Bitcoin (BTC) nears record highs, will there be a price surge by the end of May 2025?

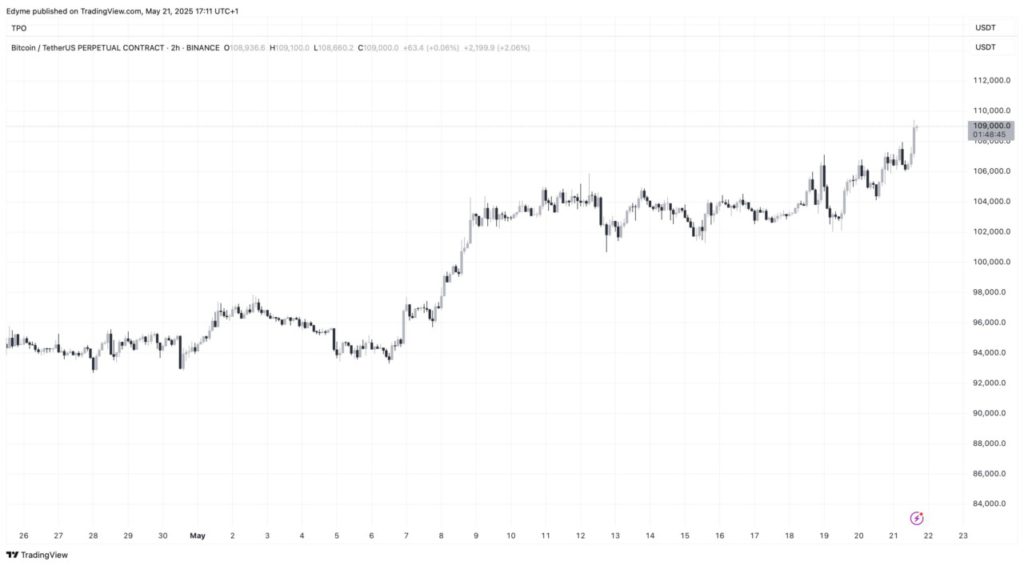

Jakarta, Pintu News – Bitcoin is showing positive momentum again by breaking through the critical $109,000 mark. Despite the drop, Bitcoin (BTC) is now trading at $108,959, showing a 3.5% increase in the last 24 hours. This increase brings Bitcoin (BTC) closer to the previous record high recorded in January of $109,958, signaling a strong bullish sentiment among investors.

Trading Behavior is Changing: Analysis from Binance

Recent analysis from Maartunn, an analyst at CryptoQuant, highlights significant changes in trading behavior on Binance, the world’s largest crypto exchange. The ratio between spot and futures trading volumes has reached 4.9, the highest level in the last 18 months. On May 12, Binance recorded spot trading volume of $30.17 billion compared to $115.56 billion in futures.

This Spot to Futures ratio provides insight into the balance between real asset purchases and derivatives-based speculation. A higher ratio indicates that trading is more concentrated in the futures market, where traders bet on price movements without owning the underlying asset.

Also Read: PEPE Coin (PEPE) Shows Bullish Signal, What’s the Secret?

Market Stability Indicated by Balanced Profitability

The on-chain metrics presented by Crazzyblockk, another analyst from CryptoQuant, provide further context on the overall market sentiment. According to the data presented, profitability among investor cohorts remains high: wallets holding Bitcoin (BTC) for less than one month recorded unrealized gains of 6.9%, while short-term holders (less than six months) saw gains of 10.7%.

Despite these high profit margins, there were no significant signs of mass profit-taking or panic selling. The Profits/Unrealized Leverage Ratio (UPL) shows that although most of the network is in profit, the distribution of profits among different groups of investors remains relatively balanced.

Preparation for the New Phase of the Market

The current market structure appears more stable, with no signs of excessive selling pressure. Although macroeconomic risks and external volatility remain factors to watch out for, the combination of strong price action, steady accumulation, and limited distribution suggests that the market may be preparing for a new phase, potentially leading to a surge beyond Bitcoin’s (BTC) existing record highs.

History has shown that an even distribution of profitability is often associated with reduced volatility and a lower risk of sudden corrections. Crazzyblockk notes that, in previous cycles, an extreme concentration of profits among one group, usually short-term holders, often preceded a massive sell-off.

Conclusion: Bitcoin (BTC) Price Increase Potential

Looking at the current dynamics and historical data, there is strong potential for an increase in Bitcoin (BTC) price in the foreseeable future. Investors and traders should pay attention to market indicators and adapt to changes to capitalize on emerging opportunities. The stability shown through a balanced distribution of profitability and high trading activity in the futures market could be important indicators for further price predictions.

Also Read: Will Pi Token (PI) Surge Beyond $0.9? Check out the Analysis!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Binance’s Spot to Futures Ratio Hits 1.5-Year Peak as Bitcoin Reclaims $109K. Accessed on May 22, 2025

- Featured Image: Generated by AI