Bitcoin in Corporate Cash: Innovation or Stability Threat?

Jakarta, Pintu News – As the price of Bitcoin increases, more and more companies are interested in investing some of their cash into the cryptocurrency. This phenomenon has been fueled by the success of several large companies that have already adopted this strategy. However, this growing trend also brings concerns about potential market stability risks and questions about Bitcoin’s decentralized ethos.

Bitcoin Adoption Trends by Corporates

A report from Standard Chartered shows that at least 61 listed companies have purchased the cryptocurrency, while Bitcoin Treasuries notes the figure has reached 130. This suggests increased confidence in Bitcoin (BTC) as a corporate asset. However, this growth also raises questions about the long-term impact on the market structure and value of Bitcoin (BTC) itself.

Companies adopting Bitcoin (BTC) generally fall into two categories. First, companies that are already profitable and use excess cash for investment. Second, companies that secure debt or equity for the purchase of Bitcoin (BTC). These two strategies, though different, both increase the demand for Bitcoin (BTC) and potentially affect its price in the market.

Also Read: Ethereum (ETH) Prepares for a Surge: Bullish Signs Strengthen

Volatility and Bitcoin’s Potential as a Safe Haven

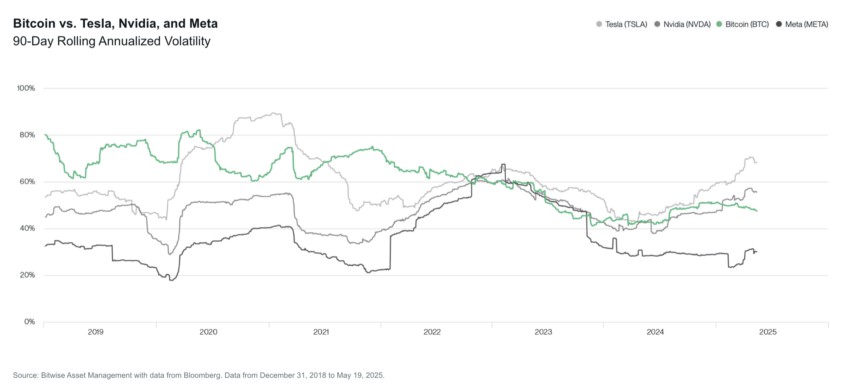

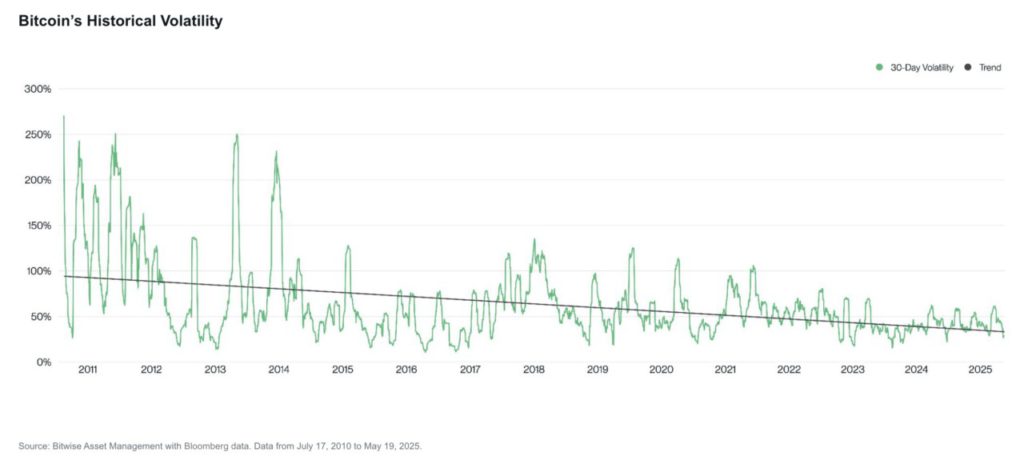

Bitcoin (BTC) is known for its high volatility, yet it often provides much greater returns than traditional asset classes such as stocks and gold. This makes Bitcoin (BTC) attractive especially in times of global economic uncertainty, rising inflation, and concerning fiscal deficits.

Referred to as “digital gold”, Bitcoin (BTC) offers an attractive alternative as a neutral store of value that is not tied to any government policies. This makes Bitcoin (BTC) a potential replacement for traditional safe haven assets like gold, especially if confidence in traditional financial institutions continues to erode.

Risks and Concerns over Concentration of Ownership

The increasing number of companies adding Bitcoin (BTC) to their balance sheets creates a form of decentralization at the market level. However, massive corporate accumulation also raises concerns about concentrated ownership. This could go against the basic principles of decentralized finance and raises concerns about potential disruptions to the basic structure of Bitcoin (BTC).

Moreover, in the event of a sharp market decline, companies with large investments in Bitcoin (BTC) may be forced to sell their assets quickly, which could trigger further price drops and create systemic risks for the market as a whole.

Conclusion

Corporate investment in Bitcoin (BTC) offers the potential for significant returns, but also carries risks that should not be ignored. Companies need to carefully consider their strategy in adopting Bitcoin (BTC), taking into account both the potential returns and the risks involved.

Read More: Will Selling Pressure Shake Chainlink’s Bullish Dominance?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Rise: Blessing or Threat to Corporate Treasuries. Accessed on June 19, 2025

- Featured Image: The image created by AI