5 Cryptos That Could Deliver 100x Returns in the Next Bull Run

Jakarta, Pintu News – Top altcoins such as Arbitrum , Ondo (ONDO), Stellar , Hedera , and Injective are preparing for their next rally as the market begins to cool down ahead of a new push into altcoin season.

As of July 23, 2025, CoinMarketCap’s (CMC) Altcoin Season Index stands at 43 out of 100, indicating that the market is still dominated by Bitcoin, although altcoins are starting to show gains.

This is a modest increase from last week’s index of 38, and a significant jump from last month’s drop to 18 – a level that reflects Bitcoin’s strong dominance.

At the time of writing, the altcoin market capitalization stands at $1.59 trillion, indicating a continued uptrend despite not yet entering the peak altcoin season (with the index above 75).

So far this year, the highest value of the index was recorded at 87 in December 2024 (a sign of entering altcoin season), while the lowest value touched 12 in April 2025 (signaling Bitcoin season).

This upward trend may indicate a gradual shift towards more altcoin-friendly market conditions.

Arbitrum (ARB) Prepares for Breakout: Cup and Handle Pattern Formed

Arbitrum (ARB) is forming a classic Cup and Handle pattern on the daily chart, indicating a potential breakout after successfully resisting heavy selling pressure from the recent token unlock process.

Read also: Bitcoin Price Prediction: Tom Lee Forecasts BTC Price to Break $200,000!

ARB price has bounced off the bottom at $0.34, crossed several support zones, and is now consolidating in the range of $0.461 to $0.5045, forming the “handle” part of the pattern.

Technical indicators support this bullish structure:

- RSI has cooled down to the 53.7 level

- MACD still showing mild bullish signal

- Trading volumes began to gradually increase

All of this points to a healthy momentum.

However, bullish investors may have to be patient as ARB may still experience a correction to the $0.415-$0.461 range. RSI is expected to drop to 35-40, and MACD is starting to weaken, so a temporary drop to around $0.374 is still possible. However, this zone is an important area for re-accumulation.

In the event of a breakout above $0.5045-which is expected to occur between August 2-5-ARB could potentially rally towards $0.522, with further upside targets in the $0.60-$0.63 range.

Backed by a $216 million grant from Arbitrum DAO and the positive momentum of the Layer 2 (L2) ecosystem, ARB is one of the altcoins with the strongest technical signals this altcoin season.

ONDO Price Forms Double Bottom Pattern Amid Surge in ETF Filings

After the filing of 21Shares Ondo Trust’s S-1 documents with the SEC on July 22, the price of ONDO Coin experienced a sharp rally, even breaking the key neckline level of $1.13 before finally experiencing a correction.

This movement was driven by speculation around potential ETF approval and growing interest in the real-world assets (RWA) tokenization sector.

On the daily chart, ONDO is now forming an ideal Double Bottom pattern, where the price is currently retesting the $0.94-$0.98 support zone-a classic formation after a breakout.

If this level holds, the technical structure remains bullish, with the next price target in the range of $1.30-$1.40, and further upside potential to $1.58.

Trading volumes are still high, and the narrative around ETFs continues to be a strong supporting factor. In the event of a confirmed bounce from this support zone, the pattern on the ONDO chart could be validated and trigger a further rally.

XLM Price Forms Bullish Flag Pattern After 90% Rally Amid RWA Momentum

Stellar (XLM) has recorded a rally of over 90% throughout July, driven by increased adoption in the real-world asset tokenization (RWA) sector and positive sentiment from the legal clarity gained by XRP.

Currently, XLM price is consolidating in a Bullish Flag pattern in the range of $0.33 to $0.44, after successfully breaking out of a long-term downtrend.

Trading volumes remained high, while the MACD indicator started to cool down after the sharp price spike. The RSI dropped from 77.5 to 59, signaling room for re-accumulation before a further rally takes place.

As long as the price stays above the $0.37-$0.38 support zone, the technical structure remains valid and bullish. In the event of a breakout from this flag pattern, XLM price could potentially head towards $0.51, with further upside projections to the $0.60-$0.62 range.

With over $450 million in tokenized assets, a CBDC pilot program, and major partnerships such as with MoneyGram, XLM is one of the most solid projects in the RWA and cross-border payments sector this market cycle.

Read also: 3 Cryptos Ready to Rally in Altseason!

