7 Ethereum Facts: Whale Buys IDR4.7 Trillion ETH, Signaling Rebound or Still Fragile?

Jakarta, Pintu News – Whale activity has returned to the crypto market’s attention after a large accumulation of Ethereum occurred amidst a volatile price environment. On-chain data shows the movement of funds worth hundreds of millions of dollars, raising the question of whether this is an early sign of recovery or a market trap. This article summarizes the key points in an educated and neutral manner for both novice and experienced cryptocurrency investors to understand.

1. Whale Ethereum Adds Rp4.7 Trillion in Assets

Ethereum whales were recorded to add around USD 280 million ETH or the equivalent of IDR 4.73 trillion to their wallets. This action was carried out in a short period when the ETH price was still moving limited. Historically, accumulation by whales is often associated with medium-term expectations.

Large withdrawals of ETH from exchanges reduce the supply available for sale. This is often interpreted as a preference for holding the asset over releasing it to the market. In the crypto context, this signal tends to be observed as a potential strengthening, although it is not conclusive.

Also Read: 5 Fun Facts: Bitcoin Often Rebounds in February – Lessons from Historical Data

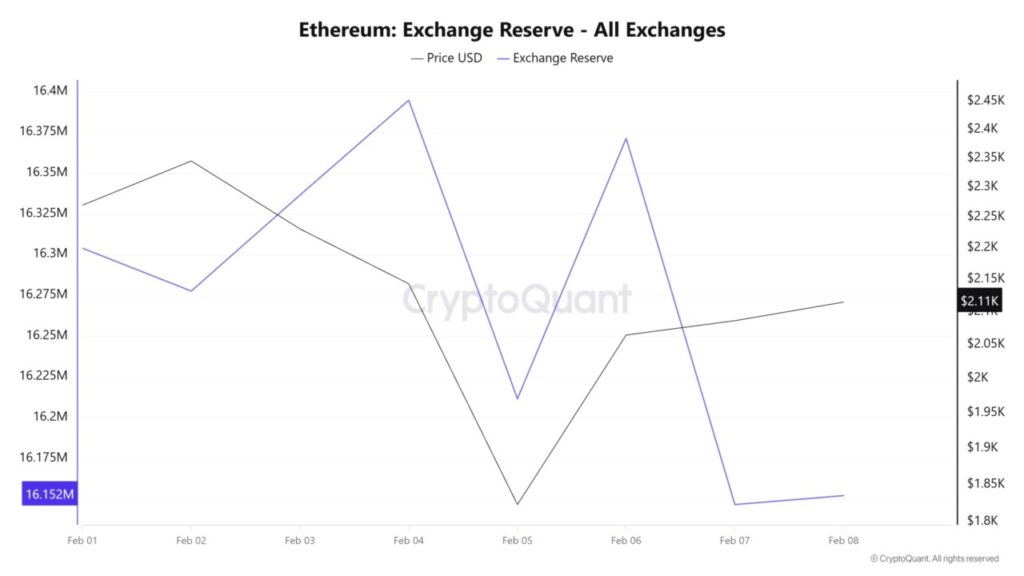

2. ETH Reserves on Exchanges Continue to Shrink

On-chain data shows Ethereum reserves on exchanges reduced by more than 200K ETH. This decrease signals the movement of assets from trading platforms to personal wallets. Similar patterns often appear when large players anticipate certain price movements.

However, reduced stock exchange reserves do not automatically guarantee price increases. External factors such as macro sentiment and market liquidity still play a big role. Cryptocurrency investors need to view this data as one indicator, not the only reference.

3. ETH price rises, but volume weakens

The price of Ethereum had risen by about 4.5 percent and was trading at around USD 2,108 or around IDR 35.6 million. This increase occurred relatively quickly after a period of selling pressure. However, the trading volume dropped significantly.

The decline in volume indicates that market participation has not been strong. This means that price increases have not been fully supported by widespread interest from retail traders. In the crypto market, this condition often triggers volatile price movements.

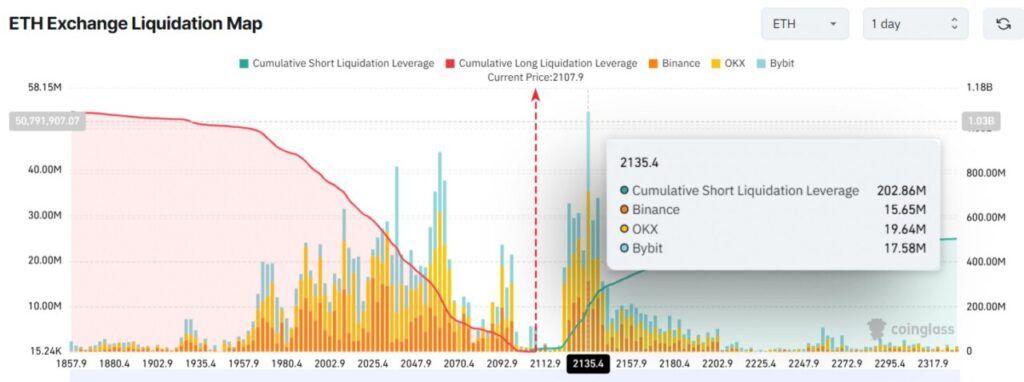

4. Resistance Level Still a Challenge

ETH’s important resistance area is around USD 2,180. This level is considered crucial to determine the direction of the next trend. A daily price close above this area could potentially open up room for further recovery.

Conversely, failure to break the resistance could trigger a further correction. The closest support is said to be in the range of USD 1,550 or around IDR 26.2 million. This range is a zone that cryptocurrency investors need to pay attention to.

5. Technical Indicators Begin to Improve

Several technical indicators showed an improvement in momentum. The oversold condition started to ease, accompanied by a gradual increase in buying pressure. This is in line with whale accumulation activity.

Even so, the indicators are not yet signaling a strong trend reversal. The market is still in the confirmation phase. Crypto investors generally wait for a combination of technical signals and volume before making major decisions.

6. Trader Sentiment Still Divided

Derivatives data shows that long and short positions have both increased. This reflects the uncertainty of Ethereum’s price direction in the short term. Some traders are speculating a rebound, while others anticipate a continued decline.

This condition is common in the cryptocurrency market when prices are in crucial areas. Volatility tends to increase in these situations. Therefore, risk management remains a key factor.

7. What it Means for Beginner Investors

For novice investors, whale accumulation can be an interesting signal, but not a guarantee of quick profits. ETH price movements are still affected by many variables. A gradual approach is often considered more rational under these market conditions.

Understanding on-chain data and crypto market structure helps reduce emotional decisions. Education is key before going deeper into the world of cryptocurrencies. With a neutral approach, investors can assess opportunities and risks in a more balanced manner.

Also Read: 5 AI Perspectives: Will XRP Fall Below $1 in February 2026?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. Is It Time to Buy Ethereum? Whales Add $280M in ETH, But… Accessed February 9, 2026.