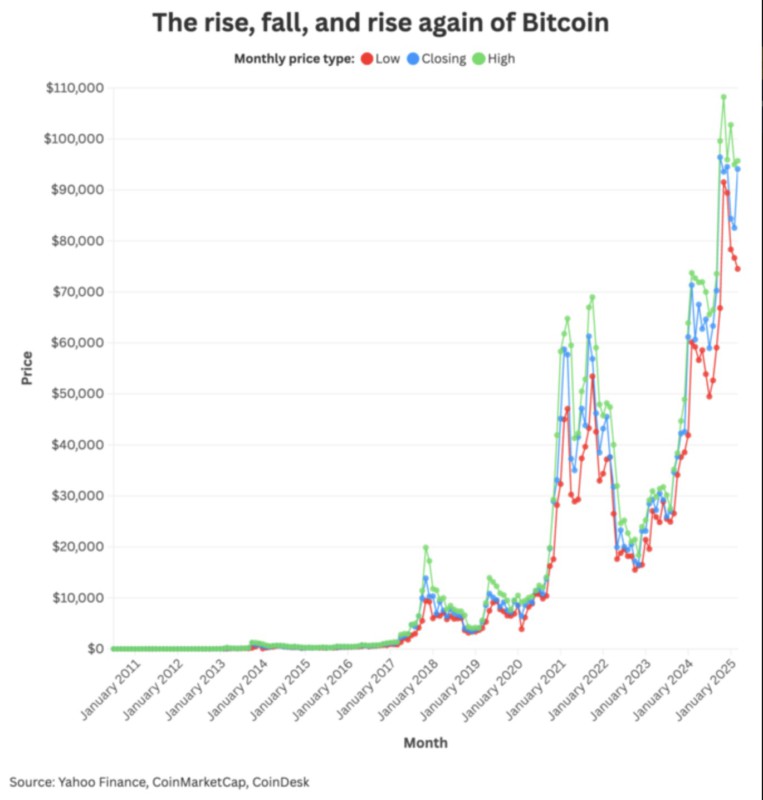

This Crypto Used to Cost $0.30 — Now It Has Skyrocketed by 39,666,567%

Jakarta, Pintu News – Who would have thought that a digital asset that was once only valued at $0.10 would now soar to over $119,000? This is the incredible story of Bitcoin, the world’s first cryptocurrency that has managed to score a fantastic price increase of more than 39 million percent since its inception in 2009.

From being known only to a small circle of technology enthusiasts, Bitcoin has now become a global asset that is taken into account by institutional investors, large companies, and world financial market players.

This long journey not only reflects the tremendous growth in value, but also illustrates how technology and public trust can shape the future of digital finance.

Here’s a timeline of Bitcoin’s price movements from year to year!

2009-2010: The Beginning of Bitcoin

Bitcoin was first launched in 2009 by a mysterious figure named Satoshi Nakamoto. In the early days, Bitcoin had no market value and was only used by a small community of technology and cryptography enthusiasts.

The first real-world use occurred in May 2010, when Laszlo Hanyecz bought two pizzas for 10,000 BTC-an event now known as Bitcoin Pizza Day. Towards the end of 2010, Bitcoin began to be publicly traded and its price rose slowly between $0.10 and $0.30.

2011: First Big Spike and Flash Crash

In 2011, Bitcoin experienced its first incredible price surge, from around $0.30 to $26.90, up more than 8,000% in just a few months. However, this euphoria did not last long.

The largest exchange at the time, Mt. Gox, experienced a massive selling incident that caused the price to plummet to $0.01. This event showed how fragile and volatile the crypto market was in its early days.

2012-2013: Became Widely Recognized

After the crash, Bitcoin began to rise slowly. The years 2012 and 2013 saw steady growth, both in terms of price and number of users.

