Bitcoin Price Slips to $67,000 Today as Analysts Warn of Further Declines

Jakarta, Pintu News – The failure of Bitcoin bulls to hold the $70,000 level has triggered another drop to around $65,000, reinforcing bearish sentiment among institutional and retail investors who fear a potential deeper price fall.

Analysts have warned that the price of BTC is at risk of plummeting to near $10,000, as on-chain data points to structural weaknesses in the market. So, how will Bitcoin price move today?

Bitcoin Price Drops 1.32% in 24 Hours

On February 13, 2026, Bitcoin was trading at around $67,565, or roughly IDR 1,124,108,907, marking a 1.32% decline over the previous 24 hours. During that period, BTC fell to a low of about IDR 1,099,416,354 and climbed as high as IDR 1,151,220,449.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 22,380 trillion, while its 24-hour trading volume has dropped 12% to around IDR 805.37 trillion.

Read also: Bitcoin Plunges 50%, Here’s a List of Grayscale’s Favorite Crypto to Rebound: ETH, SOL, LINK & More

Glassnode Highlights Structural Weaknesses Amid Macro Pressures

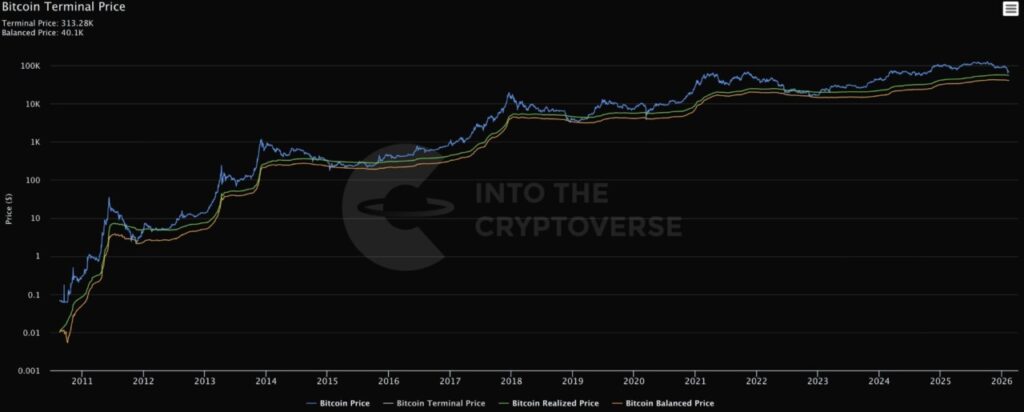

On-chain analytics platform Glassnode highlighted the structural weakness in Bitcoin amid macroeconomic pressures. The current price movement of BTC is likely to be defensive in the range of $60,000-$72,000, with the possibility of the price collapsing to touch the “realized price” around $55,000.