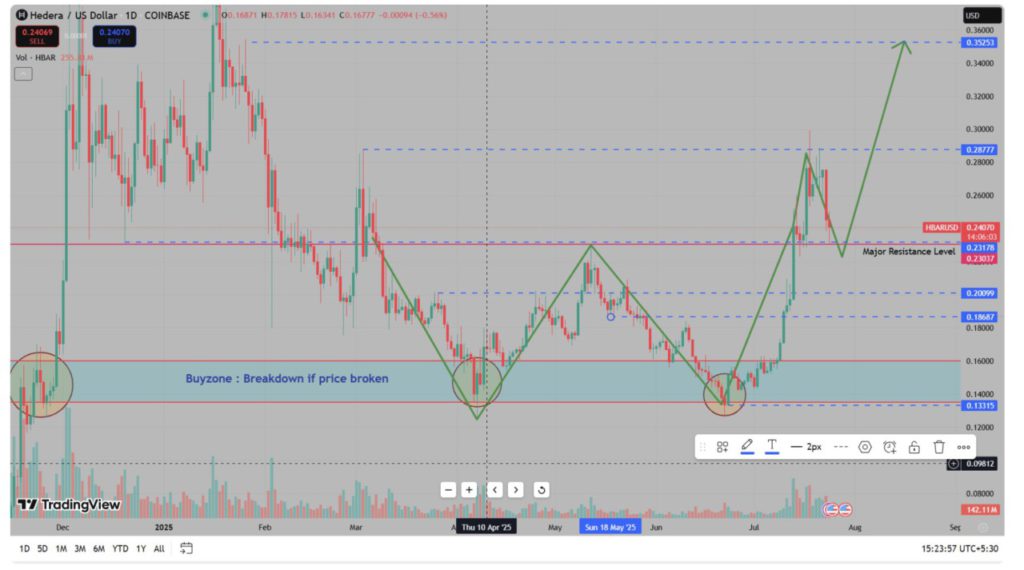

HBAR Price Breakout from W Pattern Thanks to Institutional Catalysts

Hedera (HBAR) has managed to breakout from the W pattern formed over the past few months, with the price rallying from the $0.13-$0.14 buy zone to reach a local high of $0.287 before correcting.

Currently, the price is testing the $0.23-$0.24 area, which is expected to be a strong support zone if the bullish momentum is maintained.

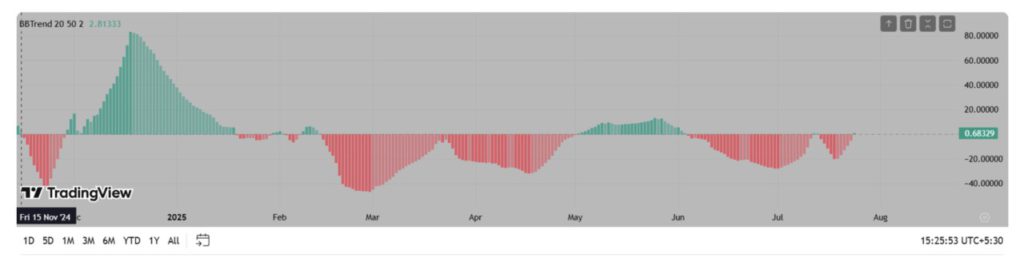

The BBTrend indicator has just turned positive (green) after being in the negative for quite some time, reinforcing the possibility of a continued rally towards $0.35 or more.

On the fundamental side, HBAR received significant institutional support with its entry into the Grayscale Smart Contract Platform Fund, as well as a trust filing by Canary Capital.

The combination of a clean technical structure and strong institutional sentiment makes HBAR one of the promising crypto assets for the next upward movement.

Injective (INJ) Experiences Surge in Daily Users After Nivara and EVM Launches

Injective’s (INJ) price reflects a significant surge in network activity, with the number of daily active addresses jumping 1,770%-from just around 4,500 users in early 2025 to a peak of 84,600 users on July 19. This represents the highest level of user activity in Injective’s history.

Read also: Bitcoin Dominance Soars While Altcoins Crash – Is a Major Market Shake-Up Coming?

These enhancements coincide with the launch of the Nivara upgrade and EVM Injective testnet, which extends smart contract compatibility and simplifies application development by developers.

This surge indicates the growing adoption of Layer-1 Injective networks for DeFi purposes and the rollout of modular dApps, which reinforces its bullish fundamental momentum.

Technically, the latest price spike towards $14.2 is in line with this increase, suggesting that the fundamental momentum is indeed in favor of price movement.

INJ price is also currently testing its 200-day moving average (200-day EMA) at $13.6, which is an important support level.

If this level is defended by the bulls, the next upside target is around $16.5, and in case of a breakout, the price could head towards $19 to $20.

The strong correlation between address activity and prices suggests continued upside potential as long as network usage levels remain high.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Top Altcoins to Buy Today as Crypto Market Cools Before Next Bull Run. Accessed on July 25, 2025