Dogecoin Price Holds Around $0.09 Today — Is There More Downside Ahead for DOGE?

Jakarta, Pintu News – Dogecoin is still under pressure as bearish sentiment dominates the crypto market. The meme coin fell 3.26% on February 11 and was trading around $0.08978. Technical indicators are signaling a potential further decline as key support levels are being threatened.

Trading volumes also appear weak, signaling investors are hesitant to open positions at current price levels. This lack of conviction makes DOGE even more vulnerable to additional selling pressure.

Then, how will the Dogecoin price move today?

Dogecoin Price Drops 0.45% within 24 Hours

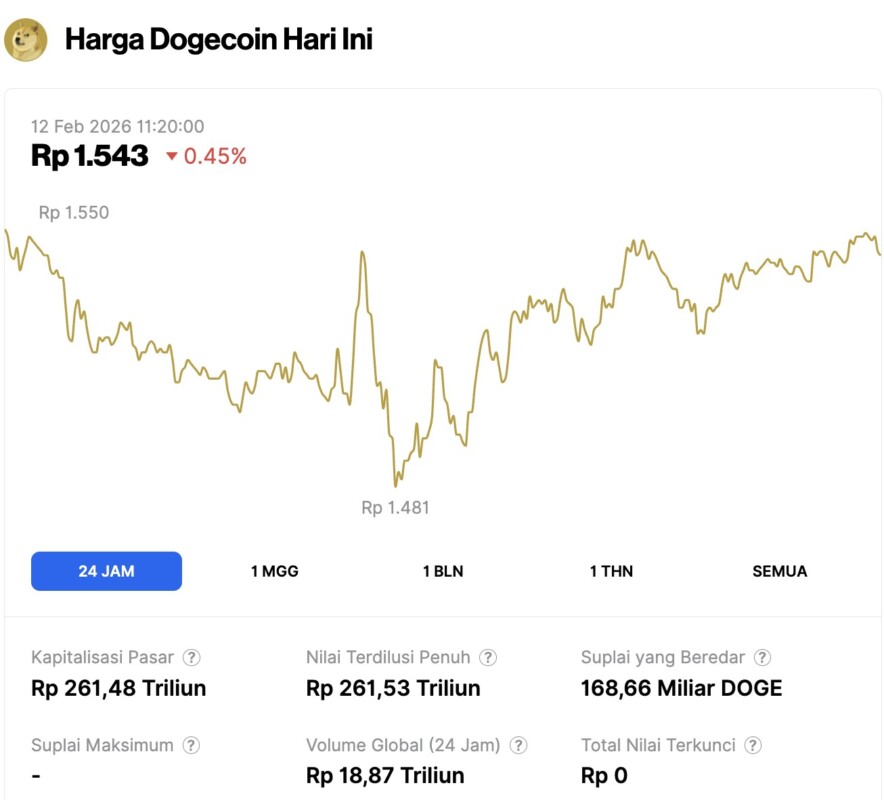

On February 12, 2026, the price of Dogecoin slipped 0.45% over the past 24 hours, trading at $0.09186, or around IDR 1,543. During that period, DOGE moved within a price range of approximately IDR 1,550 to IDR 1,481.

At the time of writing, Dogecoin’s market capitalization is roughly IDR 261.48 trillion, with a 24-hour trading volume of about IDR 18.87 trillion.

Read also: Bitcoin Price Weakens to $67,000 Today: Whale Sells $172 Million BTC!

Short-term Outlook Leads to Further Decline

On the hourly chart (11/2), we see that Dogecoin is testing crucial support at $0.08940. The bullish side should be able to defend this area to prevent a deeper correction. If the price fails to bounce before the daily close, it could potentially trigger a decline towards the $0.089 area.

Technically, there is no clear reversal pattern yet. The asset is still moving below the major moving averages, which confirms the bearish structure. The momentum indicator is still pointing downwards, indicating that selling pressure still dominates.

Volume-wise, the situation is less favorable for those hoping for a quick recovery. The lack of significant buying activity leaves the bullish camp lacking the “juice” to reclaim lost price levels. Without a large influx of new capital, DOGE seems to have the potential to continue its decline to the lower support zone.

The $0.08675 level is now emerging as the next major area of resistance. If the price drops to this point, it will be a considerable pullback from the recent high. Market participants are monitoring this zone closely, because if it breaks, the selling pressure could increase even faster and deepen the downward wave.

Read also: Ethereum Price Falls to $1,900 Today: ETH’s “Big Money” Support Starting to Weaken?

Medium-term Outlook Triggers Technical Concerns

On the weekly time frame (11/2), Dogecoin’s situation looks increasingly worrying for holders. The crypto has broken below the $0.095 support level, a development that has a considerable technical impact. This breakout invalidates the previous consolidation pattern and opens up the opportunity for a deeper decline.

If the current weekly candle closes below $0.095, the technical breakdown will be confirmed. Under such conditions, selling pressure could potentially increase as many stop-losses would be executed. The path of least resistance seems to lead to the $0.080 zone, where stronger support might form.

Historical price movements show that the $0.080 area is a key demand zone. This level has previously been the starting point of rallies after corrections in the past. However, if the price actually drops to this area, it would mean a drop of more than 11% from the current level.

Overall, crypto market conditions have not been favorable either. Bitcoin and other major digital assets are still struggling to rally consistently. The absence of “leadership” from big cryptos is usually an additional burden for altcoins like Dogecoin.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. Dogecoin Price Faces Critical Support Test as Bears Target $0.080 Level. Accessed on February 12, 2026