Ethereum Steady at $2,500 — But Why Are Users Vanishing as Addresses Surge?

Jakarta, Pintu News – Since April, the Ethereum Foundation has gradually reduced its holdings, with 21 separate outflows totaling over $52.82 million.

The most recent transaction saw 1,000 Ethereum , worth approximately $2.51 million, leave the Foundation’s wallet.

This persistent movement indicates a deliberate liquidation trend, possibly to fund development or as a signal of caution.

However, despite the consistent sales, the Foundation still holds more than 196,000 ETH, which is currently worth around $495 million.

This strategic reduction could reflect internal projections of potential future price volatility, raising the question: is the Foundation preparing for a broader market correction?

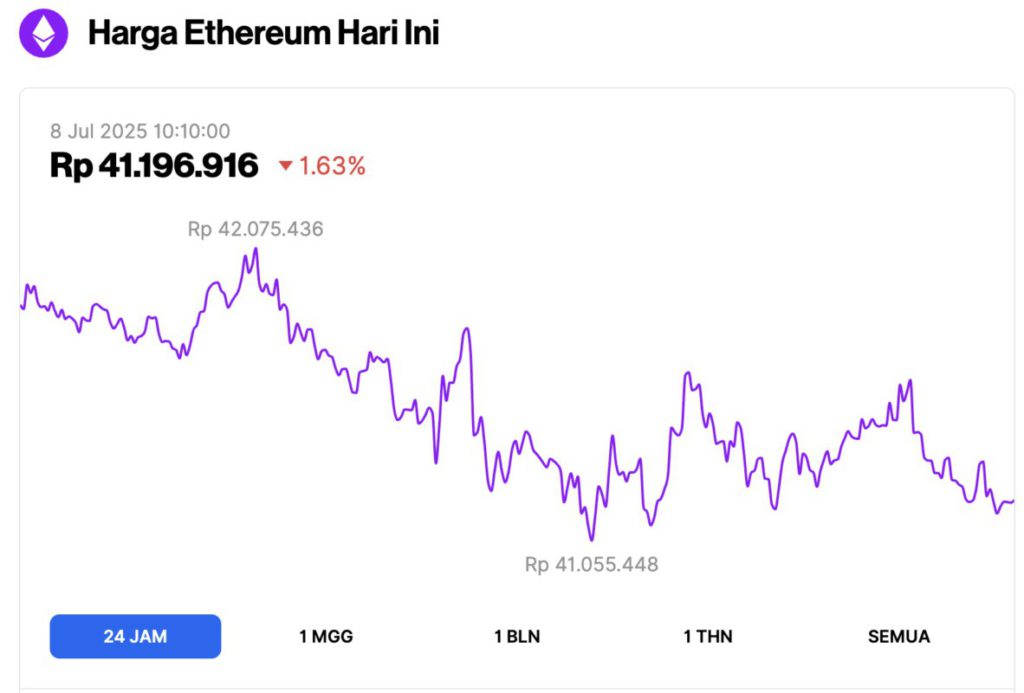

Ethereum Price Drops 1.63% in 24 Hours

As of July 8, 2025, Ethereum was trading at approximately $2,530, or around IDR 41,196,916 — marking a 1.63% drop over the past 24 hours. During that time, ETH dipped to a low of IDR 41,055,448 and peaked at IDR 42,075,436.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $305.46 billion, with daily trading volume rising 30% to $18.41 billion within the last 24 hours.

Read also: These 3 Soaring Crypto Coins on CoinGecko Could Explode in the Second Week of July!

Buyers remain calm, but will they be able to maintain their position?

