Ethereum Price Plunges to $2,200: Are Whale Addresses Sending ETH to Binance?

Jakarta, Pintu News – Ethereum whales poured large amounts of ETH into Binance and other exchanges on February 1, pushing the surge in inflows to major addresses to the highest level in months.

Meanwhile, Ethereum is again testing the $2,500 zone and is trading around $2,347 on Coinbase as the weekly chart approaches the long-term channel support area. So, how will Ethereum price move today?

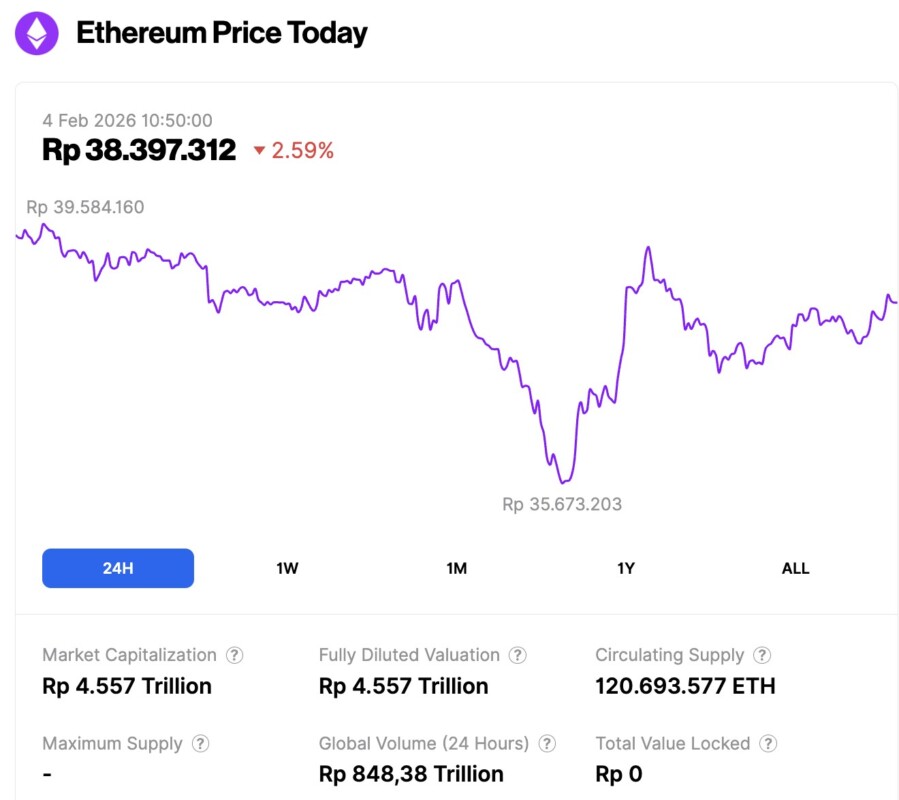

Ethereum Price Drops 2.59% in 24 Hours

On February 4, 2026, Ethereum was trading at approximately $2,277, or around IDR 38,397,312—marking a 2.59% decline over the past 24 hours. During this time, ETH dipped to a low of IDR 35,673,203 and peaked at IDR 39,584,160.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 4,557 trillion, while its daily trading volume has surged by 14% to IDR 848.38 trillion in the past 24 hours.

Read also: Bitcoin Slides Back to $76,000: What’s Next for BTC?

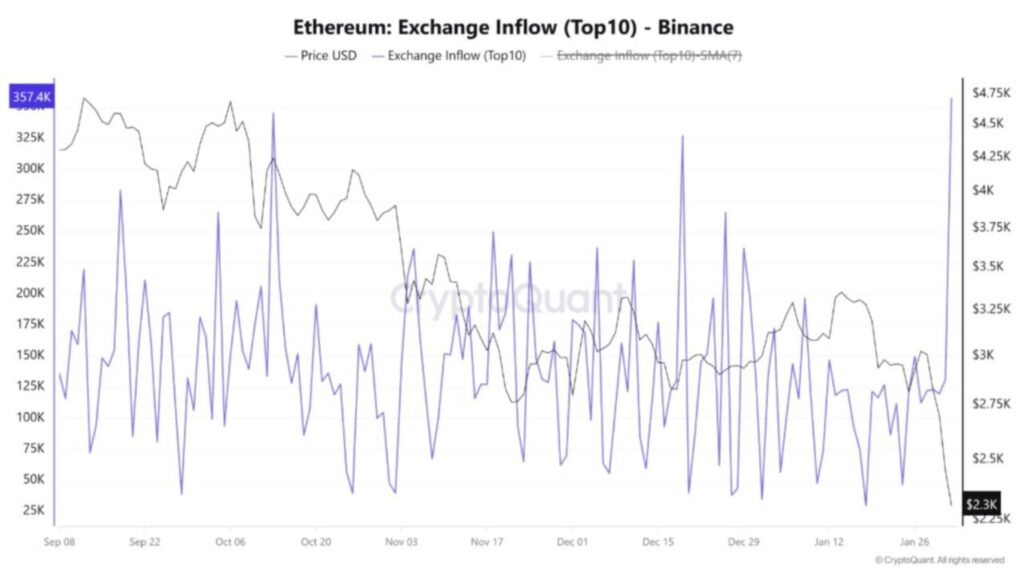

Whale ETH Inflow Surges to Binance

Ethereum’s large holders (known as whales) sent a surge in the amount of ETH to exchanges on February 1, with Binance as the main destination. Inflow from the top 10 addresses reached the highest daily level in recent months.

Data from CryptoOnchain citing CryptoQuant shows that Ethereum Exchange Inflow (Top10) on Binance surged to 357,000 ETH, becoming the highest daily level since September. Overall, Exchange Inflow (Top10) across all exchanges reached around 600,000 ETH, making it the second largest inflow in the recorded period.

This movement indicates intense whale activity when the Ethereum price is in a key area on the chart. Historically, increased inflows to exchanges are often associated with potential selling pressure or repositioning, as deposits may precede spot market sales, collateral moves, or hedging adjustments.

Binance’s central role in Ethereum liquidity makes this spike even more prominent, as large deposits there can increase short-term supply in the market. However, a large inflow does not necessarily mean there will be an immediate sell-off, as coins can also be moved to support derivatives positions, market making, or over-the-counter (OTC) settlement.

The next trading session will likely depend on whether the market is able to absorb the additional ETH supply, or if it reacts with further volatility.

ETH Tests $2,500 Level Again as Weekly Chart Touches Channel Support

On the weekly chart on Coinbase, the price of Ethereum was trading at around $2,347 when the screenshot was taken, having previously dipped below the $2,500 zone – an area that HovWaves analysts call an important level to defend.

Read also: Crypto Market Under Pressure: When Can Crypto Prices Recover from the Bearish Trend?

The chart shows that the price is above the long-term ascending channel support line, while the highlighted demand zone covers the mid $2,000 range.

In a post on X (formerly Twitter), HovWaves mentioned that the $2,500 region aligns with immediate degree support as well as the 0.618 Fibonacci level, and he also described it as “macro channel support”.

He added that the previous rally towards all-time highs looked like an extended fifth wave, and the current price correction has returned to the area where the extension started.

The roadmap annotated on the TradingView chart lists the higher T1 and T2 targets as forward projections, complete with Elliott wave labels and Fibonacci references.

However, the active candles on the chart highlight the current price fight around the base of the channel and the $2,500 zone, with the latest weekly structure suggesting a pattern of sharp rally, correction, then retest to the highlighted support band.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. ETH Near $2,500 as Top Addresses Flood Binance with Ethereum. Accessed on February 4, 2026