Ethereum Climbs to $2,200 — What Could Be Next for ETH?

Jakarta, Pintu News – The price of Ethereum has seen a sharp decline in recent sessions, which has shaken investor confidence across markets. ETH lost value significantly in a short period of time, triggering a fear-driven market reaction.

Many investors are now starting to change their attitude by increasing selling pressure on the altcoin king. While this behavior could prolong the decline, it could also potentially create healthier conditions for a long-term recovery.

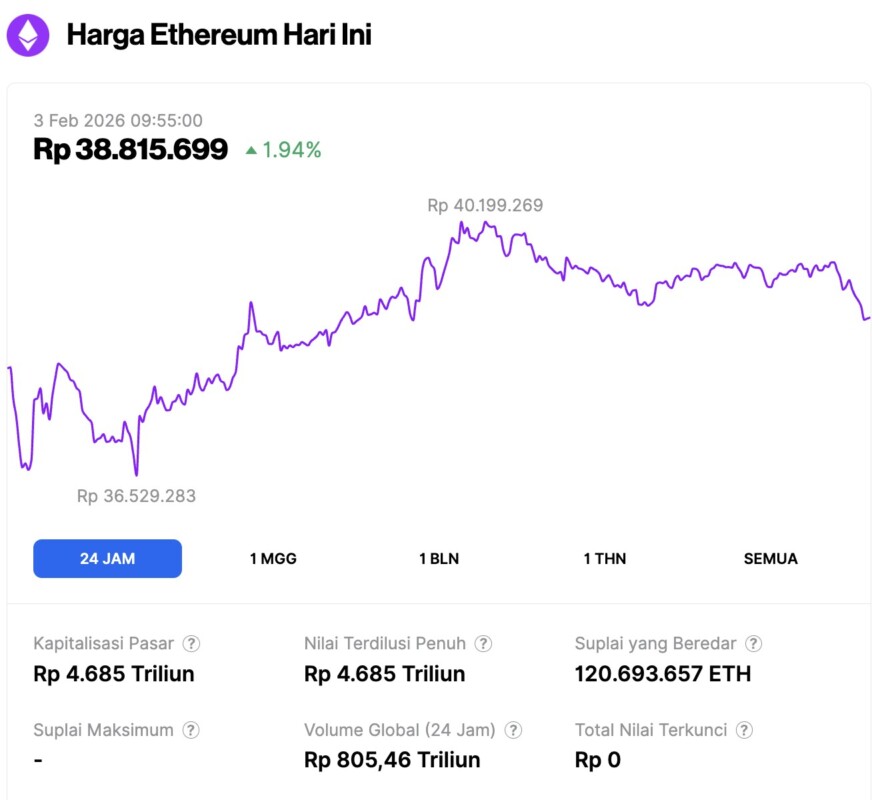

Ethereum Price Up 1.94% in 24 Hours

As of February 3, 2026, Ethereum was trading at approximately $2,289, or around IDR 38,815,699 — marking a 1.94% increase over the past 24 hours. During this time frame, ETH dipped to a low of IDR 36,529,283 and peaked at IDR 40,199,269.

At the time of writing, Ethereum’s market capitalization sits at roughly IDR 4,685 trillion, while its 24-hour trading volume has climbed 6% to reach IDR 805.46 trillion.

Read also: Ethereum Price Outlook for February 2026: Will ETH Soar or Plunge?e or Crash?

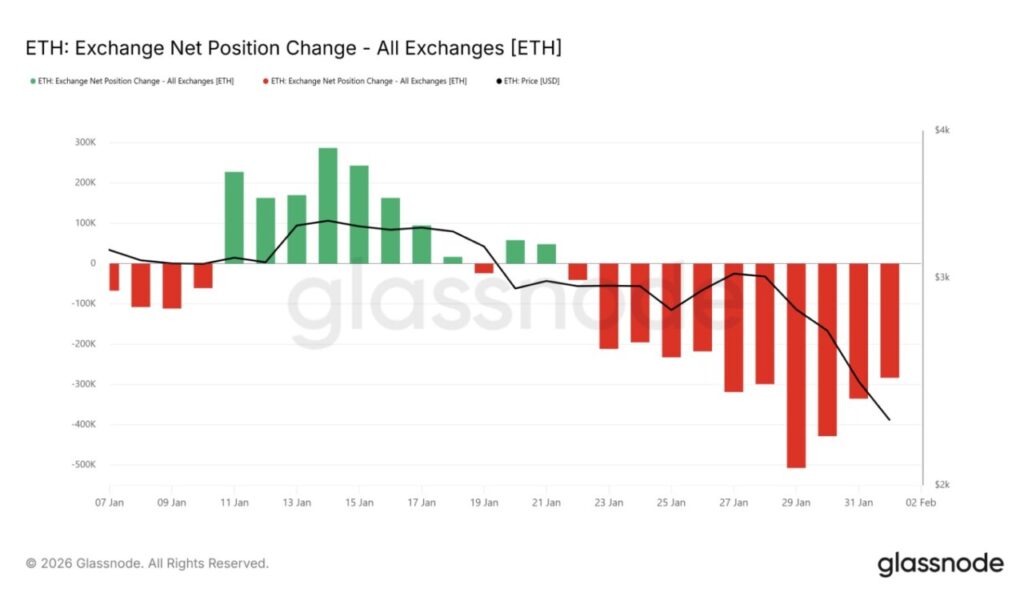

Ethereum Holders Return to Passive Buying Stance

The latest on-chain data shows a significant change in market sentiment. Changes in net positions on exchanges show that the buying momentum built up in the past two weeks is starting to weaken. The red bar representing net inflows is getting smaller, signaling that aggressive accumulation is slowing down.

As buying pressure weakens, selling momentum usually follows. Investors who entered early are likely to start exiting their positions to limit losses. This transition tends to put additional pressure on price movements. In the case of Ethereum, reduced demand increases the likelihood of further price declines before stabilizing.

Despite the short-term weakness, macro indicators provide a more positive outlook. Ethereum’s Market Value to Realized Value (MVRV) ratio is now within the opportunity zone, which is between -12% to -24%. This range has historically marked periods of selling fatigue.

In previous cycles, ETH price reversals often occurred shortly after MVRV entered this zone. When losses are already too large(loss saturation), investors tend to be reluctant to sell further for fear of realizing deeper losses.

During these phases, accumulation usually starts again. Ethereum could potentially experience similar dynamics as selling pressure reaches its peak.

Read also: Bitcoin Price Rises to $78,000 Today: Peter Brandt Highlights BTC Breakdown Risk

ETH Price Potentially Drops to $2,000

On February 2, Ethereum was trading around $2,211, slightly above the $2,205 support level. The asset is still under pressure after recording a 27% decline in the last five days. The current momentum suggests that the risk of further decline is still high.

ETH is now only about 9.2% away from the $2,000 psychological threshold. With a weakening buying impulse and increasing investor caution, a move towards this level looks increasingly likely.

Although bearish in the short term, this decline has the potential to attract value-oriented investors. Lower prices often encourage accumulation from long-term market participants.

The recovery scenario relies on the re-emergence of demand near important support levels. If investors take advantage of these discounted prices, Ethereum could recover back to current levels. This movement would be the beginning of a recovery process triggered by a trend reversal.

However, if the bearish momentum continues and stabilization fails to be achieved, ETH risks dropping deeper to the $1,796 range or even lower, which would delay any potential long-term rebound.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Is 10% From Falling Below $2,000, but There’s a Silver Lining to it. Accessed on February 3, 2026