Ethereum (ETH): Analysis of Price Drop from High Point for March 2025 Market

Jakarta, Pintu News – Ethereum has shown remarkable resilience in the face of various market crises. With a price history full of ups and downs, Ethereum (ETH) has always managed to bounce back from every significant downturn. This strength continues to attract investors who see the long-term potential of this crypto asset.

Price Drop Analysis from High Point

In 2022, Ethereum (ETH) experienced a sharp decline of -80% following the FTX crash, but managed to stabilize at -53.11% with a trading price close to $2,300 on March 9, 2025. This strong recovery pattern is not new to Ethereum (ETH).

In 2018, the asset also experienced a decline of -70% and in 2021 of -60%, but both times Ethereum (ETH) managed to bounce back. Dencun’s renewal in 2024 and the ETF approval have significantly contributed to Ethereum’s (ETH) recent recovery.

This confirms the long-term strength of the asset. Accumulation by whales during periods of price decline also boosts investor confidence. Analysts predict that Ethereum (ETH) has the potential to reach a new record high if the price can break $3,000 to $4,164.

Also Read: MicroStrategy Stock Downside Risk Amid Crypto Market Volatility

The Role of Volatility Heatmaps

Ethereum (ETH)’s resilience is closely tied to the Binance ETH/USDT liquidation heat map. The previous heatmap showed Ethereum (ETH) trading between $2,050 and $2,250 in the 24-hour time frame. This mirrors the Ethereum (ETH) bearish chart where a -53.11% decline in 2025 suggests stabilization near $2,300.

The heatmap also shows that the historical -80% drop in 2022 correlates with liquidation around $2,100, reflecting market pressure. Price fluctuations of $50 to $100 echo the -60% to -70% declines in 2018 and 2021. This suggests that volatility navigation, supported by the Dencun update and ETF approval, is key for Ethereum (ETH) to reach the $3,000 to $4,164 price range.

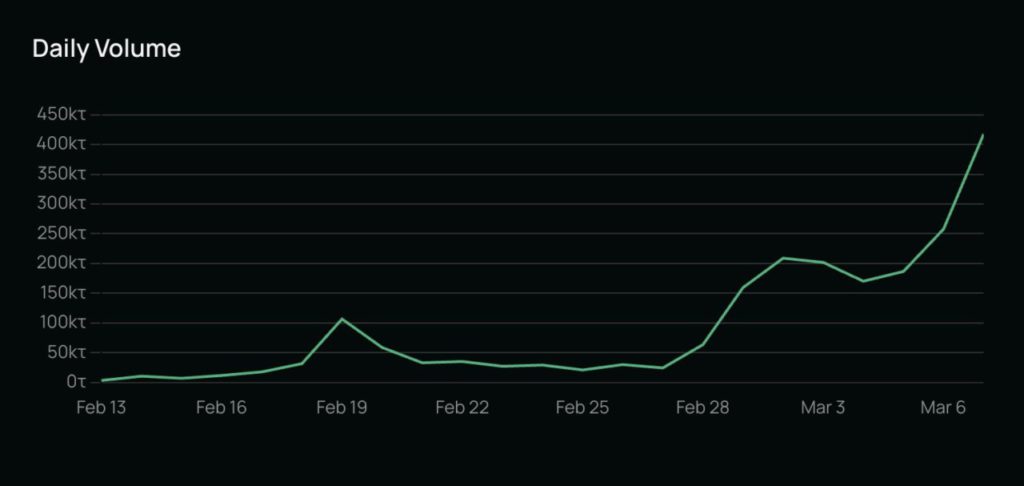

Ethereum (ETH) Trading Volume Changes

The trend in daily trading volume provides additional insight into the behavior of the Ethereum (ETH) market. The volume chart from February 13 to March 6 shows a sharp increase from 50,000 to 450,000 in trading volume. On February 19, the volume peaked at 200,000 before briefly dropping to 100,000 on February 25. The surge again pushed volumes up to 400,000 on March 6, coinciding with the stabilization of Ethereum’s (ETH) decline of -53.11% at $2,300.

Historical comparisons show that Ethereum’s (ETH) sharp decline in 2022 of up to -80% correlates with low trading volumes of between 50,000 to 100,000, indicating weak market participation. In contrast, the recent surge in volume indicates increased investor interest, likely driven by the Dencun update and ETF-related fund flows.

Conclusion

Ethereum’s (ETH) resilience in the face of various market challenges, regulations, and liquidity shifts continues to attract investors’ attention. With historical patterns showing the ability to bounce back from downturns, Ethereum (ETH) remains a promising investment option for those seeking assets with long-term growth potential.

Also Read: Shiba Inu (SHIB) and the Challenges to a Price Rally in the Cryptocurrency Market (11/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum’s Market Strength: What Draws Investors Back to ETH Time and Again. Accessed on March 11, 2025

- Featured Image: Generated by AI