Bitcoin Soars Past $82,000 Today (March 12) – Is the Correction Finally Over? These 3 Key Indicators Say It Might Be!

Jakarta, Pintu News – According to a Cointelegraph report, although Bitcoin has plummeted 30% from its all-time high of $109,350, three key indicators suggest that this correction phase may be over, opening up opportunities for price recovery in the near future.

Then, how is the Bitcoin price going today? Check out the full story!

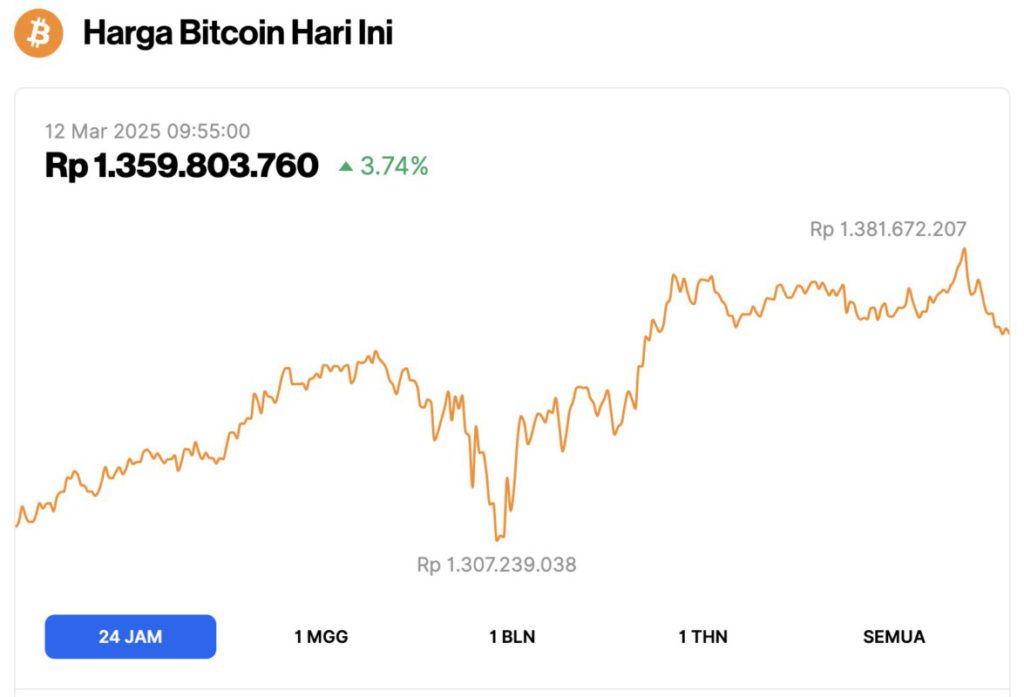

Bitcoin Price Up 3.74% in 24 Hours

On March 12, 2025, Bitcoin surged to $82,377 (approximately 1,359,803,760 IDR), marking a 3.74% increase in the past 24 hours. During this period, BTC fluctuated between a low of 1,307,239,038 IDR and a high of 1,381,672,207 IDR, reflecting strong market movement.

According to CoinMarketCap, Bitcoin’s market capitalization has now risen to $1.63 trillion, with trading volume in the last 24 hours falling 16% to $48.31 billion.

Read also: Dogecoin Price Up 5% Today (12/3/25): Crypto Analysts See Potential Rebound in DOGE!

Bitcoin Bear Market Needs 40% Drop and US Dollar Strengthening

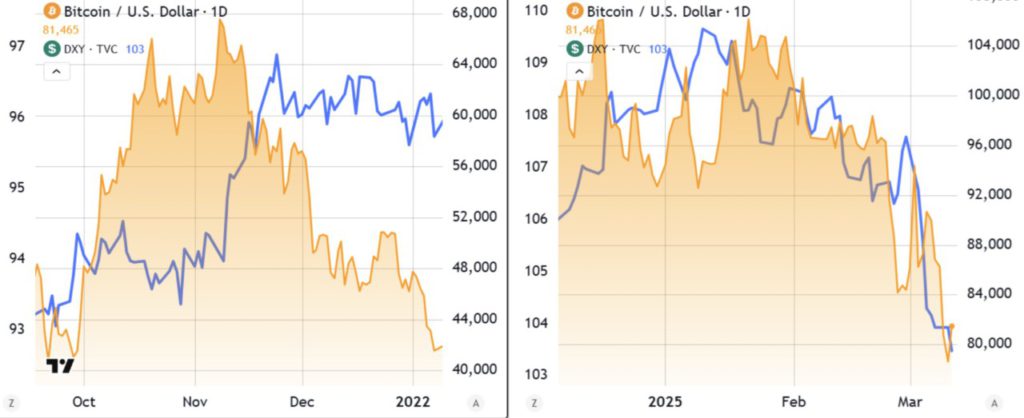

Some analysts argue that Bitcoin has entered a bear market. However, the current price movement is significantly different from the November 2021 crash, which started with a 41% drop from $69,000 to $40,560 in just 60 days.

