5 Facts on Dogecoin (DOGE) Holding at $0.10 and Potential Crypto Recovery

Jakarta, Pintu News – Dogecoin , a meme coin born as a joke, is now showing interesting technical signals amid a weak cryptocurrency market. DOGE recently managed to hold at around USD 0.10 (around Rp 1,677) after experiencing a 4.5 percent gain in the last 24 hours, prompting the question of whether this is the beginning of a recovery phase or just a temporary rally. Here are five key takeaways from DOGE’s recent movements that are relevant for both investors and beginners.

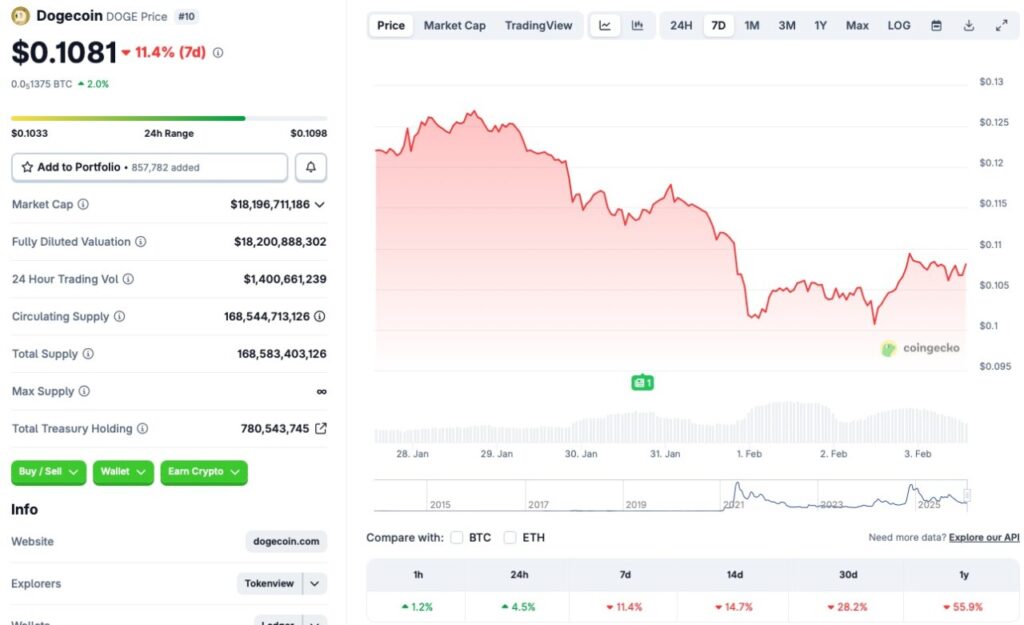

1. DOGE Gains 4.5 Percent Amid Market Declines

According to price data, Dogecoin (DOGE) recorded a rally of around 4.5 percent in a 24-hour period and managed to stabilize at levels of around USD 0.10. This rise came when most of the market was still under selling pressure. The rally shows that the extreme selling pressure on DOGE had eased at least in the short term.

However, this positive movement is in the context that the broader market is still bearish and investor sentiment has yet to return to full positivity. That means despite the price increase, the risk of volatility remains high for crypto assets like DOGE.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. DOGE Still on a Medium-Term Negative Trend

Weekly and monthly price data shows that Dogecoin is still experiencing more downward pressure. DOGE is reportedly down about 11.4 percent in the past week, down 14.7 percent in 14 days, and down about 28.2 percent over the past 30 days. These declines reflect that the recent rally occurred amidst a still negative general trend.

This medium-term price decline suggests that the 4.5 percent increase may not have represented a solid trend change, but rather a brief technical rebound in a weaker market.

3. On-Chain Indicators Point to a Potential Temporary Bounce

Other analysis indicates that on-chain indicators such as the Market Value to Realized Value (MVRV) for Dogecoin have moved from oversold positions. The 30-day MVRV shows relative undervalued levels, while the 7-day MVRV shows signs of recovery. This implies the possibility of a short-term bounce in the next few days.

However, as the overall market structure is still bearish, this rebound needs to be viewed with caution, especially for traders considering short-term positions.

4. Larger Crypto Market Still Bearish

The improvement in DOGE’s price is partly related to broader market movements, including Bitcoin’s rally from US$74,000 to around US$78,000 over the same period. The biggest gains in major assets like BTC often have a positive effect on altcoins like DOGE, so DOGE’s rally can also be attributed to broader market momentum.

Nonetheless, general market sentiment still tends to be cautious, so the altcoin rally is still vulnerable to correction if market momentum reverses.

5. Rebound Doesn’t Signal a Long-Term Change in Price Direction

While DOGE is showing a rebound and stabilization around key levels, it is still unclear whether this signals a long-term recovery or just a temporary technical reaction. The long-term outlook for DOGE remains influenced by broader market sentiment as well as other altcoin fundamentals.

Investors should pay attention to DOGE’s key support and resistance levels and additional technical indicators before deciding on a long-term strategy. Medium to long-term analysis will give a clearer picture of the trend direction.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Watcher Guru. Dogecoin Holds Steady At $0.10 Amid 4.5% Rally: Recovery On? Accessed February 4, 2026.