5 Important Facts of Hyperliquid (HYPE) 22% Rally and Position in Crypto Top 20

Jakarta, Pintu News – Hyperliquid , the token of a decentralized perpetual futures trading platform, has recently become one of the best performing crypto assets in the market. In the last 24 hours, HYPE recorded a price increase of about 22 percent and made it to the top 20 list based on market performance.

These moves are stealing the spotlight amidst a still-weak broader crypto market. Here are five key points that are relevant for both investors and beginners looking to understand HYPE’s current situation.

1. HYPE Jumps About 22 Percent in 24 Hours

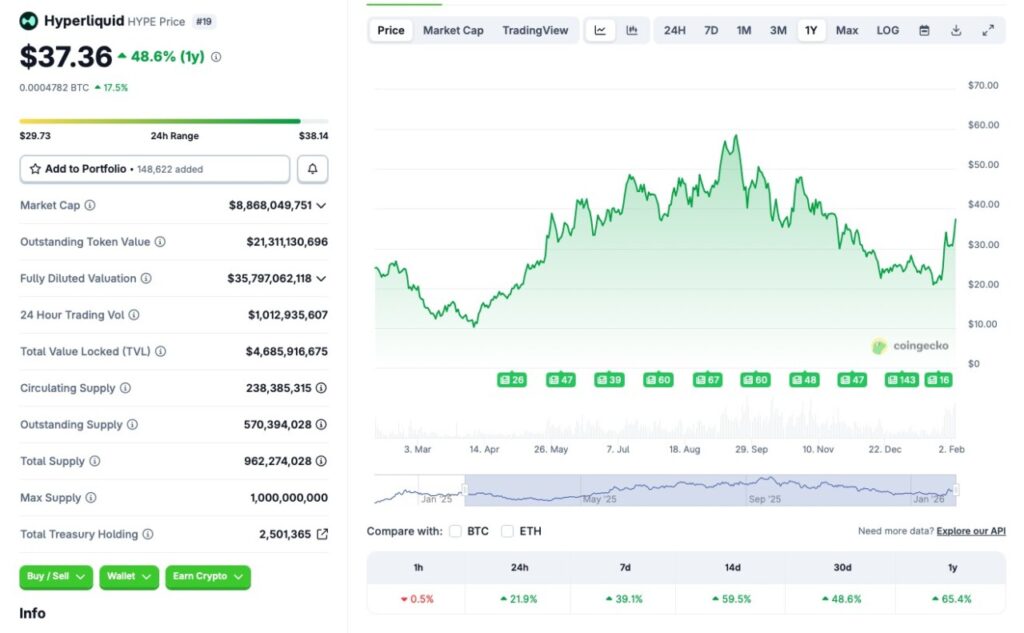

Hyperliquid (HYPE) recorded a rally of almost 22 percent in a 24-hour period, as well as showing an upward trend higher in the weekly and monthly terms. In a week, HYPE rose about 39.1 percent and more than 48 percent in the last 30 days.

This price surge puts HYPE in the top 20 list of cryptocurrencies by performance in that short period. However, this rise comes at a time when the broader crypto market remains largely under pressure.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. HYPE Remains Far Below 2025 Peak Price

While the latest rally is exciting, the Hyperliquid price is still around 37 percent below its highest peak of around US$59.30 in September 2025. This suggests that the current price is still part of a recovery phase, not new highs.

Such large declines from peak prices reflect the high volatility typical of many crypto assets, especially altcoins backed by new technological innovations.

3. The Tech Catalyst Behind the HYPE Rally

The recent rally was partly triggered by technical developments in the Hyperliquid ecosystem, specifically the HIP-4 proposal introducing an outcome trading feature. This feature is designed to bring contracts settled within a fixed range relevant to prediction markets and option-like instruments.

Although the feature is still under development and being tested on a testnet, the announcement and prospect of expanding the platform’s functionality illustrates that technological innovation is one of the attractions for investors.

4. Analysis Shows Potential Correction

Some analysts, including those from CoinCodex, predict that HYPE’s rally may not continue on a consistent basis. Price projections predict a possible drop back to around US$24.94 in the next few days, which would mean a potential correction of more than 30 percent from current levels.

This forecast is based on weaker market conditions overall, including pressure on large assets like Bitcoin , as well as the fact that rallies are often sharp but followed by consolidation or correction in the near future.

5. Market Sentiment and Risks Remain High

HYPE’s rally was also influenced by negative market sentiment towards cryptoassets in general, as well as investors’ tendency to take risk-off measures when markets show sustained pressure. This means that, despite the positive catalysts on the technology side, the risk of volatility and price correction remains high.

Investors need to combine technical analysis, project fundamentals, and broad market sentiment before making long-term decisions regarding HYPE or other assets in their crypto portfolio.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Watcher Guru. Hyperliquid Enters Top 20 With 22% Rally in 24 Hours: Peak Soon? Accessed February 4, 2026.