Bitcoin Enters February: What are the Chances of a Rebound Based on History?

Jakarta, Pintu News – Bitcoin price remains under pressure ahead of the turn of the month, having recorded a negative performance throughout January. At the time of writing, Bitcoin is trading at around USD 82,891 or around Rp 1.39 billion, down 7.5% on a weekly basis and more than 20% on a yearly basis.

This brings up a classic question in the crypto and cryptocurrency market: is February capable of bringing a recovery, or is it just extending the correction phase? The answer is widely sought through historical patterns and the views of market analysts.

January Weakens, First Quarter Still a Question Mark

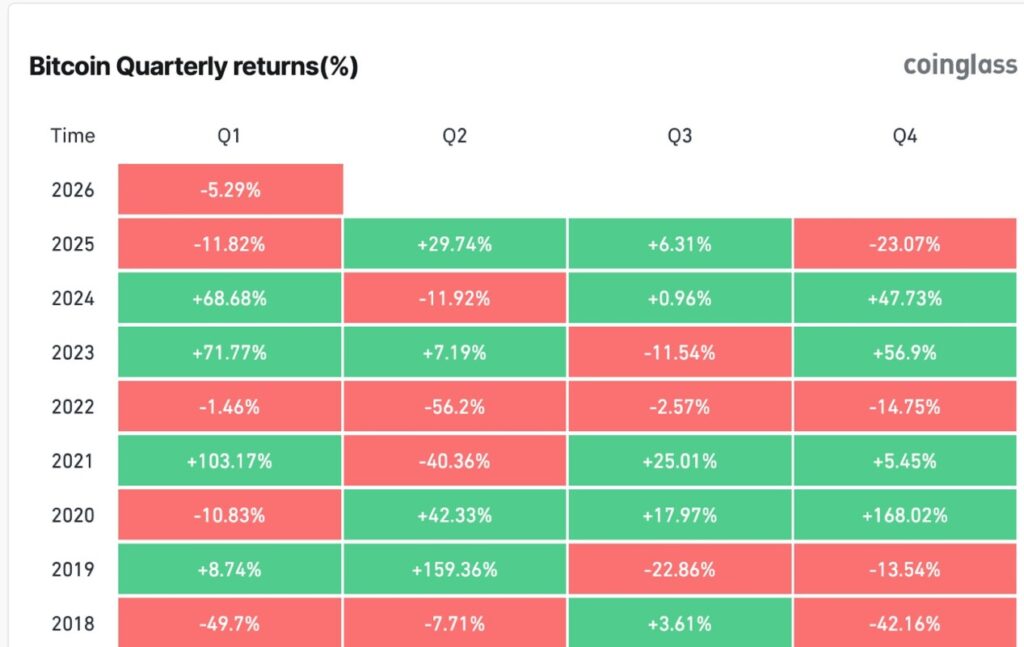

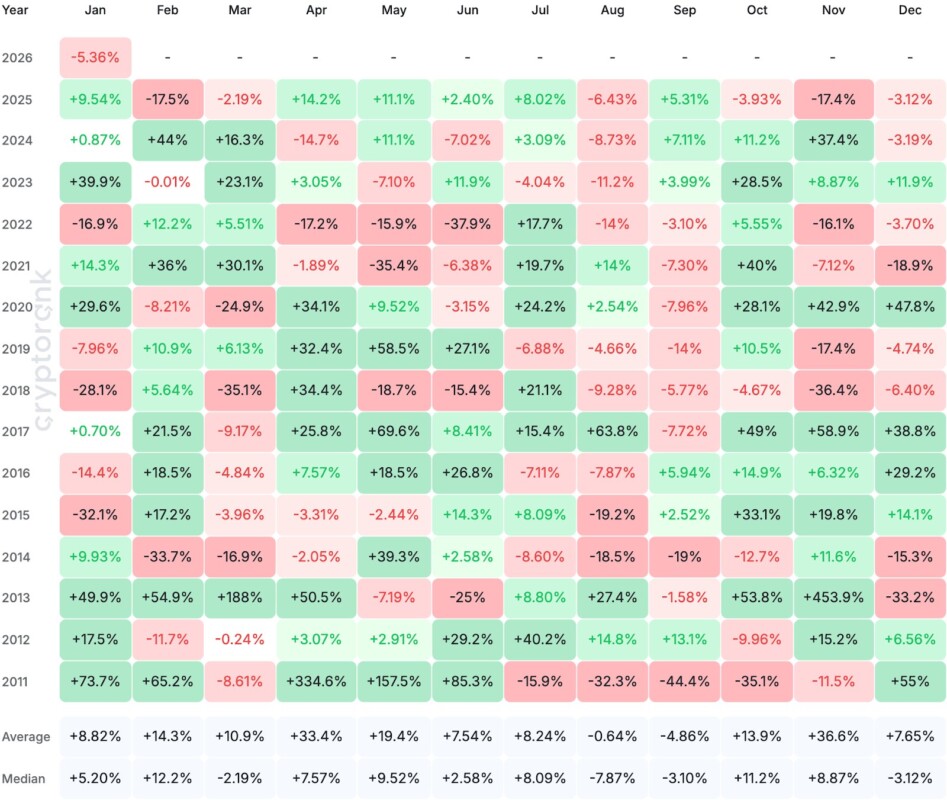

Historically, January has often been an early indicator of Bitcoin’s (BTC) first quarter movements. Data shows that Q1 performance is not always consistent, with extreme fluctuations from year to year. In 2021, the first quarter recorded a surge of over 100%, while 2018 saw a decline of almost 50%. This variation confirms that January weakness does not automatically determine the full direction of Q1.

In January 2026, selling pressure still dominated the crypto market, as global risk sentiment weakened. Bitcoin’s (BTC) price decline also impacted major altcoins such as Ethereum and Ripple , which also corrected. However, history shows that the early phase of the year is often characterized by volatility before a clearer direction is established. As such, market participants are beginning to shift focus to February’s performance for further confirmation.

Read also: Jeffrey Epstein’s Name Appears in Early Crypto Industry Archives, Here Are the Findings

February Track Record: Bitcoin’s Favorite Month?

An analysis of monthly data since 2011 shows that February is statistically a relatively strong month for Bitcoin (BTC). Out of the entire period, only four times has February closed in the negative, while the rest of the months recorded gains averaging around 13%.

In fact, some of Bitcoin’s biggest rallies have occurred in February, including a surge of more than 60% in 2011 and nearly 45% in 2024. This fact makes February often seen as a recovery month after a weak January.

