Bitcoin (BTC) Movement Amid Price Decline: What Are the Whales Doing? (2/26/25)

Jakarta, Pintu News – The price of Bitcoin fell to a three-month low on February 25, 2025, reaching around $86,000 (IDR 1,403,380,000), reflecting a decline of around 10% in the past week.

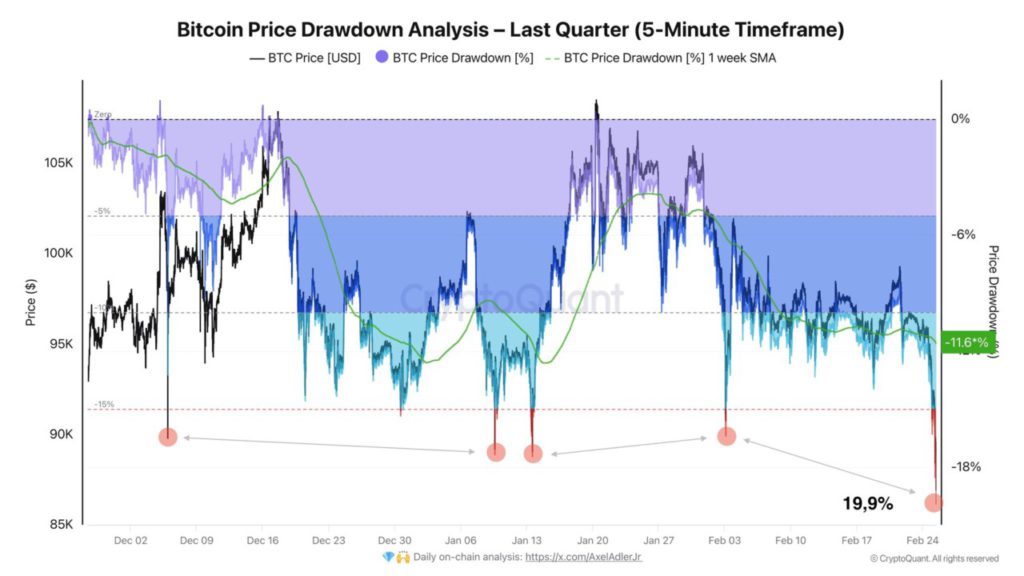

This drop indicates a major correction in BTC, with prices falling by around 20% in the first quarter of this year. While this bearish trend continues, there are indications that some Bitcoin whales are accumulating more BTC, taking advantage of the lower price.

Bitcoin Market Conditions and Price Drop

At the end of February 2025, Bitcoin continued its journey in a downward trend after finally failing to maintain its long-term market structure. On February 25, BTC was trading at around $86,000 (IDR 1,403,380,000), which marked a significant drop since the highest price recorded a few months ago. It also recorded the biggest correction since August 2024, with a decline of around 20%, which is more than double Bitcoin’s average annual decline of around 8.9%.

This price drop has mainly affected short-term holders (STHs). Data shows that over the past 24 hours, more than 27,500 BTC was moved by addresses holding Bitcoin for less than 155 days, with many of these transactions occurring at a loss. However, amidst this price drop, some whale addresses were seen accumulating more BTC.

Also Read: Senator Dick Durbin Introduces Legislation to Stop Fraud at Crypto ATMs

Bitcoin Whale Activity: Accumulation Amid Decline

Despite the significant drop in Bitcoin price, whales seem to be taking advantage of this opportunity to accumulate more BTC. Data from CryptoQuant shows that on February 24, 2025, approximately 26,430 BTC was moved to whale accumulation addresses. These addresses are typically associated with over-the-counter (OTC) transactions and long-term storage, indicating that whales are committed to holding Bitcoin for the long term.

In addition, large companies such as Strategy recently announced the purchase of 20,356 BTC for approximately $1.99 billion (IDR 32.5 trillion), which further confirms the great interest of large investors in Bitcoin despite the depressed price. This decision shows the confidence of large investors in the future potential of Bitcoin, even though the price is currently still in a downtrend.

