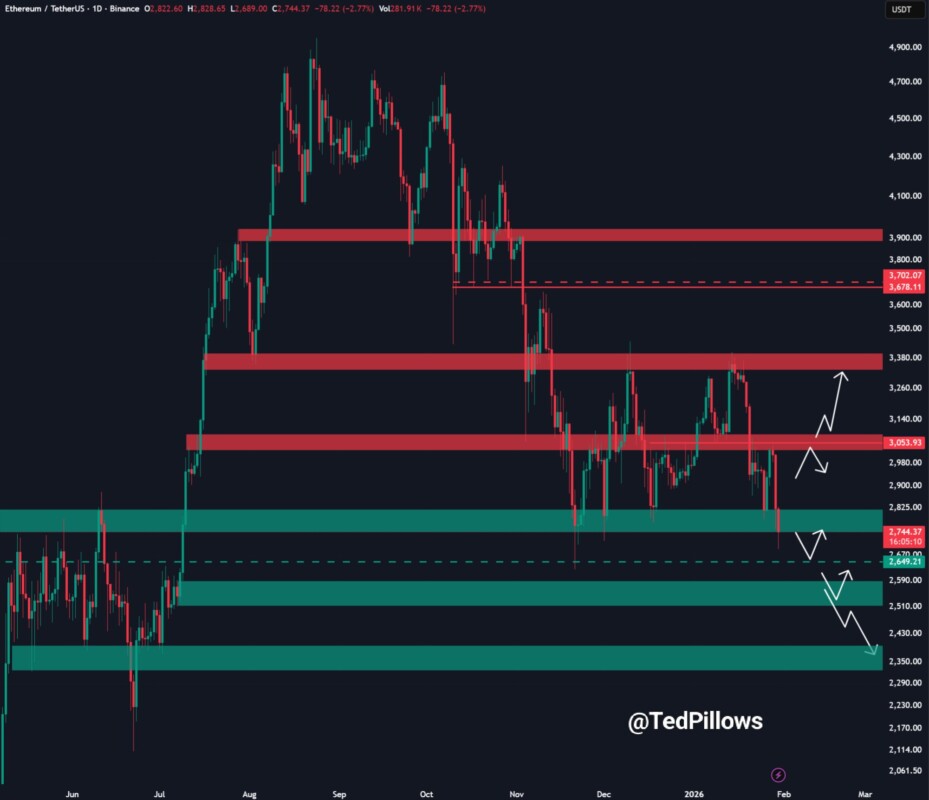

Jakarta, Pintu News – The crypto market has been rocked again after Ethereum slipped below $2,700 and triggered a new wave of concerns. Senior trader Peter Brandt thinks the latest chart structure is signaling continued weakness, as liquidity dwindles and selling pressure has yet to subside.

At the same time, outflows from spot Ethereum ETFs added weight to sentiment, signaling institutional investors are yet to return to aggressiveness. The situation was further discussed after Vitalik Buterin withdrew 16,384 ETH for a purported strategic agenda related to ecosystem sustainability.

Peter Brandt Highlights Ethereum Breakdown Pattern

Peter Brandt highlighted Ethereum’s (ETH) 24-hour chart which formed a symmetrical triangle pattern, and then experienced a downward breakdown. According to him, the pattern is often a classic signal of a downtrend continuation when selling pressure is more dominant than buying interest. He also emphasized that low liquidity could accelerate the decline as buy orders are not thick enough to withstand the selling impulse.

In other words, small movements can trigger larger declines when the market is sensitive. Brandt also shared another analysis showing a right-angled broadening pattern on the total crypto market capitalization. The total market cap is said to have dropped to an important support area of around $2.82 trillion after the latest market shock.

He warned that if the bearish pressure continues, the capitalization could plummet towards $2.41 trillion or down about 15-20% from current levels. In that scenario, large assets such as Bitcoin , Ethereum (ETH), and Ripple could potentially be dragged down further.

Read also: Kevin Warsh is the strongest candidate for Fed Chair, why did Bitcoin immediately shake?

ETF Outflows Put Pressure on ETH Price

Pressure on Ethereum (ETH) comes not only from chart analysis, but also from institutional fund outflows. On Thursday, the spot Ethereum ETF recorded net outflows of nearly $156 million, demonstrating weakened risk appetite.

Fidelity FETH led the withdrawals with around $59.2 million, followed by BlackRock ETHA with around $54.9 million. Grayscale ETHE and ETH products also experienced outflows of around $13.1 million and $26.5 million, emphasizing that institutional sentiment is still defensive.

This comes at a time when Ethereum (ETH) has corrected more than 46% in recent months, leaving little room for recovery. ETF outflows are often read as a signal that large players prefer to wait for trend certainty before adding exposure again.

When outflows coincide with price declines, the market tends to assess the risk of further declines as greater than the chance of a quick rally. The combination of factors makes any price bounce prone to be considered a mere relief rally.

Also read: These 3 Altcoins Are Said to Have the Potential to Print a New All-Time High in February 2026

Vitalik’s withdrawal of 16,384 ETH sparks market speculation

Amidst market scrutiny, Vitalik Buterin confirmed the withdrawal of 16,384 ETH which sparked additional speculation. He stated that the funds were directed towards two purposes, namely accelerating the Ethereum (ETH) roadmap to stay ahead in performance and scalability without compromising resilience, sustainability, and decentralization. In addition, the funds are also intended to sustain the long-term sustainability of the Ethereum Foundation and maintain the network’s core mission.

The focus includes strengthening the core layer of the blockchain and ensuring users can access the network with self-sovereignty, security, and privacy. While the explanation is fundamental, large withdrawals can still trigger negative short-term sentiment when markets are weak.

Fund movements from important figures are often interpreted variously, ranging from operational needs to potential selling pressure, although not always resulting in outright sales. Vitalik is also said to be exploring secure decentralized staking options so that staking returns can be allocated for long-term purposes. However, in a risk-off phase, the market is usually quicker to respond to headlines than to consider their strategic impact.

Conclusion

Ethereum (ETH) is now at the crossroads between technical pressure, ETF outflows, and the internal dynamics of an ecosystem that is being rebuilt. The price has recorded a drop of more than 7% in the last 24 hours and is trading around $2,733, with a daily range of $2,689 to $2,939.

Some analysts see the $2,500-$2,600 zone as important support as the area is said to be the biggest accumulation point for spot ETFs and certain players. Derivatives data also showed ETH futures open interest fell more than 10% to around $34.89 billion, signaling position reduction and increased caution.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinGape. Peter Brandt Predicts Deeper Ethereum Price Crash, Vitalik Buterin Withdraws ETH. Accessed on February 2, 2026

- Featured Image: Crypto News Australia