PLTR Stock: Palantir’s Strong Financial Performance Sends Shares Soaring 14% Today

Jakarta, Pintu News – Palantir Technologies (PLTR) reported strong fourth quarter financial results on Monday afternoon (2/2). The company’s shares rose about 4% in after-hours trading.

Adjusted earnings per share (EPS) came in at 25 cents, exceeding the Wall Street consensus estimate of 23 cents, and up from 14 cents a year earlier. Revenue for the quarter totaled $1.41 billion, exceeding expectations of $1.34 billion, and grew 70% year-on-year.

CEO Alex Karp stated that the company’s financial performance “again exceeded even our most ambitious expectations.”

“A growth spurt of this magnitude, especially for a company of our size and scale, is a remarkable achievement-a great reward for those who were attracted to our unconventional project in the first place, and accepted, or at least didn’t completely reject, our unique way of working,” says Karp.

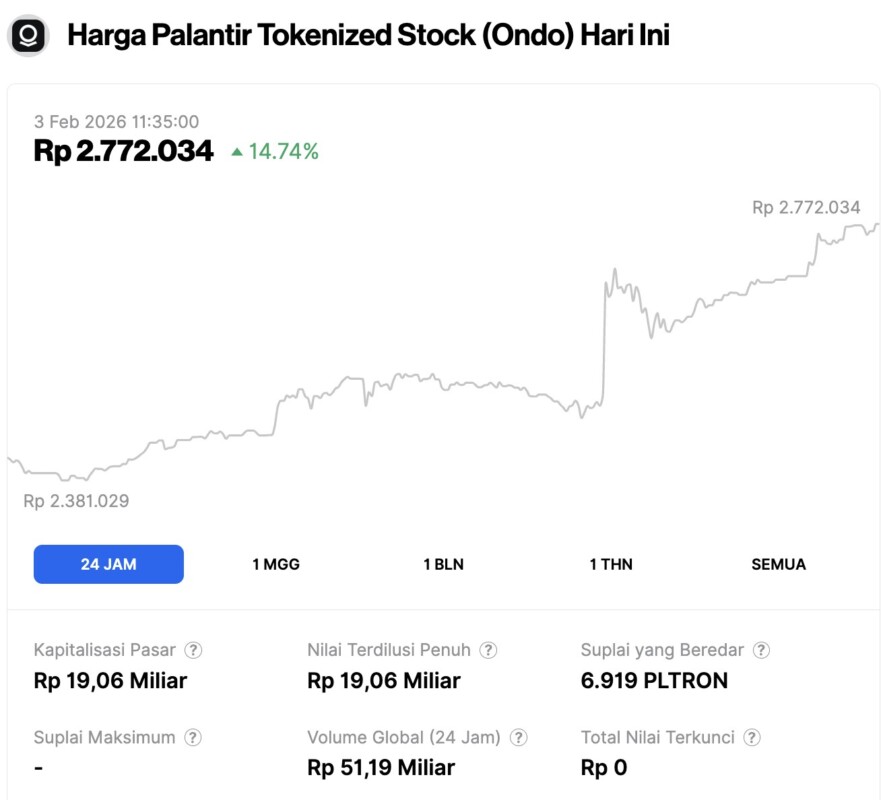

PLTR Stock: Palantir Tokenized Asset Sees 14.74% Price Spike Today

Read also: Nvidia in the Spotlight, Here’s Wall Street’s 2026 NVDA Stock Price Prediction!

On February 3, 2026, the tokenized price of Palantir shares on the Pintu Market reached IDR 2,772,034, marking a sharp 14.74% increase from the previous day. The surge reflects strong investor enthusiasm following Palantir’s impressive fourth-quarter earnings report, which exceeded expectations.

Over the past 24 hours, the token’s price had dipped as low as IDR 2,381,029 before rallying significantly. This upward momentum was accompanied by a robust global trading volume, totaling IDR 51.19 billion.

Palantir Sales Up 93%

Palantir’s sales in the core United States market rose 93% compared to the previous year. As has been the recent trend, revenue from the commercial sector was the most prominent, jumping 137% to $507 million.

Meanwhile, sales to the US government reached $570 million, up 66%. For the first time, Palantir’s quarterly revenue in the US crossed the $1 billion mark.

Although Palantir faces greater challenges in selling its products overseas, international sales still grew 22% over last year. Palantir also provided financial projections for the first quarter and all of 2026 that far exceeded current analyst estimates.

Palantir Continues Positive Trend

In the fourth quarter, the company’s operating margin was 41%, continuing the positive trend in profitability. Through 2025, 47% of sales were successfully converted into free cash flow, and Palantir now has more than $7 billion in cash and marketable securities.

Palantir helps large organizations to process and understand large amounts of data using artificial intelligence . Its technology helps decision-makers see interconnections and strategic options that were previously not obvious.

The company has its roots in the intelligence and defense sectors, and has now accelerated its already extensive contracts with the US federal government. Most recently, in December, Palantir announced a new contract with the US Navy worth up to $448 million.

Read also: Gold, Silver, or Bitcoin: Which Will Lead by the End of the First Quarter of 2026?

But now Palantir has gone beyond its government roots. As more and more large companies struggle to manage and analyze their daily data, Palantir sees a huge opportunity in the private sector. Since almost any large data-rich organization can benefit from its software, the US remains a key market.

Palantir Shares Supported by Large Retail Investors

Few analysts doubt Palantir’s long-term prospects in the commercial sector. However, the stock’s valuation is a concern, as with a forward price-to-earnings (P/E) ratio of around 145, Palantir is one of the highest valued stocks-although still below Tesla which has a ratio of around 206.

In both cases, their shares were backed by a large base of retail investors, who not only believed in the company but also felt personally connected to it, driving the share price up.

Louie DiPalma of William Blair stated that he liked what the report showed.

“In our view, the share price will rise back past $200 per share within the next year,” he wrote in a note to clients on Monday afternoon.

Trading US Stock Tokens on the Door

Imagine being able to buy shares of big companies like Nvidia , Amazon (AMZNX), and Meta in token form for just a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks and Ondo at Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Trade on the Door Now!

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Barrons. Palantir Reports Strong Earnings. The Stock Is Rising. Accessed on February 3, 2026