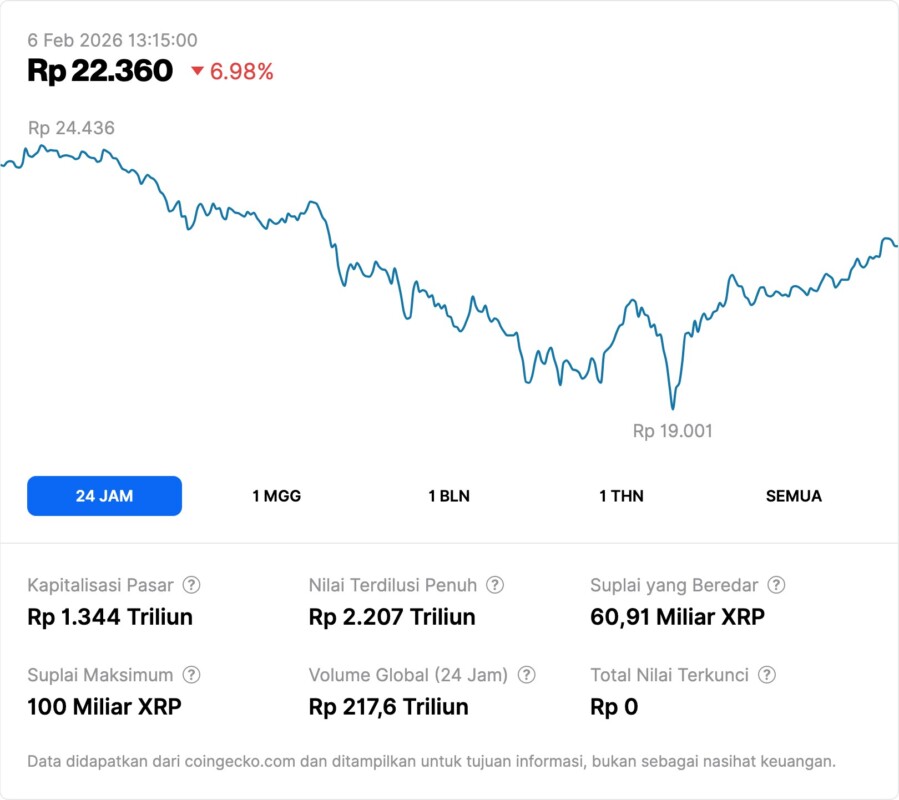

6 Reasons XRP is Depressed in 2026: US Policy, Economic Data, & Impact on Crypto

Jakarta, Pintu News – XRP token – one of the major assets in the crypto market – experienced significant price and sentiment pressure in early 2026, as a combination of strong US economic data, crypto policy delays, and global macro risks. These conditions not only impacted XRP, but also reflected broader dynamics in the cryptocurrency market, which is important for both novice and experienced investors to understand.

1. Strong US Economic Data Boosts Dollar

US economic data releases showed stronger than expected figures, including indicators of unemployment and service sector growth. This led to a strengthening of the US dollar against other major currencies, reducing the appeal of riskier assets including cryptocurrencies.

A stronger dollar often depresses the price of XRP, as investors tend to look for assets that provide yield or hedge against the strength of the dollar. In this context, cryptocurrencies like XRP lose their appeal relative to fiat-based assets.

Also Read: 5 Crypto that Whale is Eyeing in February 2026, Quietly Accumulating Amid Volatility

2. Cryptocurrency Policy Delay in the US

US regulators have several times delayed important decisions regarding crypto policy, including rules that could potentially provide legal certainty for assets like XRP. Uncertainty regarding regulatory status has caused many institutional investors to delay capital allocation decisions to crypto.

This delay increases market uncertainty as crypto industry participants await clear regulatory parameters to mitigate legal and operational risks. XRP, which has been involved in previous legal disputes with US regulators, remains sensitive to this policy development.

3. Risk-Off Sentiment in Global Market

Global investors exhibit risk-off behavior, which is a preference for safe assets like bonds and the dollar over risky assets like crypto. When risk sentiment increases, demand for XRP and other cryptocurrencies typically falls as capital allocation is shifted to more conservative instruments.

This change in sentiment also weakened the price movement of XRP, as most institutional and retail investors reduced their exposure to cryptocurrencies amid macro uncertainty. The risk-off sentiment became an additional catalyst for short-term price pressure.

4. Trading Volume Declines

XRP trading volumes on major exchanges have also shown a decline compared to previous months. Lower volumes generally indicate a lack of strong buying interest at current prices, which can magnify volatility in the event of a sell-off.

Low volumes tend to trigger faster liquidation of leveraged positions when the market moves sharply, due to the lack of market depth to withstand selling pressure. This suggests that market sentiment towards XRP is yet to show significant signs of a positive reversal.

5. Correlation with Broader Crypto Market Sentiment

XRP’s price movements remain correlated with price trends in the broader cryptocurrency market, specifically Bitcoin and Ethereum . When BTC experiences a correction or major selling pressure, altcoins like XRP usually follow the downtrend due to Bitcoin’s high dominance in the market.

This correlation emphasizes the importance of monitoring Bitcoin price dynamics and overall crypto market sentiment when evaluating potential XRP movements in the short and medium term.

6. Regulatory Risk Affects Investor Decisions

Regulatory issues not only in the US, but also in various other jurisdictions, remain a risk factor affecting investors’ decisions on XRP. The uncertainty of legal interpretations on how XRP is classified in some countries – whether as a security, commodity or otherwise – makes investors cautious.

This regulatory risk impacts institutional capital flows in the crypto sector, as large investments tend to wait for a clearer legal framework to reduce litigation risk and uncertainty. This is one of the fundamental factors suppressing sentiment towards XRP at the moment.

Also Read: 3 Crypto Underrated in February 2026 that Investors are Starting to Look at, Not Just Hype!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

FXEmpire. XRP news today: XRP pressured by US data and crypto policy delays(https://www.fxempire.com/forecasts/article/xrp-news-today-xrp-pressured-by-us-data-and-crypto-policy-delays-1577718). Accessed February 6, 2026.