XRP Overtakes Bitcoin and Ethereum as Price Finds a Bottom, Setting the Stage for a Rebound

Jakarta, Pintu News – The price of XRP recently dropped through the $1.50 level, continuing its correction phase and resurfacing a bottom signal that last appeared almost two years ago. This drop has made the XRP price fall below its realized price, one of the important metrics in on-chain analysis.

This triggered a panic sell-off, but some investor groups saw this weakness as an opportunity. Even so, historical patterns indicate the possibility of a deeper consolidation phase, or the formation of attractive valuation areas for accumulation.

XRP Holders Begin to Dispose of Assets

Investor skepticism towards XRP is growing as the coin’s price struggles to record a meaningful recovery. Both retail investors and large holders are seen reducing their exposure.

Read also: PEPE Coin Update: As the Price Plummets, Whales Scoop Up 23 Trillion Tokens – Is a Revival Coming?

The lack of consistent upward momentum has weakened confidence and reinforced fears of a potential prolonged downturn in the current crypto market cycle.

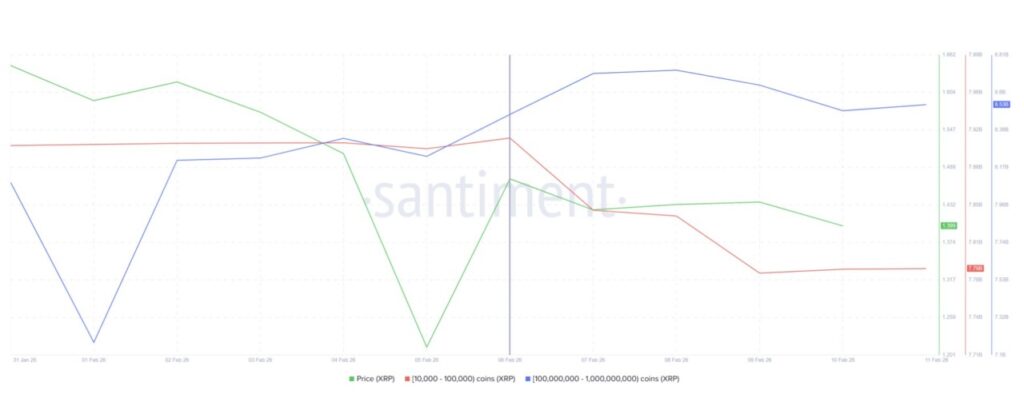

On-chain data shows addresses holding between 10,000 to 100,000 XRP have reduced their holdings. Large-cap wallets holding between 100 million and 1 billion XRP have also recorded aggressive sell-offs. In total, this group has offloaded around 350 million XRP in the last five days.

This wave of distribution was worth more than $483 million. Outflows of this magnitude confirm the growing pessimism among major market participants. Persistent selling pressure from whales often affects broader sentiment, increasing short-term volatility and pressuring XRP’s price stability.

Is XRP Forming a Bottom or Still Going Down?

The macro picture for XRP currently relies heavily on the realized price metric. The realized price represents the average purchase price of all coins in circulation, giving a clearer view of the aggregate position of investors than simply looking at the spot price.

Currently, the spot price of XRP is below its realized price.

When the spot price falls below the realized price, the market generally enters aloss-making phase. This last happened in July 2024. Historically, this kind of setup can signal a potential bottom.

However, recovery is usually not immediate and often requires a lengthy consolidation phase. A similar pattern occurred in 2022. After a rally in early 2021, the XRP price gradually weakened.

When the price fell below the realized price in May 2022, the bottom phase only really ended around March 2023. If the historical pattern repeats itself, XRP could potentially enter a prolonged period of consolidation instead of recovering sharply in a short period of time.

