Bitcoin Skyrockets to $111K — Here’s What Triggered Today’s Shocking New All-Time High!

Jakarta, Pintu News – Bitcoin started 2025 in poor shape, falling more than 30% and bottoming out at $74,500 in April.

However, Bitcoin’s rebound since then has been impressive. After reaching a new all-time high of $111,980 in May, the Bitcoin price had corrected to $98,200.

The price of Bitcoin then moved back up in June and today managed to print a new all-time high of $111,999. Let’s take a look at the chart to analyze where the price is headed next.

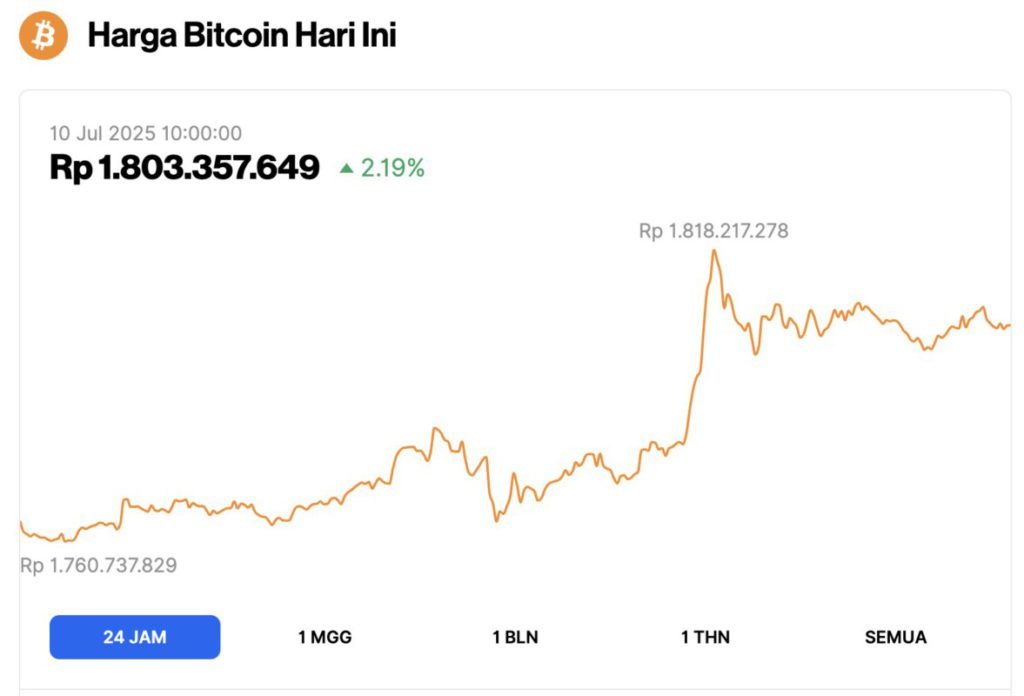

Bitcoin Price Rises 2.19% in 24 Hours

On July 10, 2025, Bitcoin was trading at $111,270, equivalent to IDR 1,803,357,649 — marking a 2.19% gain over the past 24 hours. Within that time, BTC dipped to a low of IDR 1,760,737,829 before surging to a new all-time high of $111,970, or IDR 1,818,217,278.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.21 trillion, with trading volume in the last 24 hours up 43% to $60.59 billion.

Read also: Top 3 Crypto Altcoins to Buy Today, According to Analysis!

Key Reasons Behind Today’s Bitcoin Price Rise

According to Coinpedia, the price of BTC had previously stagnated despite increased demand from institutional investors and the growing clarity of crypto regulation.

For example, spot Bitcoin ETFs in the US have recorded net fund inflows of more than $13 billion in the past four months, led by BlackRock’s IBIT and Fidelity’s FBTC.

Based on market data from Santiment, bullish sentiment towards Bitcoin emerged today, triggered by ongoing retail saturation and the rise of FUD.

In addition, BTC prices are also facing an important psychological resistance level at around $109,000, which is reinforced by the re-heating of the US-led tariff war as well as global geopolitical tensions.

Bitcoin’s Latest All-Time High

According to a CCN report, the price of Bitcoin dropped to a low of $98,240 in June, sparking fears of a potential drop below the $104,000 horizontal area.

The drop is crucial as it could invalidate the $140,000 support area, which was previously an all-time high.

Read also: Which Crypto will Boom in 2025? Check out the Analysis of Ethereum, XRP, and Pi Network!

However, Bitcoin price managed to rebound in the last week of June, forming a bullish engulfing candlestick (green icon) and thwarting the potential decline.

After that, the price resumed its upward trend this week and printed a new all-time high of $111,999 on July 9.

As the price of BTC is now at an all-time high, the 1.61 Fibonacci retracement external resistance could be the next target around $131,000.

While these Fibonacci levels are suitable as initial targets, wave count analysis can provide a more accurate picture of the future price direction of Bitcoin.

The Beginning of a Bigger Rally?

Bitcoin’ s wave count analysis shows a very bullish price prediction. According to the count, Bitcoin is currently in the fifth and final wave of an upward trend that started in December 2022.

This fifth wave undergoes an extension, with the sub-wave count and minor sub-waves marked in black and orange respectively.

While there are various possible patterns for the development of the last wave – such as expanding or contracting diagonals – the parabolic nature of price movements makes the extension scenario the most plausible.

The initial target for this upside move is at $237,185, which is derived by assuming wave five is the same length as waves one and three combined.

Bitcoin’s short-term outlook is also in line with these bullish predictions. It can be seen that Bitcoin has completed a five-wave upward movement (green) and a W-X-Y correction (red) since April 7.

This correction occurred within a descending parallel channel, and the recent breakout confirms that the correction phase has ended.

Therefore, this wave count remains valid as long as the price of BTC does not drop below the low of wave Y, which is $98,200 (red).

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Bitcoin (BTC) Reaches New All-Time High Price – Don’t Miss What Happens Next. Accessed on July 10, 2025

- CoinPedia. Bitcoin Price Hits New ATH of $112k, Is the 2025 Altseason Here? Experts Insights. Accessed on July 10, 2025