Pi Network Coin Jumps 3% Today (July 28) – Is a Strong Support Level Finally Emerging?

Jakarta, Pintu News – Reporting from BeInCrypto, Pi Network’s kopin has experienced significant price movements recently, with a sharp decline to near important support levels.

Despite the drop, the altcoin was still able to stay above its possible All-Time Low. The inflow of funds from investors is now providing a much-needed boost to Pi Coin’s recovery.

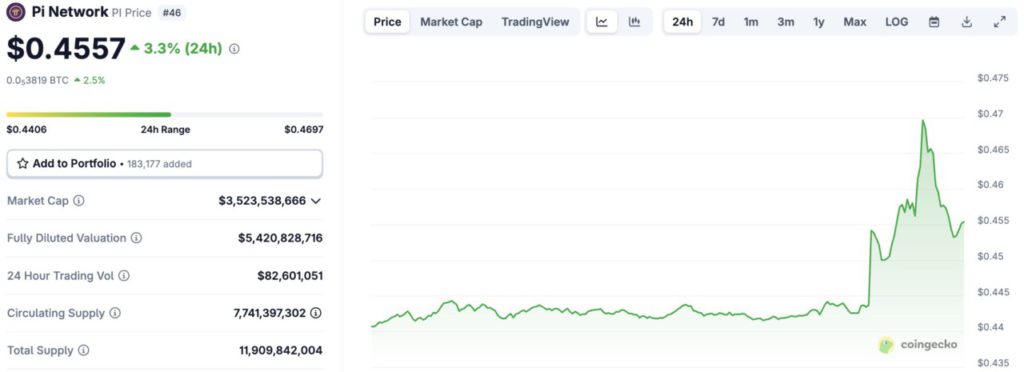

Pi Network Price Rises 3.3% in 24 Hours

On July 28, 2025, the price of Pi Network was recorded at $0.4557, having risen 3.3% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,335), then 1 Pi Network is IDR 7,443.

In the last 24-hour period, its highest price reached $0.4697, while its lowest level was at $0.4406.

Read also: Pi Network Price to Explode? Here are the 3 Main Triggers!

This price increase indicates increased buying interest, along with a spike in daily trading volume that reached $82.6 million. Pi Coin’s market capitalization currently stands at $3.52 billion, with a fully diluted valuation of $5.42 billion.

Pi Network Starts to Show Positive Development

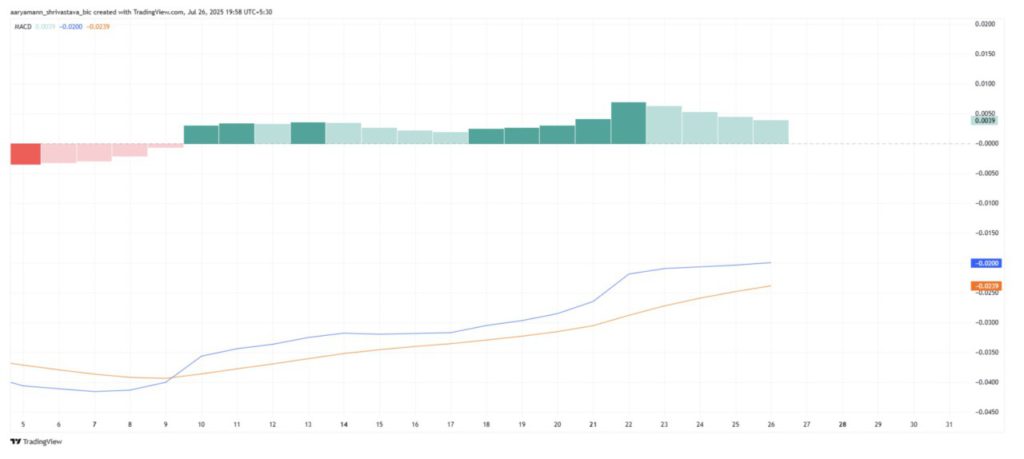

Market sentiment towards Pi Coin is currently showing positive signs. The Moving Average Convergence Divergence (MACD) indicator reveals that bearish momentum has not completely dominated.

The recent bullish crossover, accompanied by green bars on the histogram, indicates that Pi Coin still has the potential to bounce back. This is an important development as it suggests that the altcoin could regain upward momentum, possibly avoiding a drop to an all-time low (ATL).

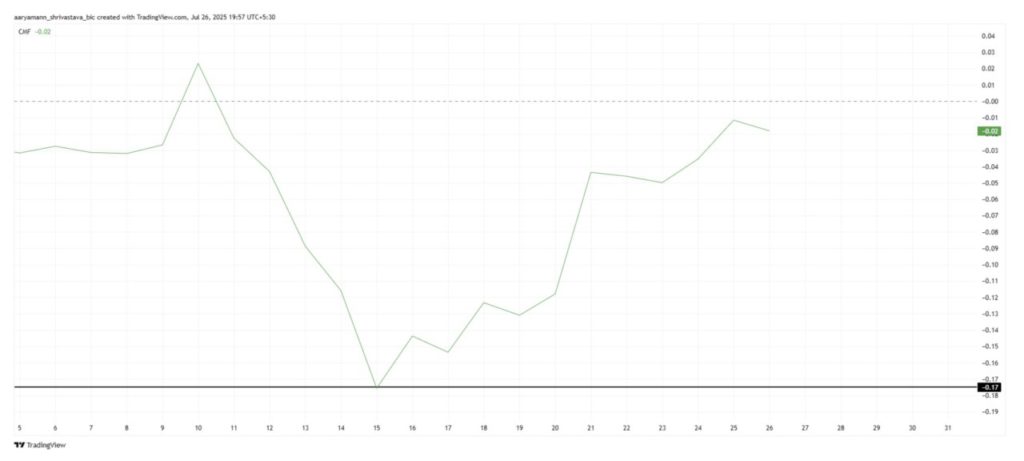

Macro-wise, Pi Coin’s momentum has also started to show improvement, as indicated by the Chaikin Money Flow (CMF) indicator. The CMF experienced a sharp spike, which signaled an increased inflow of funds into the altcoin.

Although this indicator is still below the zero line, its upward trend is signaling that Pi Coin is starting to attract market attention again. This could be an important factor in helping this altcoin keep its price above the support level and prevent a drop to lower levels.

In addition, the increased investor participation in Pi Coin is also a positive indicator of its potential recovery.

As more investors show interest in the token, it could create a more stable foundation for future price growth.

This capital inflow also has the potential to help altcoins break through resistance levels, which in turn could encourage a price rebound.

Read also: Dogecoin Surges Today (July 28): Is a Major Breakout Just Around the Corner?

Pi Coin Price Finds a Point of Support

Pi Coin’s price has seen a 9.7% decline in the last four days, with the altcoin trading at $0.442 on July 26. At that time, Pi Coin was approaching the local support level of $0.440 which has so far held fairly steady.

The key factor for Pi Coin’s recovery is its ability to bounce off the $0.440 support and make the $0.450 level the new support.

If this is successful, it could open up opportunities for a price rebound towards $0.493 and recover the losses incurred in recent days.

However, if investor sentiment turns from accumulation to selling, Pi Coin is at risk of further declines. If the price breaks below $0.440, then the altcoin could test its all-time low of $0.400.

Currently, Pi Coin is only about 9.6% away from that crucial level. If the selling pressure increases, it is likely that this altcoin will hit the ATL (All-Time Low) again.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Eyes Recovery As Investor Inflows Jump to 2-Week High. Accessed on July 28, 2025