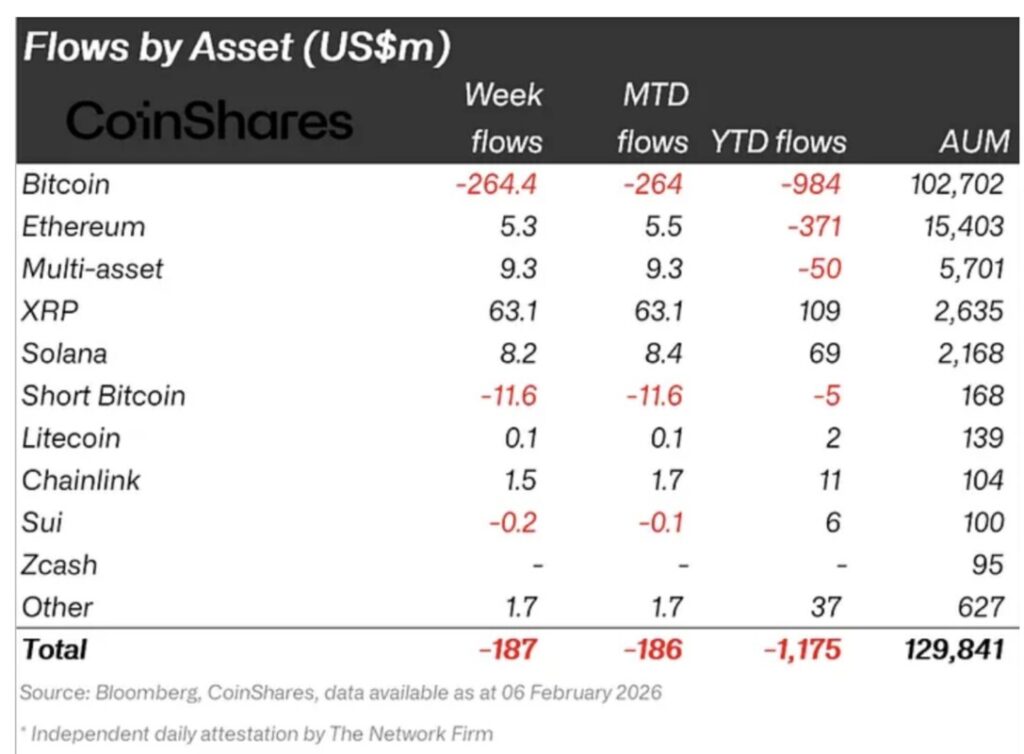

Institutions Still Optimistic

Although retail investors tend to be cautious, interest from institutional investors in XRP still continues. Based on CoinShares data, XRP recorded fund inflows of $63.1 million in the week ending February 6. This performance surpassed even Bitcoin, Ethereum, and Solana in the same period.

Read also: Solana Strengthens Below $90, Long-term Chance of Breaking $1000 Still Open?

Year-to-date, total inflows into XRP-based investment products have reached $109 million. In contrast, Bitcoin and Ethereum have recorded net outflows.

This difference suggests that institutions may view the utility of XRP and its function in cross-border payments as something that remains strong amid the broader digital asset market.

The influx of institutional funds can be a price support in times of market weakness. Continued capital allocation from asset managers could potentially limit further downside risk. While not eliminating volatility, these inflows could help prevent the XRP price from deepening its bottom phase into a long consolidation period.

XRP Price Rebound Potential

Currently, the price of XRP is hovering around $1.38, still holding slightly above the $1.37 support level. The short-term outlook looks semi-bullish amid mixed investor signals. Selling pressure is still present, but institutional fund inflows and the historical pattern of bottom formation provide some optimism.

XRP’s immediate target is to reclaim the $1.52 level as support. This zone could be an important psychological point that helps relieve selling pressure. If investor sentiment improves and buying interest strengthens again, XRP prices have the opportunity to advance to the $1.77 area and even test the $2.00 level.

Conversely, if the bullish momentum is unable to continue consistently, downside risks will increase. A decisive break below $1.37 could drag XRP towards $1.26. Missing that level could invalidate the previous positive outlook and open the door for further weakness down to around $1.12 if market conditions remain depressed.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Outshines Bitcoin and Ethereum As Price Marks Bottom; Reversal Ahead? Accessed on February 12, 2026