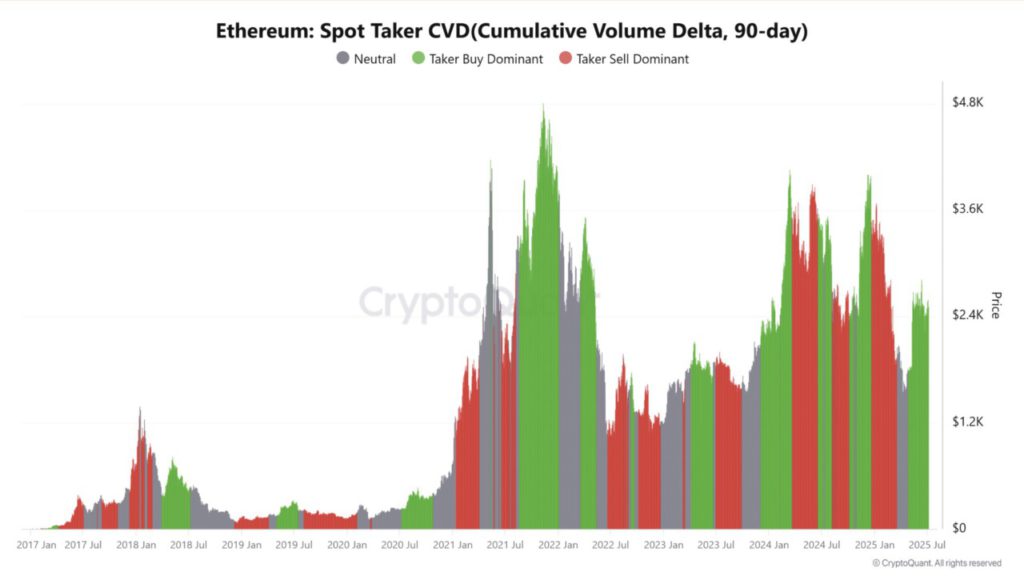

As reported by AMB Crypto (7/7), derivatives data shows that Spot Taker CVD (for 90 days) still shows the dominance of Taker Buy as of July 6.

This metric tracks the cumulative volume difference between buying and selling in the market, and the current reading indicates aggressive dip-buying behavior.

As such, market participants seem to be able to absorb the selling pressure due to outflows from the Foundation.

This buyer power suggests that ETH might stay above the $2,500 level, despite the macro bearish sentiment.

Such confidence usually comes from institutions or high conviction traders who expect a rebound in the near future.

Is the ETH User Base Growing?

According to data from IntoTheBlock as of July 6, the number of New Addresses on the Ethereum network increased by 6.2%, indicating the onboarding of new users.

However, the number of Active Addresses actually decreased by 3.3%, and Zero Balance Addresses decreased by 8.54%, signaling a decrease in churn and the possibility of users who are no longer active.

This suggests that despite increased speculative interest, long-term holder activity appears to be on the decline-a directional divergence that makes Ethereum’s growth narrative more complex.

Without continued engagement from the existing user base, this surge in new addresses may not translate into real demand.

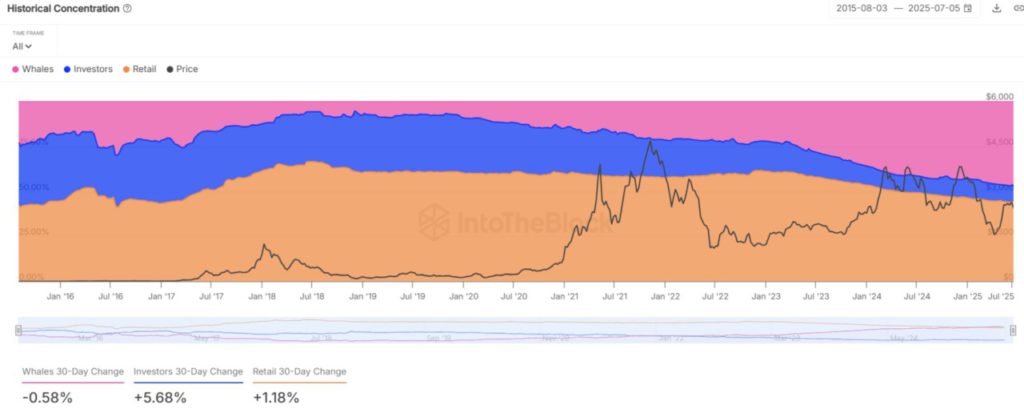

Are the Whales Losing Faith?

