Ethereum Sinks 4% Today (Feb 28, 2025) – What’s Behind the Sharp Drop in ETH Price?

Jakarta, Pintu News – Ethereum experienced significant selling pressure on February 28, 2025, with the price dropping 4% to $2,217 (36.9 million IDR).

This drop comes amidst increased crypto market volatility, triggered by a variety of factors, ranging from macroeconomic uncertainty to the lingering impact of the Bybit hack.

So, what are the main factors driving ETH price weakness today? Check out the full analysis below.

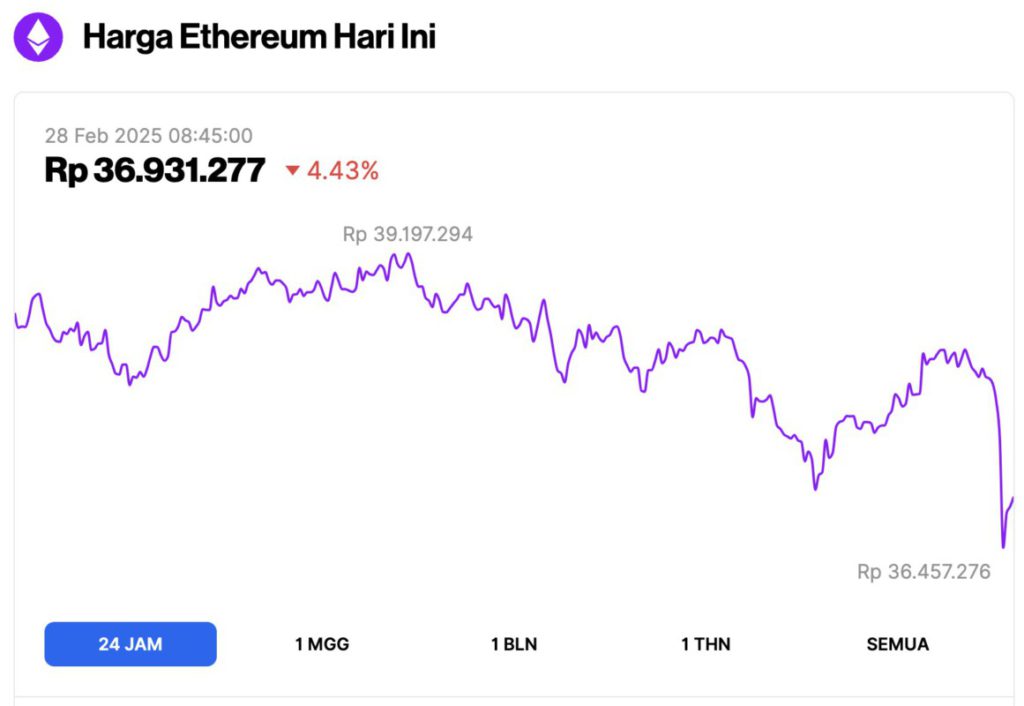

Ethereum Price Drops 4.43% in 24 Hours

On February 28, 2025, Ethereum (ETH) was trading at approximately $2,217 or 36,931,277 IDR, reflecting a 4.43% decline over the past 24 hours. During this period, ETH briefly surged to a high of 39,197,294 IDR before undergoing a correction and retreating toward its lowest point of 36,457,276 IDR.

Data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $267.75B billion, with daily trading volume also plummeting 13% to $25.47B in the last 24 hours.

Key Factors Behind Ethereum’s Price Drop

Reporting from FX Street (2/27/25), Ethereum faced strong selling pressure this week after losing the psychological support level at $2,500, which triggered a massive wave of liquidation.

On Thursday, ETH fell to $2,327, wiping out the recent gains and further strengthening the bearish sentiment in the market. And now, ETH has fallen back to $2,217.

According to reports, this drop came after the settlement of the Bybit hack case, where hackers allegedly linked to the North Korean Lazarus group stole more than 400,000 ETH.

Initially, Ethereum was still holding above $2,800, while the crypto community debated various solutions and their impact on the market. However, although Bybit quickly responded to this incident by fully refunding customers as well as sending over 100,000 ETH to partner exchanges such as Binance and Bitget that provided emergency liquidity, market sentiment remained negative.

Recovery efforts were further complicated after Ethereum developers rejected the rollback option, leaving the resolution of the case to legal authorities.

Read also: Vitalik Buterin Pushes for Poseidon Hash Function in Ethereum—What Are the Benefits?

In addition, on-chain data shows that some of the stolen ETH has been laundered through Solana -based meme coins, raising concerns that recovering the lost funds will be a long and complicated process, further depressing ETH prices.

Impact of President Trump’s New Tariff Announcement

On the other hand, macroeconomic factors also contributed to Ethereum’s weakness. On Monday, US President Donald Trump announced new tariffs on imports from Canada and Mexico, which raised market concerns of higher inflation.

The combination of uncertainty due to the Bybit hack and risk-off sentiment triggered by US trade policy are the two main factors driving the sharp decline in Ethereum prices.

As the implementation of US trade tariffs on March 1, 2025 approaches, investors are increasingly exhibiting risk-off behavior, avoiding riskier assets such as Ethereum.

Additionally, concerns continue to rise regarding the impact of Bybit’s hacked funds on market liquidity, as stolen ETH continues to circulate through money laundering channels.

Selling Pressure Continues: US Trade Tariffs and Impact of Bybit Hack Shadow Ethereum

Citing the FX Street report, in the derivatives market, short traders are taking advantage of Ethereum’s weakness to reap profits. Based on liquidation data from Coinglass, the total liquidation of Ethereum in the last 24 hours reached $124 million.

Read also: Pi Network Breaks Records! Check Today’s Price in Rupiah (Feb 28, 2025)

Interestingly, long traders suffered the biggest losses, with total liquidations reaching $99.77 million, while shorts only lost $24.85 million. This means that the liquidation of long positions was almost 75% greater than that of shorts, suggesting that bearish traders are currently in control of the market.

This imbalance indicates that many leveraged long positions were caught in selling pressure, causing forced sell-offs that further exacerbated the decline in ETH prices.

With bearish sentiment still dominating, short traders may continue to extend their lead in the next few days.

If ETH fails to reclaim the $2,500 level in the near term, selling pressure could intensify, with bears targeting lower support levels for greater profits from leveraged short positions.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Ethereum price analysis: Short traders in profit as ETH loses $2,500 support despite Bybit hack resolution. Accessed on February 28, 2025