Quant (QNT) Price Prediction: Will it Drop to $74 Amid Bearish Sentiment? (10/3/25)

Jakarta, Pintu News – Quant has recently shown dynamic price movements. After breaking out of thesideways channel trading zone, the price briefly jumped up to $112. However, QNT is currently trading in a downward trend and is in a descending channel, with the current price at around $82.4 after a 6% increase in the last 24 hours.

Technical indicators such as Moving Average Convergence Divergence (MACD) are at -1.5 and -2.2 on the histogram, which indicates bearish momentum and provides a warning for traders. If QNT is able to maintain its upward momentum and break the resistance around $90, then further upside potential could occur. However, if selling pressure remains high, the price could retest the support level at $74, which is the recent low.

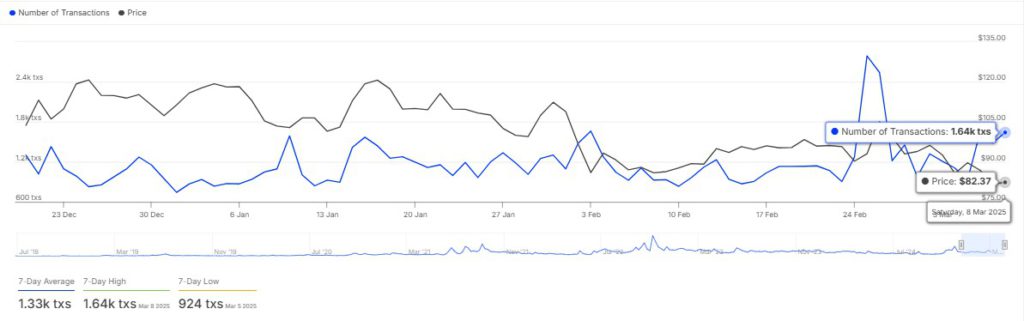

Transaction Volume and its Effect on Price

Despite the downward trend in QNT price, the number of transactions on the network increased, peaking at 1,640 transactions. This phenomenon may indicate an increase in demand or accumulation from investors anticipating future price increases.

However, the increase in transactions could also be due to sell-offs from QNT holders looking to exit their positions, which could exacerbate the bearish pressure in the market. If the surge in transactions reflects increased buying interest, QNT prices may stabilize or even experience a recovery. Conversely, if the increase in transactions comes from selling, the price could continue to fall.

Also Read: El Salvador’s President Closes Bitcoin Animal Hospital: Controversy and Impact

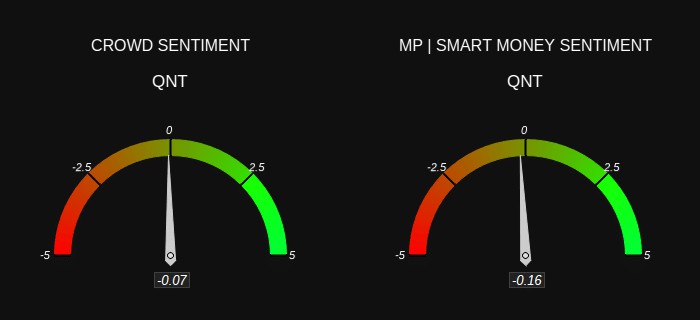

Market Sentiment towards Quant (QNT)

Sentiment analysis shows that the market is currently trending bearish towards QNT. Sentiment from the general investor community stands at -0.07, indicating a slight pessimism. Meanwhile, sentiment from institutional investors or smart money is even more negative, standing at -0.16.

If this negative sentiment continues, then selling pressure could further depress QNT prices. However, if optimism returns to the market, QNT prices could potentially experience a stronger recovery as institutional and retail investors start buying again.

Conclusion

Quant (QNT) is currently facing uncertainty in its price movement. If buying pressure increases and the price manages to break the $90 resistance, a potential recovery could occur. However, if selling pressure remains dominant, QNT could drop back down to $74.

With increasing transactions amidst a downward trend in prices, investors need to look closely at whether this is an accumulation or a massive sell-off. In addition, changes in market sentiment could be a key indicator of whether QNT will see a recovery or continue to weaken in the days ahead.

Also Read: Cardano and Check Point Collaborate for AI-Based Blockchain Security!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. Quant Price Prediction: Will QNT Drop to $74 Amid Bearish Sentiment?. Accessed March 10, 2025.

- Featured Image: Capital.com