Antam Gold Price Chart Today July 23, 2025: Prices Begin to Rise Will They Break New Records?

Jakarta, Pintu News – Gold prices returned to the attention of investors and market players on Wednesday, July 23, 2025. Significant price increases were seen in Antam’s gold products for both corporate and physical purchases, sparking new enthusiasm among the public. This surge is not only reflected in the rupiah value per gram, but is also evident in the gold price chart in recent months. The following is a complete review of today’s Antam gold price developments along with chart analysis and driving factors.

BRANKAS Corporate Gold Purchase Price Increases

On July 23, 2025, the BRANKAS gold purchase price for corporate customers reached Rp1,910,600 per gram. This figure increased by IDR 24,000 compared to the previous price of IDR 1,886,600 per gram. The surge marks a bullish trend amid global market fluctuations and rising corporate demand. Businesses are increasingly looking at gold as a hedging instrument amid economic uncertainty.

This price increase emphasizes gold’s role as a safe haven asset. In recent months, large companies and institutions have started to add gold reserves to anticipate economic turmoil. Stable demand from the corporate sector has helped keep gold prices stable in the domestic market. The price chart also shows a consistent upward trend throughout 2025.

Also Read: 6 Top Crypto Movers 24 Hours July 23, 2025: Some skyrocketed, some heavily discounted!

Physical Gold Purchase Price

Apart from corporates, today’s physical gold buying price was recorded at Rp1,970,000 per gram, an increase of Rp24,000 from the previous price of Rp1,946,000 per gram. The higher physical gold price indicates strong demand in the retail market.

The general public still considers physical gold as one of the safest and most affordable forms of investment. This surge shows that gold remains a top choice for individuals looking to protect their assets from inflation and global uncertainty. Analysts expect this upward trend to continue in the near future. The physical buying price chart also shows a steady upward pattern since the beginning of the year.

Gold Price Chart: Uptrend Throughout 2025

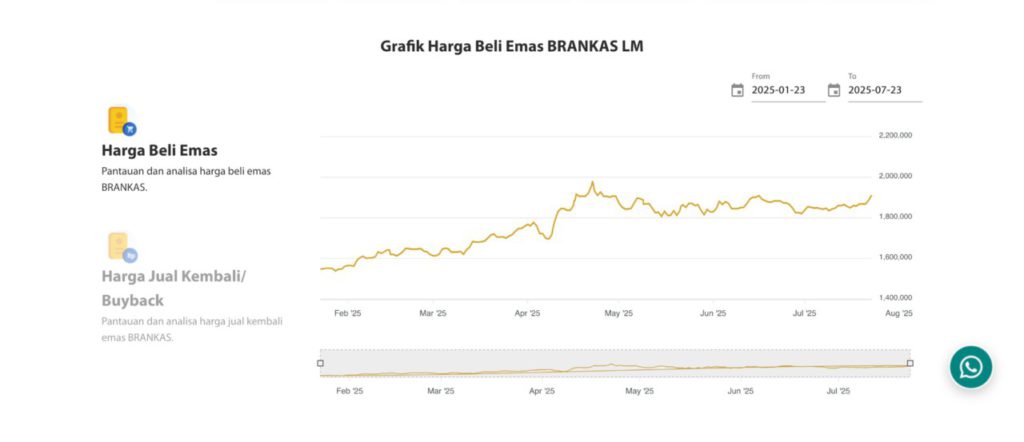

Based on the BRANKAS LM gold purchase price chart from January to July 2025, the upward trend is very clear. Starting at the beginning of the year, gold prices moved up gradually and touched the highest point in the middle of the year.

This upward pattern indicates that interest in gold investment remains high, both from the corporate and individual sectors. The spike in July 2025 is believed to be a response to global economic dynamics and exchange rate weakness. Market participants often take advantage of gold price spikes to buy and sell in the short term. Price fluctuations recorded on the chart are also an important reference in determining future gold investment strategies.

Factors Driving the Rise in Gold Prices

There are several main factors driving the recent rise in gold prices. First, global economic uncertainty triggered by changes in monetary policy in various countries encourages investors to secure funds in gold instruments. Second, high inflation has made gold more attractive as a store of value.

In addition, the weakening of the rupiah against the US dollar also triggered an increase in gold prices in the domestic market. Analysts predict that as long as the global situation remains volatile, gold prices have the potential to continue their upward trend. Not surprisingly, more and more people are starting to increase the portion of gold in their investment portfolio.

Tips for Monitoring and Buying Gold Today

If you’re planning to buy gold today, it’s always a good idea to monitor real-time price movements. Utilize the app or the gold provider’s official website to get the latest prices and historical charts for consideration.

Choose the type of gold that suits your needs-whether it’s physical gold for long-term investment, or more flexible digital gold for daily transactions. By understanding price chart trends and fundamentals, you can maximize the profit potential of your gold investment in the future. Don’t forget to always check the authenticity and reputation of the seller before buying gold.

Conclusion

Antam’s July 23, 2025 gold price marks a new chapter for the Indonesian precious metals market. The price surge and upward trend in the chart give a strong signal that gold remains a reliable asset in the face of economic uncertainty. For those of you who want to invest, make sure to stay updated on price developments and understand the factors that affect the gold market.

Also Read: 5 Cryptos with the Highest Gains at the Market Door on July 23, 2025-Anything Over 24% in a Day!

That’s the latest information about Antam gold prices. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Precious Metals. Gold Price Today. Accessed July 23, 2025.