World Copper Prices Today, Thursday, February 5, 2026: Sideways around $5.80 per Pon

Jakarta, Pintu News – World copper prices today, Thursday, February 5, 2026, moved relatively stable with a sideways trend in the range of USD 5.80 per pound. After experiencing selling pressure in the previous session, the movement of copper prices showed a consolidation phase as market participants awaited new directions from macroeconomic sentiment and global industrial demand.

World Copper Price Today: Sideways in the Range of $5.80 per Pon

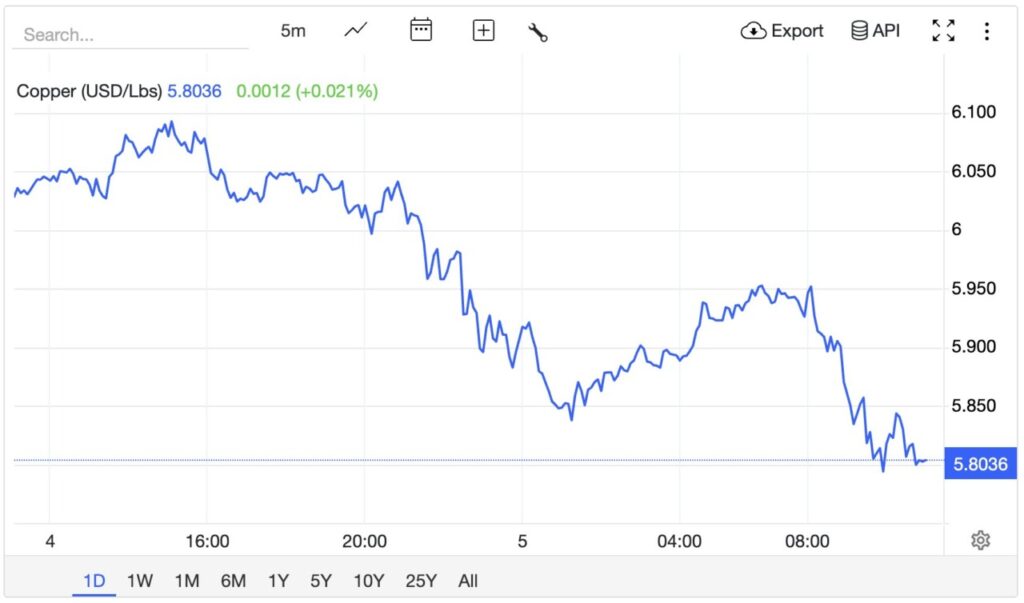

The copper price chart in the past day shows a fairly clear weakening trend even though it had moved volatile. At the beginning of the period, copper prices were in the upper area and had recorded a gradual increase before turning consistently weak. Selling pressure became more visible towards the middle of the chart, characterized by a sharp decline from the area above USD 6.00 per pound. This pattern indicates reduced buying interest in the short term.

Entering the next session, copper prices had a limited recovery, but failed to maintain the upward momentum. After forming a lower peak, the price corrected again to near the level of USD 5.80 per pound, before finally stabilizing in the range of USD 5.80-5.85. Overall, this movement reflects the dominance of short-term bearish sentiment, with the market likely to wait for a new catalyst to drive the next price direction.

Also read: Silver Jewelry Price Today, Thursday February 5, 2026

Gold, Silver and Copper Prices Correct, Annual Trend Still Positive

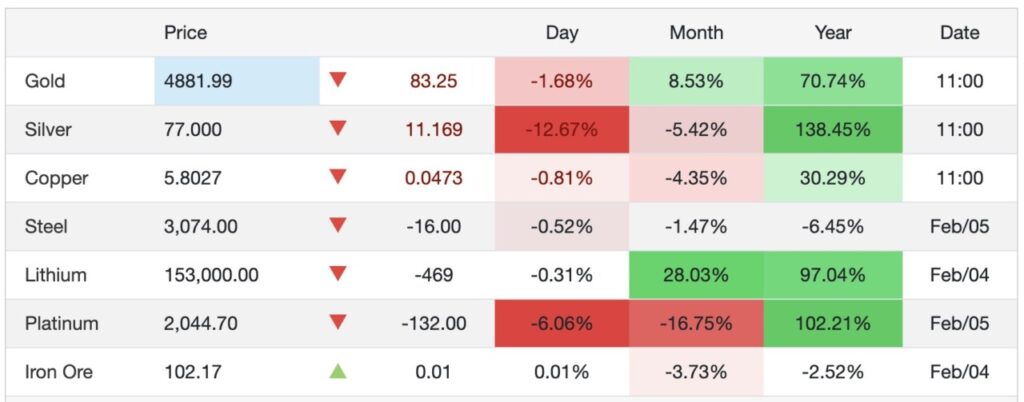

The table shows the price movements of gold, silver and copper, all of which are under pressure in the short term. The price of gold was recorded at 4,881.99 and weakened 1.68% on a daily basis, although it still recorded an increase of 8.53% in a month and 70.74% on an annual basis.

This indicates a short-term correction after a strong uptrend in the medium to long term. Gold’s daily weakness reflects profit-taking amid global market uncertainty.

Meanwhile, silver recorded the sharpest daily decline with a 12.67% correction to 77,000, and is still under pressure on a monthly basis with a 5.42% decline. However, on an annualized basis silver showed a very strong performance with a 138.45% surge, signaling high volatility.

On the other hand, copper traded at around 5.8027 and fell 0.81% on a daily basis and 4.35% on a monthly basis, although it still posted a 30.29% gain in a year. This movement shows that although industrial metals such as copper are experiencing a short-term correction, the long-term trend is still relatively positive.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Trading Economics

- Featured Image: Generated by AI