The composition of Ethereum investors has changed significantly in the last 30 days. Holdings by whales fell by 0.58%, while the investor and retail segments rose by 5.68% and 1.18% respectively.

This redistribution may indicate that whales are exiting or transferring their assets, while participation from small actors is increasing.

Read also: Toncoin Skyrockets After Bold Crypto Staking Visa Claim — Is the UAE Offering Residency for Crypto?

Such behavior may reflect increased decentralization of ownership, but it may also indicate decreased confidence from large institutions.

Of course, small holders may not have enough financial strength to sustain a price rally if not supported by the participation of whales. Without the support of large funds, the upward momentum can quickly lose steam.

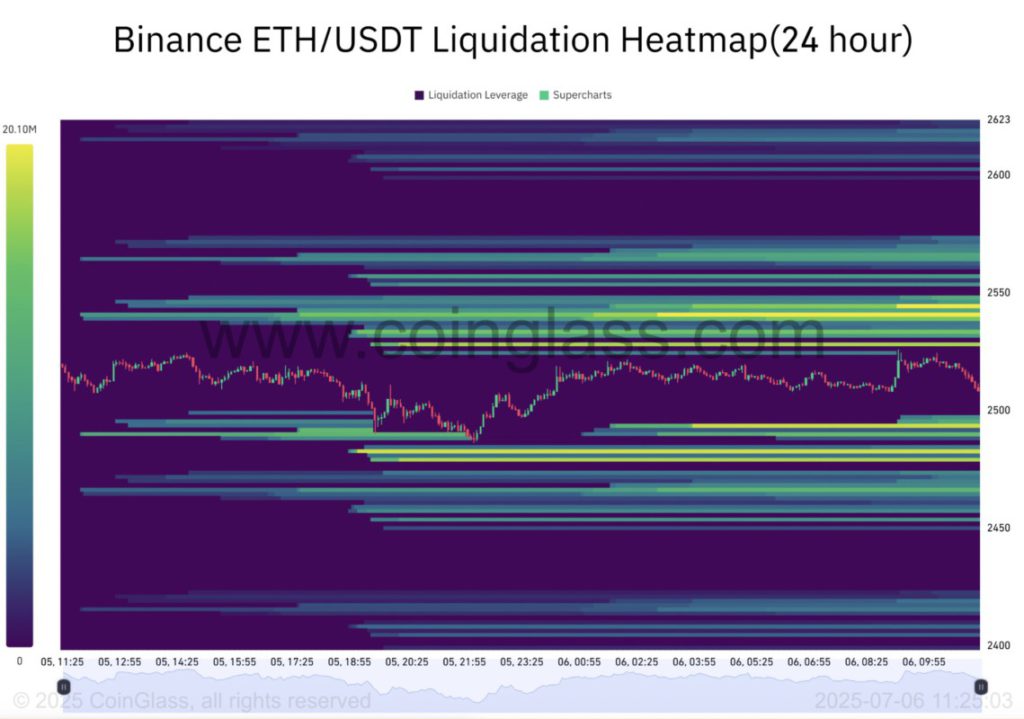

Can ETH Break the Liquidation Wall Near $2,550?

The Liquidation Heatmap for the Binance ETH/USDT pair shows a dense liquidation cluster between the $2,480 to $2,550 level, making this zone an important pressure point.

If ETH manages to close convincingly above $2,550, it could trigger a short squeeze, erasing bearish positions and pushing prices higher.

However, if there is repeated rejection in this area, it could strengthen the position of the bears and trap longs who enter too late.

In essence, this level doubles as resistance as well as a volatility trigger. What ETH will do in this zone will most likely determine the direction of the market throughout the rest of July.

Ultimately, ETH is at a crucial moment, where outflows from the Foundation, retreating whales, and shifting user activity interact with each other.

However, the continued dominance of buyers and rising investor interest are counterbalancing the bearish signals.

If ETH is able to break the $2,550 zone, it could be a confirmation of strength despite selling pressure from the Foundation. The next movement will likely depend largely on whether buyers can maintain their momentum or weaken under mounting selling pressure.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum activity shifts: More addresses but less users – What’s going on? Accessed on July 8, 2025