Michael Saylor is Ready to Buy Bitcoin Again: Institutional Company Now Holding 3.5 Million BTC!

Jakarta, Pintu News – Michael Saylor, co-founder of MicroStrategy (now known as Strategy), announced that he will resume buying Bitcoin after halting accumulation for a week. This move emphasizes the role of large corporations as the main drivers of BTC demand in the global market, even as the price has broken new record highs. Saylor stated, “Some weeks, you don’t just HODL,” signaling his belief in Bitcoin’s long-term potential.

MicroStrategy: Largest BTC Accumulation in the Corporate World

Prior to the accumulation pause, MicroStrategy had been buying BTC for 12 consecutive weeks. The last purchase occurred on June 30 with the addition of 4,980 BTC for USD 532 million, bringing the company’s total holdings to 597,325 BTC-equivalent to over USD 70.9 billion at current market prices.

In addition to being the largest corporate BTC collector, MicroStrategy (MSTR) shares alone are up more than 16% this month, although still below the peak of USD 543 per share in November 2024. Saylor also recently announced a USD 4.2 billion fundraising plan that could be used for further Bitcoin purchases.

Also Read: Crypto Investment July 2025: Assets to Watch Out For!

Phenomenon: Corporate BTC Demand Outpaces New Supply

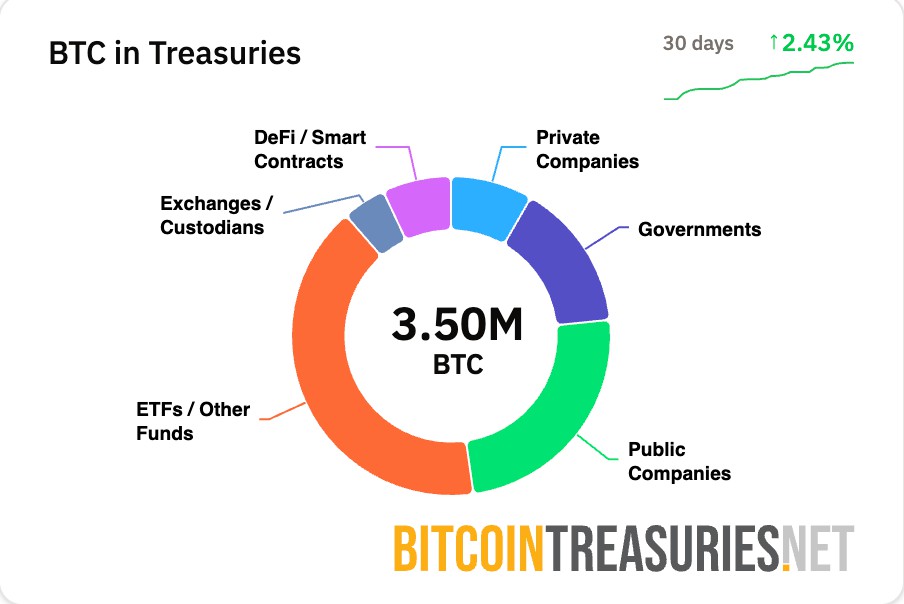

Institutions now hold more than 3.5 million BTC-including public, private, pension funds, and asset managers-according to BitcoinTreasuries.net. Companies like MicroStrategy, Tesla, Coinbase, and a number of large financial institutions have been buying Bitcoin at an amount that exceeds even the production rate of miners (around 13,500 BTC per month). In the past six months, MicroStrategy alone accumulated 379,800 BTC, or an average of 2,087 BTC per day, well above the new supply from miners.

This phenomenon has sparked fears of a supply shock, where high institutional demand causes the supply of Bitcoin on exchanges to dwindle, potentially pushing prices up more aggressively. However, there are also analysts who warn that the accumulation of large amounts of debt-funded BTC could increase systemic risk if the market experiences a sharp correction.

Will the Accumulation Trend Continue?

With more and more public companies and institutions buying BTC, the competition to accumulate the digital asset has intensified. Saylor and MicroStrategy exemplify how Bitcoin-based treasury strategies can change the global BTC ownership structure. Interestingly, observers think that companies like MicroStrategy are now “synthesizing halving”-that is, accelerating the scarcity of BTC by accumulating it much faster than the supply produced by miners.

While this trend is considered bullish for long-term prices, investors should be mindful of the risk of leverage and high volatility, especially if prices experience a sharp reversal.

Conclusion

Michael Saylor and MicroStrategy’s move to re-accumulate Bitcoin confirms the major shift of BTC ownership into institutional hands. With total institutional ownership already reaching 3.5 million BTC, a supply shock is increasingly likely to occur, as well as being a major catalyst for Bitcoin prices in the future.

Also Read: Revealed! The Future of Bitcoin and Crypto Market in the Second Half of 2025

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Saylor signals BTC buy after week break. Accessed July 14, 2025.