If a similar scenario occurs now, then Bitcoin price could potentially drop to $64,400 by the end of March.

The latest correction shows a similar pattern with a 31.5% drop from $71,940 on June 7, 2024 to $49,220 in 60 days.

Moreover, in the bear market at the end of 2021, the US dollar experienced significant gains against global currencies, which was reflected in the DXY index jumping from 92.4 in September 2021 to 96.0 in December 2021.

However, this time around, the DXY has actually weakened, starting from 109.2 in early 2025 and now down to 104. Many traders believe that Bitcoin has an inverse correlation with the DXY index, given that BTC is more often viewed as a risk-on asset rather than a hedge against a weakening US dollar.

Overall, the current market conditions do not indicate any major shift to cash positions, which means Bitcoin still has support from investors and is yet to show signs of entering a full-fledged bear market.

Read also: UAE Reportedly Planning Shiba Inu Reserve – What’s Coming Next?

Bitcoin Derivatives Market Remains Stable Amid Investor Fears of AI Bubble

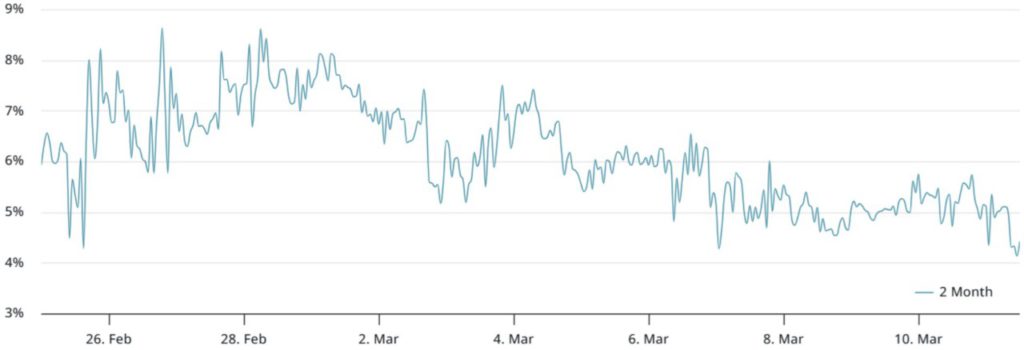

According to Cointelegraph (11/3/25), the Bitcoin derivatives market remains in good health, despite the 19% drop in BTC prices between March 2 and 11. Currently, the annualized premium on futures contracts stands at 4.5%, showing stability compared to the previous bear period.

In comparison, on June 18, 2022, this indicator dropped below 0% after Bitcoin experienced a sharp fall of 44%, from $31,350 to $17,585 in just 12 days.

Meanwhile, the funding rate on Bitcoin perpetual futures is still close to zero, signaling a balance of leverage demand between long and short positions. Typically, bearish market conditions would cause short demand to increase excessively, pushing the funding rate below zero.

On the other hand, some public companies with valuations of more than $150 billion experienced sharp declines from their highs. Some of them are:

- Tesla (-54%)

- Palantir (-40%)

- Nvidia (-34%)

- Blackstone (-32%)

- Broadcom (-29%)

- TSMC (-26%)

- ServiceNow (-25%)

Investor sentiment, especially in the artificial intelligence sector, is increasingly bearish as fears of a global recession grow.

In addition, traders are also keeping a close eye on a potential US government shutdown on March 15, as Congress must agree on a bill to raise the country’s debt limit.

However, according to a report by Yahoo Finance, the Republican Party is still experiencing internal divisions, so a deal is not certain.

Read also: Thailand Officially Recognizes USDT and USDC for Crypto Trading!

House Speaker Mike Johnson’s proposal has drawn debate, especially regarding budget increases for defense and immigration.

If an agreement is reached, risk-on markets, including Bitcoin, will likely respond positively, opening up the opportunity for a recovery in BTC prices in the near future.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. 4 signs that $76.7K Bitcoin is probably the ultimate low. Accessed on March 12, 2025