SEC Investigation into Uniswap Terminated: What Does It Mean for the DeFi Industry?

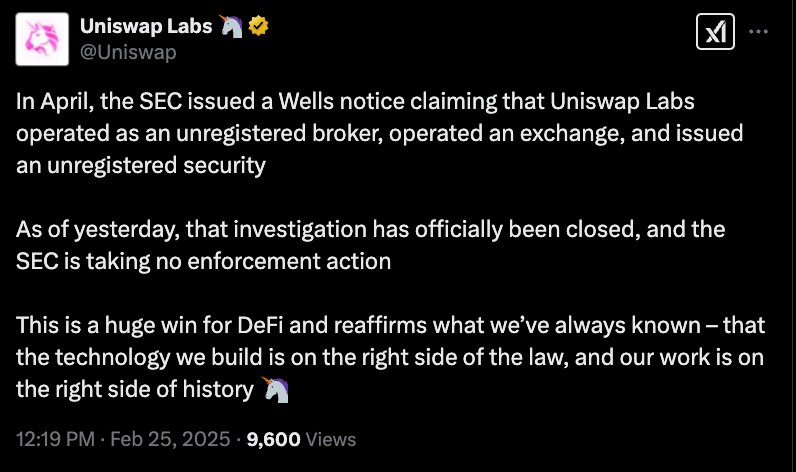

Jakarta, Pintu News – Uniswap Labs, the developer behind the decentralized exchange Uniswap, announced that the investigation conducted by the US Securities and Exchange Commission (SEC) against the company has been terminated.

In a post on February 25, 2025, Uniswap stated that the SEC has concluded its investigation and does not plan to take further enforcement action against the company. This announcement came after Uniswap received Wells’ notice from the SEC in April 2024, when the commission’s leadership was still under Gary Gensler.

A Big Win for the DeFi Industry

The SEC’s decision to halt its investigation into Uniswap is considered a major victory for the Decentralized Finance sector. In its statement, Uniswap emphasized that the technology they developed is on the “right side of the law” and judged that their work is in line with history. Uniswap considers this decision as proof that their business model, which is entirely based on the principle of decentralization, is not a violation of regulations.

This investigation previously covered possible violations involving improper registration of crypto-related investment products. However, with the termination of this investigation, many in the DeFi industry consider that it indicates a better understanding of how DeFi technology can operate without violating existing laws.

Also Read: Senator Dick Durbin Introduces Legislation to Stop Fraud at Crypto ATMs

SEC’s Changing Approach to Crypto

This decision suggests that the SEC may be changing its approach to crypto oversight. According to several reports, the SEC recently met with various crypto company representatives to explore potential changes in the regulation of digital assets. Hester Peirce, the SEC commissioner leading the special team for crypto, proposed that the SEC wait until it has a chairman approved by the Senate to set up a different regulatory path for the crypto sector.

Although the SEC did not officially announce the termination of the investigation into Uniswap, this move could be part of a larger change in the way it handles crypto companies. Some experts predict that many other SEC cases, including those involving Ripple Labs and several other large companies, may be delayed or terminated.

What is the Impact on the Crypto Industry?

This decision also affects how regulators in the US might treat the crypto sector as a whole going forward. Given that the SEC has ended cases against major companies such as Coinbase, Robinhood Crypto, and OpenSea, this suggests a change in direction when it comes to crypto enforcement. Many are of the opinion that the crypto sector may face fewer regulatory hurdles in the future, although challenges remain regarding oversight policies.

This decision is also an important symbol for the DeFi industry, which is often considered more susceptible to strict regulations compared to centralized exchanges (CEXs). If this trend continues, the DeFi sector will probably develop faster and be safer in terms of relations with regulators.

Conclusion

The SEC’s halted investigation into Uniswap points to a possible sea change in the way US regulators oversee the crypto industry. While the dismissal of the case is a breath of fresh air for Uniswap and the DeFi sector, there is still a lot of uncertainty regarding the future of crypto regulation in the US. The SEC’s decision may pave the way for clearer policies that support the development of the blockchain and crypto industry.

Also Read: 3 Factors Causing the 50% Drop in Solana (SOL) Price from All-Time Highs

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. SEC Investigation into Uniswap Dropped. Accessed February 26, 2025.

- Featured Image: Unchained Crypto