Ethereum’s Dramatic Rise: Not the Result of Bitcoin’s Rotation!

Jakarta, Pintu News – Ethereum has performed impressively in July, with a rise of more than 60% from around $2,400 on July 1 to a peak of $3,941 on July 27. This rise is interesting because it was driven by new capital flows, rather than funds moving away from Bitcoin as previously thought.

Ethereum Capital Flow Analysis

According to a CryptoQuant Quicktake post by Carmelo Aleman, the idea that Ethereum’s (ETH) current rise is the result of capital rotation from Bitcoin (BTC) to Ethereum (ETH) is unfounded. Aleman uses on-chain data, specifically Bitcoin Realized Cap, to support his analysis.

Bitcoin Realized Cap measures the total value of all Bitcoin (BTC) in circulation based on the price at which each coin last moved on the blockchain, not the current market price. This provides a more accurate picture of the actual capital invested in Bitcoin (BTC), helping to identify accumulation or distribution trends over time.

Also Read: 5 Hot Altcoins of 2025: Crypto that Analysts Predict to Soar 100x in Altseason 2025!

Ethereum Ecosystem Growth

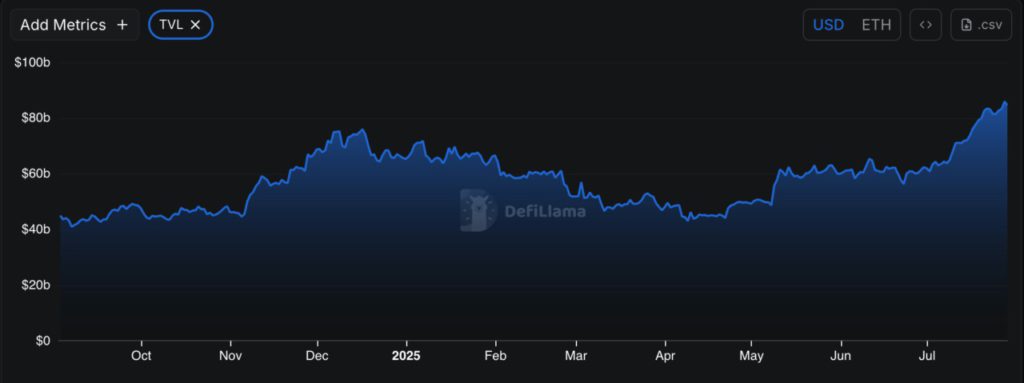

In July, there was a significant surge in interest in the Ethereum (ETH) ecosystem, which was reflected in the rise in the price of this digital asset. Data from DefiLlama shows that the Total Value Locked (TVL) in the Ethereum (ETH) decentralized finance platform has increased significantly, from $49 billion on April 29 to $84.6 billion on July 29. Additional on-chain metrics also show a similar trend, confirming that there are new capital flows coming into the Ethereum (ETH) ecosystem.

Ethereum Speculation and Supply Pressure

There is growing speculation that a decline in the circulating supply of Ethereum (ETH) is contributing to upward price pressure. Over the past month, ETH reserves on centralized exchanges have fallen by one million coins, supporting the narrative of a growing “supply shortage”. In addition, Ethereum liquid staking recently hit a new record high, with 35.5 million ETH now locked in the liquid staking protocol. Currently, Ethereum (ETH) is trading at $3,772, down 1% in the last 24 hours.

Conclusion

Ethereum’s (ETH) significant price increase in July was not the result of funds being diverted from Bitcoin (BTC), but rather due to new capital flows into its ecosystem. With a range of favorable indicators, Ethereum (ETH)’s growth looks set to continue as innovation and adoption increases within its ecosystem.

Also Read: 5 Viral New Crypto to Watch in 2025: Which is the Most Potential Cryptocurrency?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Rally Stalls As Bitcoin Dumps: Chainlink Signals Gains. Accessed on July 30, 2025