Interestingly, February often follows January’s directional bias, but is not entirely dependent on it. In some cases, even though January closed in the red, February was still able to turn positive. This shows that February has independent power as an early year evaluation period. For the cryptocurrency market, this month often determines whether bullish sentiment is starting to take shape or if risk still dominates.

Read also: Crypto Market Crucial Week: Rise from Correction or Fall Deeper?

Analyst Projections: Between Downside Risk and Turnaround Signal

Analysts’ views on Bitcoin’s (BTC) prospects in February and the first half of 2026 remain divided. A number of technical analysts think the risk of further decline is still open, with the area of USD 75,000 or around IDR 1.26 billion as important support.

In fact, the extreme scenario puts the USD 65,000-60,000 zone as the target if the macro pressure continues. In this view, the short-term rally is considered to be held back by technical resistance.

On the other hand, other analysts think Bitcoin (BTC) is starting to approach a historically attractive valuation phase. Indicators such as the RSI against gold and the MVRV Z-Score are said to be at levels that often appear towards the end of a bear market.

If Bitcoin is able to break back into the USD 87,000 area or around IDR 1.46 billion, the opportunity to return to the previous price range is open, with a psychological target of USD 100,000. This perspective reinforces the narrative that February could be the starting point for a change in momentum.

Conclusion

February’s performance will be an important test for the direction of the crypto market in early 2026. Historical data provides reason for optimism, however downside risks have not completely disappeared according to a number of analysts. With January closing negative, February could potentially be a period of confirmation as to whether the pressure has eased or continues. For market participants, a combination of historical patterns, on-chain indicators, and macro dynamics will be key in reading Bitcoin’s (BTC) next move.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Edition. Will February Bring Gains for Bitcoin? What Do Historical Trends Analysis Say. Accessed February 3, 2026

- Featured Image: Investing News Network