XRP Price Outlook: Consolidation After the Sell-Off as Market Confidence Begins to Fade

Jakarta, Pintu News – XRP remains under pressure as the short-term chart shows continued weakness, although corporate communication from Ripple remains consistent. Price action on the four-hour time frame shows that sellers are still in control of the momentum.

As such, traders are still paying more attention to the price behavior in the support area rather than the upside potential. Market data shows that XRP is now trading in cautious conditions, affected by technical limitations and pent-up demand.

Short-term Structure Still Favoring Bears

XRP is still moving down after failing to break the $2.40-$2.30 area earlier this year. Importantly enough, the price remains below the Ichimoku cloud, confirming the continued downward structure.

Read also: TON Foundation Launches TON Pay, What Makes It Different?

The rebound from the February low of $1.12 also lacked a strong continuation, so many traders considered it to be a correction, not the beginning of a trend reversal.

Support at $1.42 is the key area in the short term. If this level is broken, prices could potentially quickly test $1.36. Furthermore, a drop below $1.12 could trigger stronger selling pressure towards the $1.00 area.

To the upside, the $1.53 zone acts as the closest resistance. Previously, sellers were also quite aggressive in defending the Fibonacci level of $1.62. A rise above $1.77 would signal an early improvement in the technical structure. However, a broader recovery is likely if the price is able to return above $1.92.

The ADX indicator hovering around 17 confirms the weak strength of the current trend. Even so, the price position that is still below the Ichimoku cloud makes the downside risk remain more dominant.

Derivatives and Spot Flows Signal a Cautious Attitude

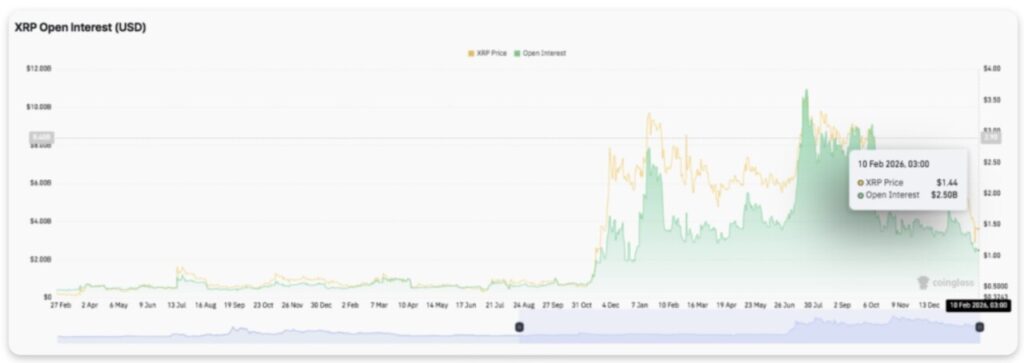

XRP derivatives data shows a completed leverage cycle. Open interest rose sharply at the end of the fourth quarter when prices surged. But after that, open interest began to decline as volatility increased.

As a result, forced liquidations and position closures saw speculative exposure shrink. Although prices occasionally seemed to stabilize, confidence in leveraged positions continued to weaken.

Recently, the open interest has started to stabilize at a lower level. This change indicates that much of the excess leverage has been dissipated. As such, the market is now likely to enter a consolidation phase rather than taking aggressive one-way positions.

Spot flow data is in line with the cautious tone. Net outflows have still dominated in recent months, illustrating continued distribution pressure. Moreover, the sessions with the largest outflows usually occur when prices are falling.

There were occasional spikes in inflows, but they were unable to change the big trend. As a result, spot demand remains limited and further strengthens the bearish structure.

Ripple Reaffirms XRP’s Role in Institutional Strategies

Meanwhile, Ripple continues to emphasize the role of XRP in its payments business strategy. CEO Brad Garlinghouse responded to the community’s concerns regarding the product’s focus and emphasized that XRP remains core in the design of transaction settlement solutions for institutions.

Read also: Shiba Inu Strengthens, OKX Moves 20.8 Billion SHIB to Cold Storage

In addition, Ripple’s development team also highlighted XRP as a key bridge asset for on-chain liquidity.

This emphasis aligns with Ripple’s broader goals in the areas of regulatory compliance and infrastructure development. It also supports XRP’s long-term utility narrative, even if price performance in the short-term remains weak. However, for now the market is prioritizing technical signals over the company’s strategic message.

XRP Price Technical Outlook

Key levels are still quite evident as XRP moves within a fragile short-term structure.

On the upside, the area to monitor is $1.53 as an initial hurdle, followed by $1.62 adjacent to the 0.382 Fibonacci retracement. In case of a stronger rise, the way could open up towards $1.77 and then $1.92, which coincides with the 0.618 Fibonacci level and the broader trend recovery zone.

To the downside, $1.42 serves as the closest support. If this level is broken, the market focus is likely to shift to $1.36, with $1.12 as the February swing low and the last major defense before the $1.00 area.

Technically, XRP is still under the Ichimoku cloud, which signals a bearish bias and weak momentum. The current price movement pattern points more towards the risk of consolidation rather than signaling an imminent trend reversal.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. XRP Price Prediction: XRP Consolidates After Selloff as Market Conviction Fades. Accessed on February 11, 2026