XRP Tries to Break $3, Ethereum (ETH) Aims for $4,000, How Will Bitcoin (BTC) Fare?

Jakarta, Pintu News – In the dynamic world of cryptocurrency, several digital currencies are showing significant movement. Ripple is striving to break the psychological barrier of $3, while Ethereum seems unstoppable towards $4,000. On the other hand, Bitcoin is facing challenges that could change the direction of its trend.

Ripple (XRP) Struggles at the Threshold of $3

Ripple (XRP) has shown remarkable resilience despite failing to break $3.02 in last week’s price surge. Currently, the currency is consolidating below that critical level. The current chart structure is extremely bullish with all major moving averages well above the current price action. The RSI indicator hovering around 80 shows that the market is still dominated by buyers.

After briefly dropping to the $2.85 range, Ripple (XRP) quickly returned to the $2.90 range, indicating that any price drop was taken advantage of by buyers to enter the market. If Ripple (XRP) manages to break and hold above $3.02, this could trigger momentum-driven buying that would push the price near the next resistance level around $3.30.

Also Read: XRP Price Surges Again: Momentum Rising, Eyeing Key Resistance

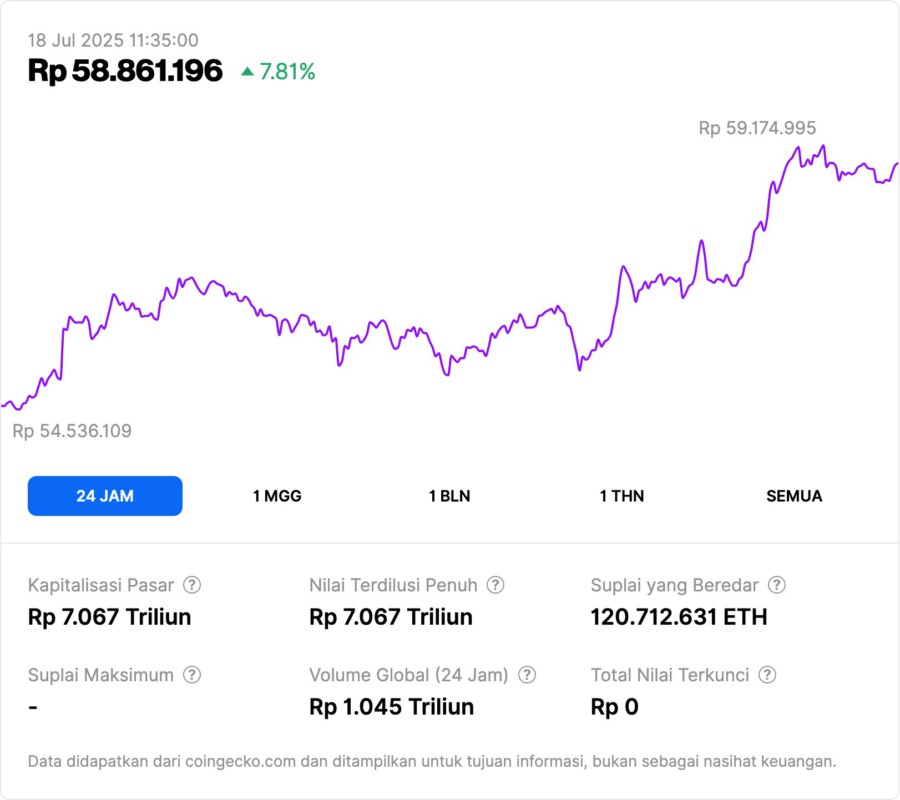

Ethereum (ETH) Goes Fast

Ethereum (ETH) has successfully broken the psychological barrier of $3,000 and is now moving with strong momentum. Unlike the previous breakout attempts, this time Ethereum (ETH) managed to cross all major moving averages, including the 200-day EMA at $2,600. The increasing volume and price are proof that this rally is more than just speculation.

Although the RSI is approaching the overbought zone above 77, this reflects more breakout strength than exhaustion. Ethereum (ETH) now faces little structural resistance towards the $4,000 zone. If this momentum continues, it is possible that Ethereum (ETH) will attempt this important psychological level in the coming weeks.

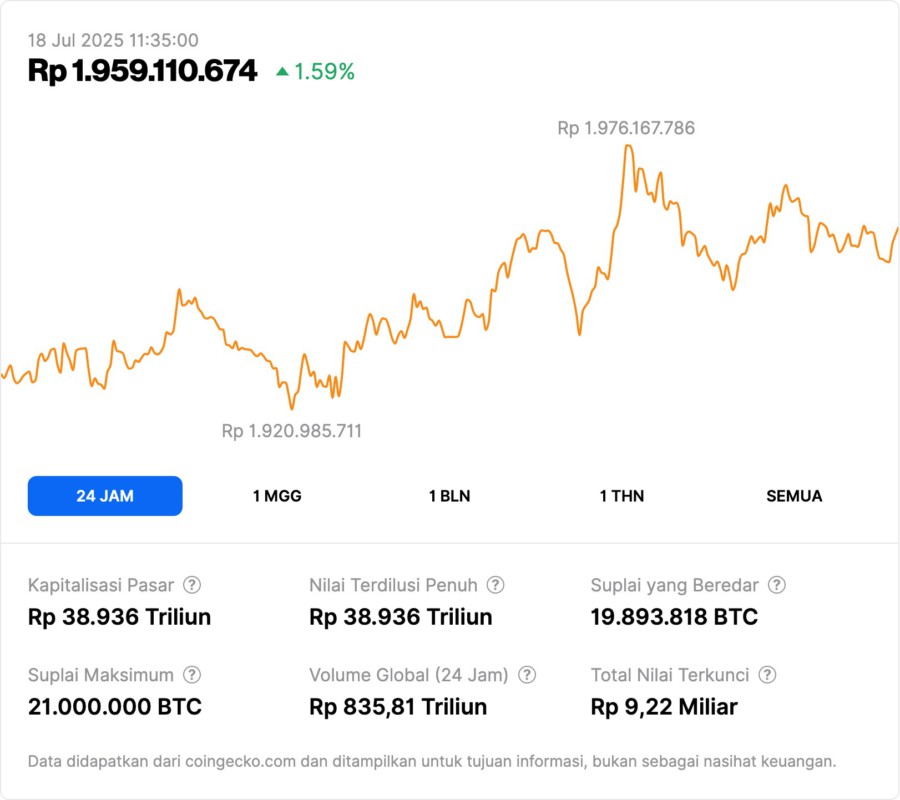

Bitcoin (BTC) Needs Support

Bitcoin (BTC) is showing contradictory signals after a spectacular breakout above $120,000. However, after reaching $125,000, there was massive selling that pushed the price back below $120,000. This is often an indication that big players are using the rally to take profits or sell positions.

Although there is strong support in the $112,000 to $118,000 range, Bitcoin (BTC) needs to stabilize and consolidate above this range to maintain bullish momentum. The RSI still high at 69 shows that there is still room for the bulls to reorganize and possibly start another attempt to break higher.

Conclusion

With different dynamics among the major digital currencies, the current cryptocurrency market offers diverse opportunities and challenges. Investors and traders should stay alert to changing trends and market dynamics to optimize their strategies.

Also Read: $2 Billion Fresh Money Injection, Bitcoin Ready to Fly Again? Analyst: Big Crypto Rally Signals!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. XRP Out of 1,000,000,000 Club: Ethereum (ETH) Now Eyes $4,000, Is Bitcoin (BTC) in Trouble. Accessed on July 18, 2025