Bitcoin crossed $100 in April 2013 and reached $1,000 in November on the Mt. Gox exchange. Its popularity began to spread, the media began to discuss it frequently, and some shops and services began to accept Bitcoin as a means of payment.

Also read: Pi Network Price Prediction 4th Week of July 2025 According to Perplexity AI

2014-2016: The Mt. Gox Crisis and Sluggish Times

Early 2014 was a negative turning point for Bitcoin when Mt. Gox declared bankruptcy after losing around 650,000 to 850,000 BTC due to a hack. This triggered a crisis of confidence and caused the price of Bitcoin to plummet, marking the beginning of the “bear market”.

Despite the sharp drop in price, developers continued to improve the technology and security of the system. Crypto infrastructure is being taken more seriously, and new, more secure exchanges are emerging.

2017: Peak Popularity and ICO Explosion

2017 has been a phenomenal year for Bitcoin. The price soared from under $1,000 to almost $20,000 in December. This increase was driven by public enthusiasm and the emergence of Initial Coin Offering (ICO) projects that attracted investors.

Unfortunately, many ICO projects lack real products, leading to cases of fraud. Countries like China are banning ICOs and shutting down local crypto exchanges, while global authorities are beginning to draft regulations for digital assets.

2018-2019: Major Corrections and Institutional Entry

After the 2017 peak, Bitcoin price experienced a major correction and dropped to below $4,000 by the end of 2018. However, unlike before, interest from financial institutions remained high.

Major corporations are beginning to explore custodial services and Bitcoin derivative products. Bitcoin is beginning to show links to stock markets and other risky assets, signaling that it is starting to be considered as part of the global financial system.

Read also: 3 Altcoins Ready to Surprise Traders Amid Bitcoin Dominance (BTCD) Decline

2020: Pandemic Impact and Resurgence

When the COVID-19 pandemic hit the world, Bitcoin fell to around $3,850 in March 2020 due to market panic. However, the price recovered quickly thanks to massive government stimulus and low interest rates.

By the end of the year, Bitcoin closed 2020 at almost $30,000. In a crisis, Bitcoin began to be seen as “digital gold” and a hedge against inflation and a weakening US dollar.

2021-2023: Institutional Adoption and Crypto Winter

2021 saw a new peak for Bitcoin with the highest price reaching $64,895 in April. Large companies like Tesla and MicroStrategy are buying Bitcoin for their cash reserves.

Financial products such as Bitcoin ETFs and digital payment services also began to support crypto transactions. However, in 2022, the market crashed again in a period known as “crypto winter”, characterized by the collapse of major companies and a sharp drop in prices. Even so, financial and regulatory infrastructure continued to evolve.

2024: Bitcoin Spot ETF Breakthrough

In January 2024, the US Securities and Exchange Commission (SEC) officially approved the first spot Bitcoin ETF. This move opened up access to Bitcoin through conventional investment channels in the stock market.

Bitcoin’s price has risen sharply due to the enthusiasm of institutional and retail investors. With this ETF, Bitcoin is increasingly seen as a legitimate and easily accessible asset, without the hassle of crypto wallets or complicated exchanges.

Also read: Tom Lee’s Prediction: “Bitcoin (BTC) to $250,000 in 2025!”

2025: Bitcoin Goes Mainstream

Entering 2025, Bitcoin is solidifying its position in the global financial world. As of May 2025, the price of Bitcoin had surpassed $110,000. Its volatility has decreased dramatically compared to the past, and its price movements are starting to resemble commodities like oil. =

Bitcoin’s correlation with tech stocks (+0.52) and high-risk bonds (+0.49) increased, while its correlation with the US dollar remained negative (-0.29).

This makes Bitcoin a dual asset: risky but also a hedge against global monetary policy. Bitcoin now not only exists as a technological experiment, but has become an important part of modern financial portfolios.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Oanda. Bitcoin’s price journey: A data-driven history from 2009 to 2025. Accessed July 24, 2025

- Featured Image: Generated by Ai