Hidden Opportunities Behind DeFi’s Decline in Dominance Below 3%: Challenges and Opportunities

Jakarta, Pintu News – The dominance of the DeFi market, which has now fallen below 3%, may signal an investment opportunity that not many people are aware of. Although many DeFi projects have started to fade in performance, some of them still show strong fundamentals. With the market distracted, the current accumulation phase could be key for those seeking opportunities in the DeFi ecosystem.

DeFi: Decline in Dominance or Hidden Opportunities?

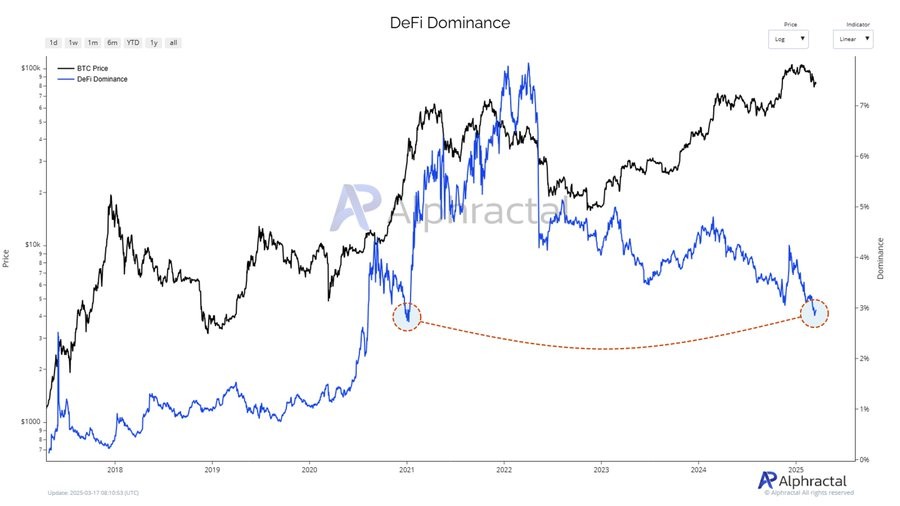

Recent data from Alphractal shows that DeFi’s dominance has dropped below 3%, a figure last seen in early 2021. Back then, the decline was a turning point for the massive rise of DeFi, as capital began to shift from Bitcoin to undervalued altcoins.

Currently, with Bitcoin (BTC) trading near local peaks and DeFi tokens lagging behind, these conditions may indicate a similar cyclical pivot point. Investors who were well-positioned during 2021’s dominance decline made significant gains, and the same scenario may be developing now.

Also Read: CryptoQuant CEO Ki Young Ju’s Warning Against Crypto Market End of March 2025

DeFi: Between Uncertainty and Innovation

Despite the declining dominance of DeFi, some projects continue to show resilience and innovation. Hemi Labs recently launched a mainnet with a Total Value Locked (TVL) of $440 million, with the goal of integrating Bitcoin (BTC) and Ethereum in one unique network.

On the other hand, Converge developed by Ethena and Securitize, is scheduled to launch in the second quarter as an Ethereum-compatible blockchain, featuring native KYC and custodian solutions targeted at institutional adoption. Despite DeFi’s decline in market share, these projects show that innovation is still ongoing and attracting attention and investment.

DeFi: Investment Challenges and Opportunities

The DeFi sector is currently at a tipping point. Recent events, such as Aave’s price volatility associated with fee change proposals, have raised concerns about manipulation. However, in February, regulatory clarity emerged when the SEC halted its appeal against a ruling that exempted DeFi platforms from securities laws.

Although the damage from previous enforcement scares still lingers, history shows that similar low points in DeFi have previously been followed by large rebounds. Initiatives such as World Liberty Finance, backed by former President Donald Trump, have secured $550 million in token sales, showing that there is still significant investor interest.

Conclusion: The Future of DeFi and the Hidden Opportunities

Despite facing challenges, the DeFi sector is showing signs of life through projects that continue to innovate and attract investment. With declining market dominance, it may be the right time for patient investors to accumulate assets in the DeFi ecosystem.

History has shown that periods like this are often followed by strong comebacks, providing opportunities for those who recognize and act on the right signals.

Also Read: When will Chainlink (LINK) reach $24? Check out the prediction! Here’s LINK’s Technical Analysis!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. DeFi dominance falls below 3%: Is there a hidden opportunity here?. Accessed on March 20, 2025

- Featured Image: PYMNTS