Bitcoin Crashes to $118K as Wall Street Pulls $199 Million – Is This the Start of a Bigger Meltdown?

Jakarta, Pintu News – Bitcoin’s rise to a new record high of $122,054 has triggered a wave of profit-taking in the market. On-chain data suggests that interest from institutions may be starting to decline.

After six consecutive weeks of net inflows into US-listed spot Bitcoin ETFs, this week saw a trend reversal, with some funds experiencing outflows.

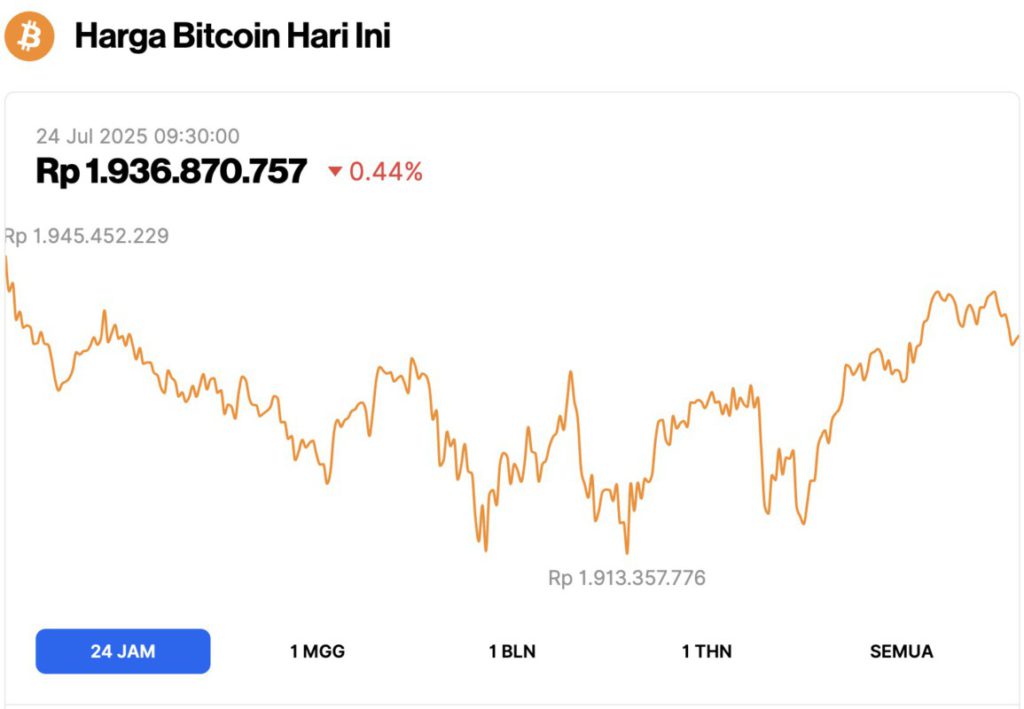

Bitcoin Price Drops 0.44% in 24 Hours

On July 24, 2025, Bitcoin was trading at $118,938, equivalent to approximately IDR 1,936,870,757. The cryptocurrency saw a slight dip of 0.44% over the past 24 hours. During this time, Bitcoin’s price ranged from a low of IDR 1,913,357,776 to a high of IDR 1,945,452,229.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.36 trillion, with trading volume in the last 24 hours falling 13% to $65.94 billion.

Read also: BlackRock Crypto Portfolio: BlackRock Crypto ETF Fund Flows Soar 366%!

Institutional Investors Withdraw $199 Million from Bitcoin ETFs

According to data from SosoValue, spot Bitcoin ETFs saw outflows of $199 million this week, ending a six-week positive run.

This change indicates a shift in sentiment among institutional investors, who have been consistently adding to their exposure to BTC through ETFs during the recent market rally.

This withdrawal comes after Bitcoin’s price surged to a new record high of $122,054 on July 14. Some investors waiting for a decisive breakout above $120,000 seem to have seized the moment to sell and lock in profits.

ETF fund flows are often considered a leading indicator of institutional investor confidence. A sharp decline in inflows, especially after a period of strong accumulation, suggests that institutional risk appetite is starting to subside.

Even long-term holders – who are often dubbed as having “diamond hands” – seem to be taking advantage.

While this may not necessarily signal a long-term bearish sentiment, it does reflect increased market caution in the short-term.

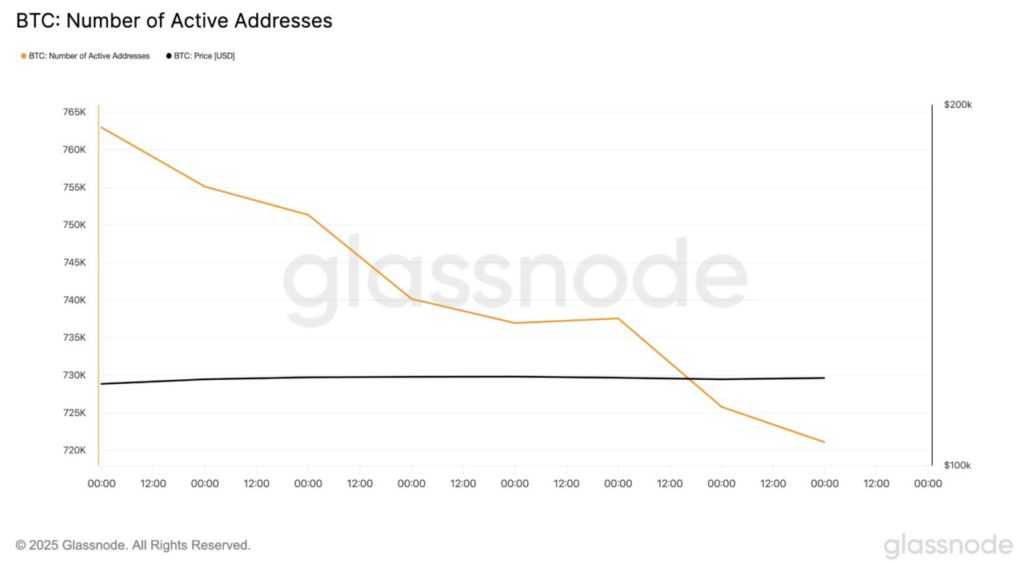

In addition, data from Glassnode shows that on-chain activity is also weakening, which could magnify the downside risk of BTC prices.

Read also: XRP Price Prediction According to ChatGPT!

The data provider reported that the number of active unique addresses on the Bitcoin network has been steadily declining over the past seven days, and as of yesterday, there were only 721,086 addresses – the lowest number in a week.

As institutional capital begins to withdraw and retail activity also slows down, this suggests an overall market pause, which increases the likelihood of a BTC price correction in the near future.

BTC aims for $120,000 breakout, but weak demand threatens downside

BTC/USD daily chart data shows that Bitcoin has mostly moved in a narrow range since hitting a record high of $122,054 on July 14. Currently, BTC is facing a resistance level at $120,811, with the support level being at $116,952.

As demand begins to weaken, BTC is at risk of testing that support level. If it fails to hold, Bitcoin price could drop further to $114,354.

However, if renewed demand emerges in the market, BTC could potentially break the $120,811 barrier and attempt to return to its all-time high.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Slides as ETF Inflows Reverse and Network Activity Dips. Accessed on July 24, 2025