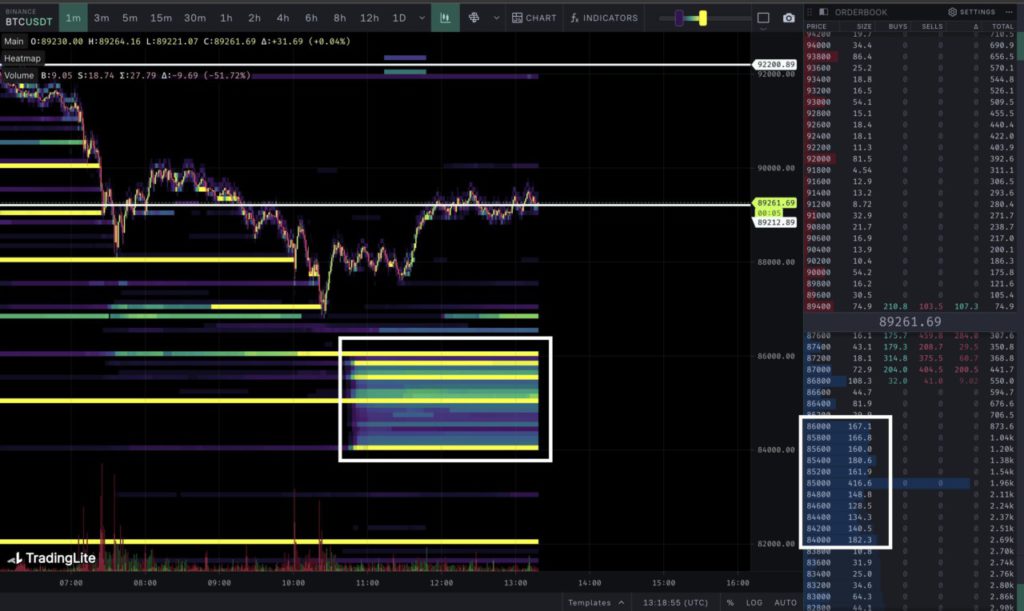

Bitcoin Price Prediction: Range $85,000 to $81,000

Analyzing Bitcoin’s technical movements, some traders predict that BTC could be in a price range between $85,000 (IDR 1,387,050,000) to $81,000 (IDR 1,321,730,000) in the near future. The daily candle close below $92,000 (IDR 1,502,400,000) on February 24 confirmed the double-top pattern that has been forming over the past few months. The price drop after this pattern emerged is expected to reach levels around $78,000 (IDR 1,271,340,000) to $76,000 (IDR 1,239,080,000).

Furthermore, there is an identified liquidity area between $81,700 (IDR 1,334,001,000) and $85,100 (IDR 1,388,300,000) that has not yet been filled, which might be a buffer point for Bitcoin price. Some traders have also noted large spot offers on Binance in the price range of $84,000 (IDR 1,369,720,000) to $86,000 (IDR 1,402,420,000), which strengthens the possibility that Bitcoin price will find support in this area.

However, if Bitcoin price fails to hold at $81,000 (IDR 1,321,730,000), the next support is between the CME gap at $77,000 (IDR 1,257,410,000) and $80,000 (IDR 1,305,760,000), which would complete the price target of this double-top pattern.

Bitcoin’s Outlook in the Coming Weeks

Although there is potential for a short-term upward movement between the mentioned support levels, technical analysis suggests that Bitcoin may still come under pressure in the near future. With sharp price corrections and market uncertainty, investors need to closely monitor how Bitcoin price interacts with existing support areas.

The whale movement that continues to accumulate Bitcoin may reflect long-term optimism towards the cryptocurrency, but in the short term, market dynamics will still be affected by the existing bearish sentiment.

Also Read: 3 Factors Causing the 50% Drop in Solana (SOL) Price from All-Time Highs

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Whales Shift 26.4K BTC to Accumulation Addresses as Bitcoin Falls to 3-Month Low. Accessed February 26, 2025.

- Featured Image: Generated by AI