BTC Surge: Is the Bubble About to Burst? Here’s What Analysts Think about Bitcoin’s Future!

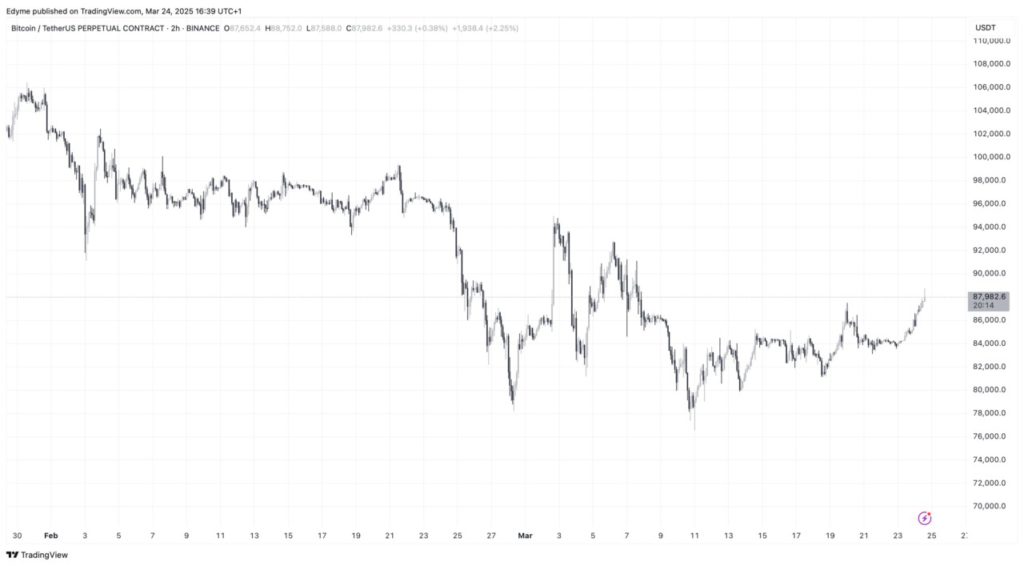

Jakarta, Pintu News – Bitcoin started the week with significant gains, breaking back through the $88,000 level for the first time in weeks. Currently, Bitcoin (BTC) is trading around $88,025, showing an increase of 6.2% over last week.

This recovery follows a period of volatility where the asset experienced significant resistance below the $85,000 price level. Although this upward price action brings renewed optimism to the market, analysts have also highlighted factors that might affect the short-term direction of Bitcoin (BTC).

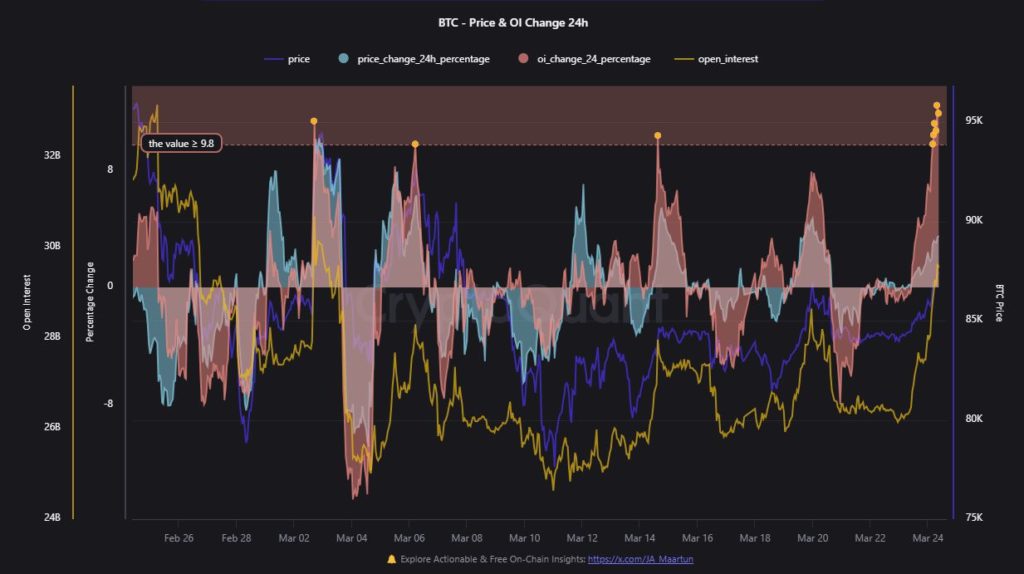

Increased Open Interest and High Leverage Risk

On-chain data shared by CryptoQuant analyst IT Tech shows that Bitcoin’s (BTC) Open Interest (OI) has reached a record high of over $32 billion. Open Interest refers to the total value of unsettled derivative contracts, such as futures and options. A rise in OI alongside a rising price can indicate a growing bullish sentiment, but it can also be a signal of increased risk if the market becomes over-leveraged.

IT Tech notes that while the rally has sparked enthusiasm, it comes with a caveat. “High OI combined with rapid price increases often lead to liquidation cascades if the trend reverses,” the analyst wrote. If bulls fail to maintain momentum, over-leveraged positions may be liquidated, triggering a sharp correction. Monitoring sudden shifts in OI and price will be critical in the coming days.

Also Read: Why is Bitcoin (BTC) Following the 2024 Summer Trend? Check out the Next Prediction!

Mixed Signals from Analysts on the Future of Bitcoin

Despite concerns about leverage, some analysts remain optimistic. Javon Marks, a technical analyst active on X, suggested that Bitcoin (BTC) may be in the early stages of another big bullish breakout. “Bitcoin (BTC) seems to be working on another big bullish breakout,” Marks said, adding that altcoins may soon follow suit.

On the other hand, analyst named Ali offers a more cautious view, citing the TD Sequential indicator as a potential sign of an impending short-term top. He highlighted key price levels that traders should keep an eye on, pointing to a significant support zone between $82,590 and $85,150, where over 625,000 BTC has accumulated previously. Meanwhile, resistance lurks between $95,400 and $97,970, a region that could see strong selling pressure due to past investor activity.

Conclusion

With market dynamics constantly changing and new factors emerging, market participants and investors need to remain vigilant. Understanding trends and signals can help in making more informed investment decisions. As the market evolves, it will be important to constantly monitor key indicators and changes in market sentiment.

Also Read: Lighter Tariff Hike Triggers Altcoin Surge: Solana, DOGE, and ADA Shine

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Surge Fueled by $32B in Open Interest, Here’s What Could Happen Next. Accessed on March 26, 2025

- Featured Image: Generated by AI