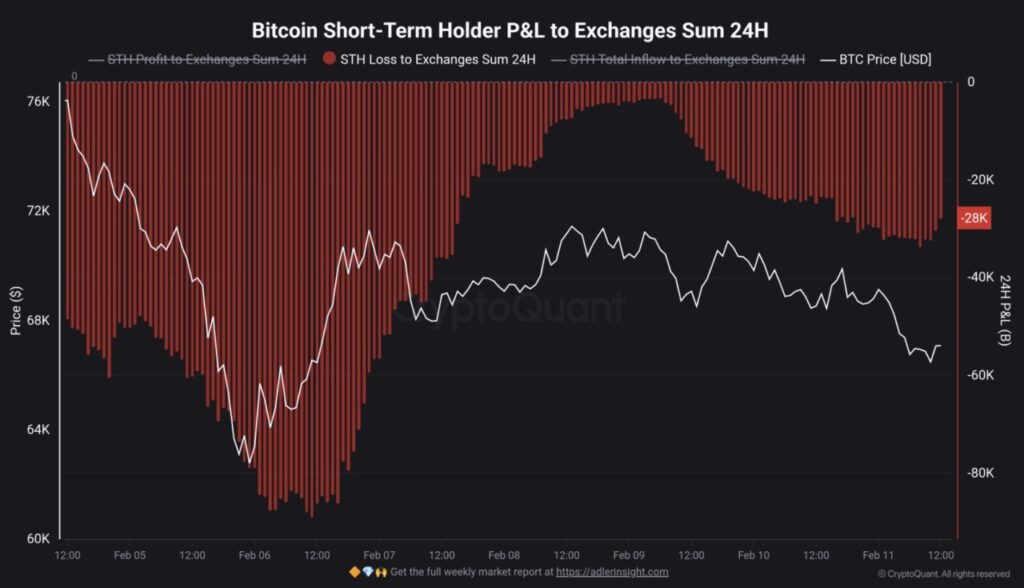

Bitcoin spot volumes are structurally weak and declining, creating a demand vacuum and accelerating the realization of losses. Forced liquidation of futures positions, falling fund inflows into ETFs and corporate crypto cash, and high demand for downside protection via BTC options make the current conditions similar to the bear market patterns of early 2022 and 2018.

The Bitcoin Fear & Greed Index dropped to level 5 (extreme fear) after the Nonfarm Payrolls data rose by 130k in January, above market expectations of 70k and much higher than December’s 48k. The unemployment rate also fell from 4.4% to 4.3%, fading hopes of an interest rate cut by the Fed.

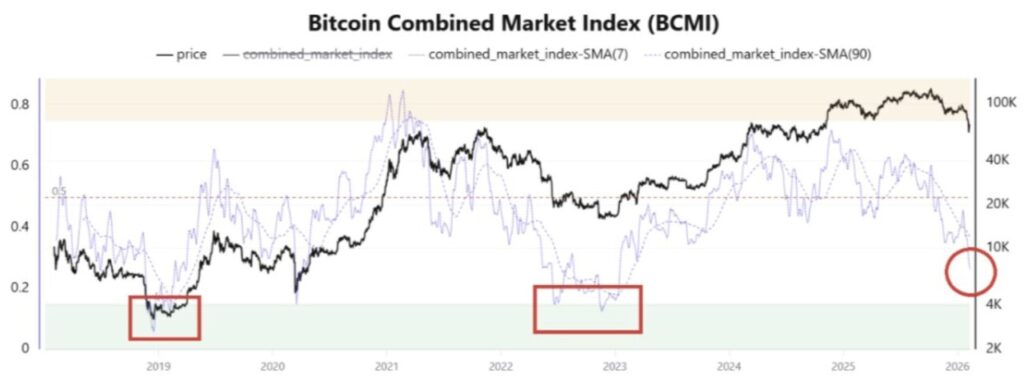

CryptoQuant’s Bitcoin Combined Market Index (BCMI) metric is increasingly indicating a transition into a deeper bear market phase, rather than just a short correction. “From a cyclical perspective, a true bottom is likely still ahead,” said a CryptoQuant analyst.

Analysts predict BTC price crash

CryptoQuant’s head of research, Julio Moreno, and analyst Benjamin Cowen voiced concerns regarding the move by Susquehanna-backed crypto lender BlockFills to temporarily halt client deposits and withdrawals citing heightened market volatility.

Read also: XRP Beats Bitcoin & Ethereum: Price Hits Bottom, XRP Ready to Rebound?

Previously, Julio Moreno has highlighted the outflow of funds from Bitcoin ETFs, the negative Coinbase premium, the drying up of stablecoin liquidity, and the absence of strong fundamental triggers for a bullish trend. According to him, this indicates that the Bitcoin market has entered a bear phase with limited room for upside.

Benjamin Cowen argues that in a bear market phase, Bitcoin price tends to fall below the realized price and balanced price. He predicts that the price of BTC could plummet to below $40,000 as bearish sentiment strengthens in the market.

Peter Schiff Predicts Deeper BTC Crash Toward $10,000

Gold advocate and economist Peter Schiff has reiterated his critical view that BTC could potentially experience a very sharp price fall. In his latest statement, he highlighted that the long-term chart shows the initial support area to be around $10,000 and warned about Bitcoin’s current weak position.

Schiff’s comments come amid an ongoing wave of sell-offs, with the narrative that Bitcoin is currently overvalued and vulnerable to broader macroeconomic pressures. In addition, options traders have also adjusted their positions following the release of the Non-farm Payrolls data, which triggered a surge in call and put transaction volumes.

Currently, the price of BTC is moving around $67,000 after rebounding from a 24-hour low of $65,757. In the last 24 hours, short-term Bitcoin holders moved around 28,000 BTC to crypto exchanges at a loss. Traders are now looking forward to Friday’s US CPI inflation data and crypto options maturities to trigger the next market movement.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness. Accessed on February 13, 2026